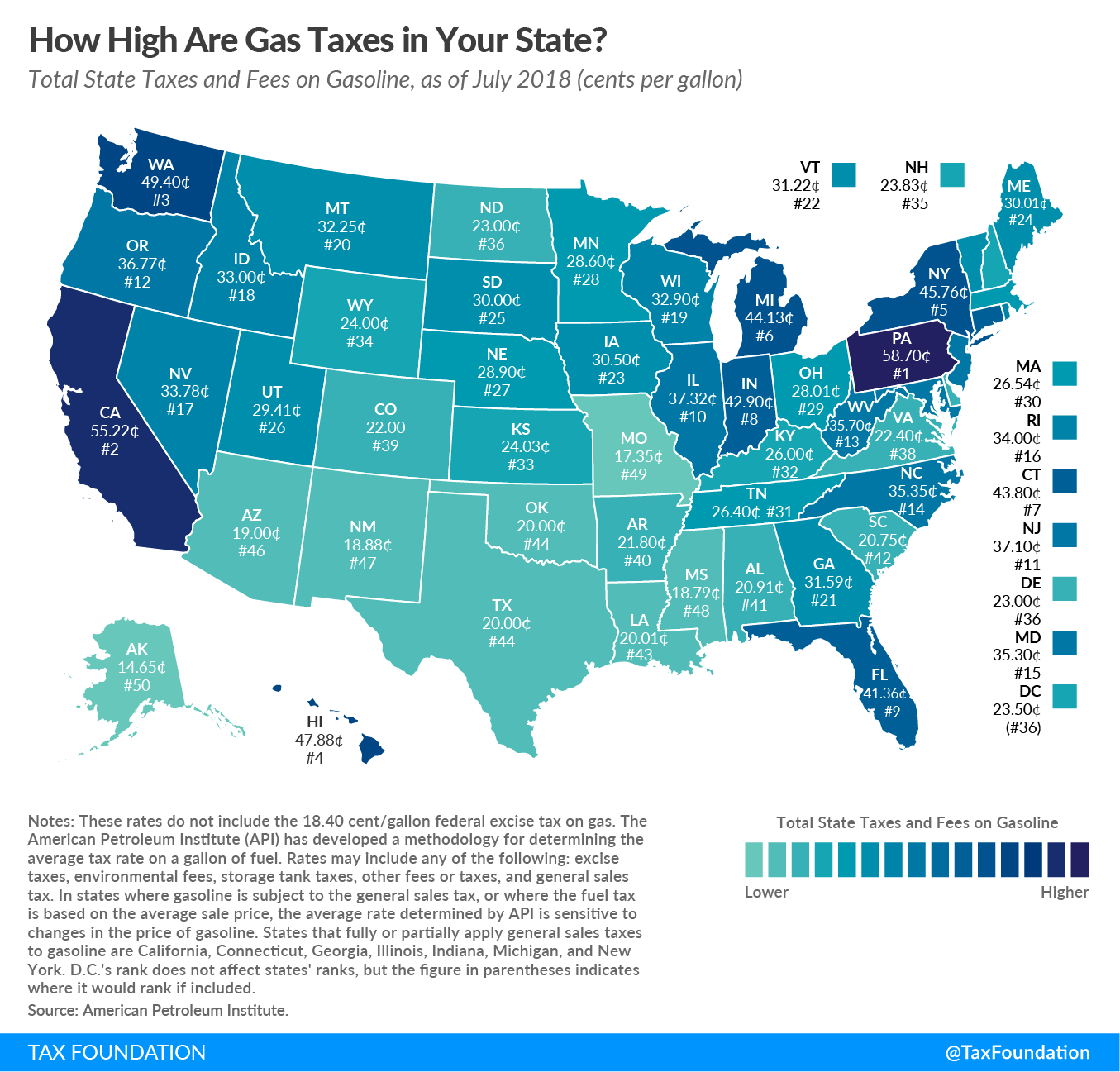

Today’s map shows gasoline taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates in each state as of July 2018, using recently released data from the American Petroleum Institute.

States levy gas taxes in a variety of ways, including per-gallon excise taxes collected at the pump, excise taxes imposed on wholesalers and passed along to consumers in the form of higher prices, and sales taxes that apply to the purchase of gasoline. The American Petroleum Institute has developed a methodology to account for these different approaches and calculate the average tax rate on a gallon of gasoline in each state. These rates vary widely from state to state and are shown in the map below.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribePennsylvania’s gas tax rate is highest at 58.7 cents per gallon, followed by California (55.22 cpg) and Washington (49.4 cpg). The lowest gas tax rate is found in Alaska at 14.65 cents per gallon, followed by Missouri (17.35 cpg) and Mississippi (18.79).

While gas taxes tend to be politically unpopular, they are a relatively good embodiment of the “benefit principle,” or the idea in public finance that the taxes a person pays should relate to the benefits received. In general, drivers benefit from the government services that are funded by their gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. dollars, including road construction, maintenance, and repair. By connecting the costs of road upkeep with the act of driving, gas taxes incentivize efficient road use, which helps mitigate congestion and wear and tear attributable to overuse.

Because they adhere to the benefit principle, gas taxes and other user taxes and fees are the revenue tools most suitable for generating the funds needed to maintain and repair public roads over time. One of the primary issues with federal and state gas taxes, however, is that they are not indexed for inflation, meaning the nominal value of revenue generated from the gas tax isn’t keeping pace with infrastructure funding needs across the country. Indexing gas taxes for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. is one of the most important actions states can take to create a more stable source of revenue to fund infrastructure maintenance and repair needs for years to come, and to avoid leaning on less suitable taxes to maintain roads and bridges.

Share this article