(Note: this map has been corrected since it was first published. An incorrect percentage for the District of Columbia has been fixed.)

President Obama reiterated his call for higher taxes on the rich today, claiming that high income earners often pay taxes at relatively low effective rates, due to various deductions and low capital gains rates. Part of his proposed remedy is what he calles the “Buffett Rule” – while the details are scarce, it’s been described as a new AMT that requires high income earners to pay a minimum effective rate, thus negating the effects of many deductions and preferential rates. He also has a separate proposal which would limit the ultimate value of itemized deductions to 28% of their amount, even if one is paying a higher marginal rate.

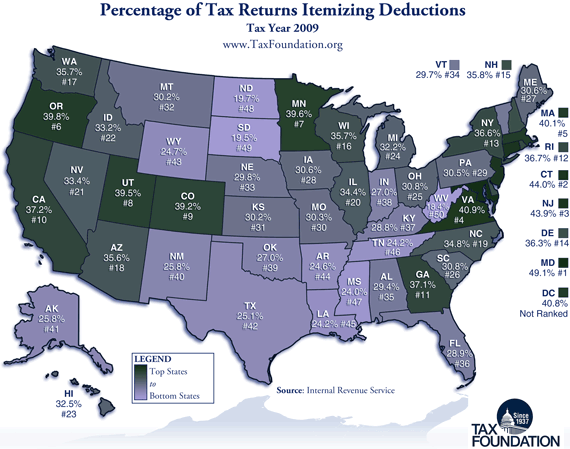

Since these proposals primarily affect itemizers, we made a map showing which states have the most:

Click on the map to enlarge it.

Previous Monday Maps here.

Share this article