Last November, during an appearance on CNBC, soon-to-be Treasury Secretary Steven Mnuchin said that the Trump administration would focus on limiting taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. deductions for high-income households. “Any reductions we have in upper-income taxes would be offset by less deductions,” he suggested. Mnuchin’s comment may have led viewers to wonder: what are the largest deductions that high-income Americans currently claim?

We can answer this question with a new set of data, released by the IRS last week, on households with over $200,000 in income in 2014.[1] While the households in this dataset may not match every definition of “high-income Americans,” the data presents a clear picture of which itemized deductionItemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers. s have the largest benefits for the rich:

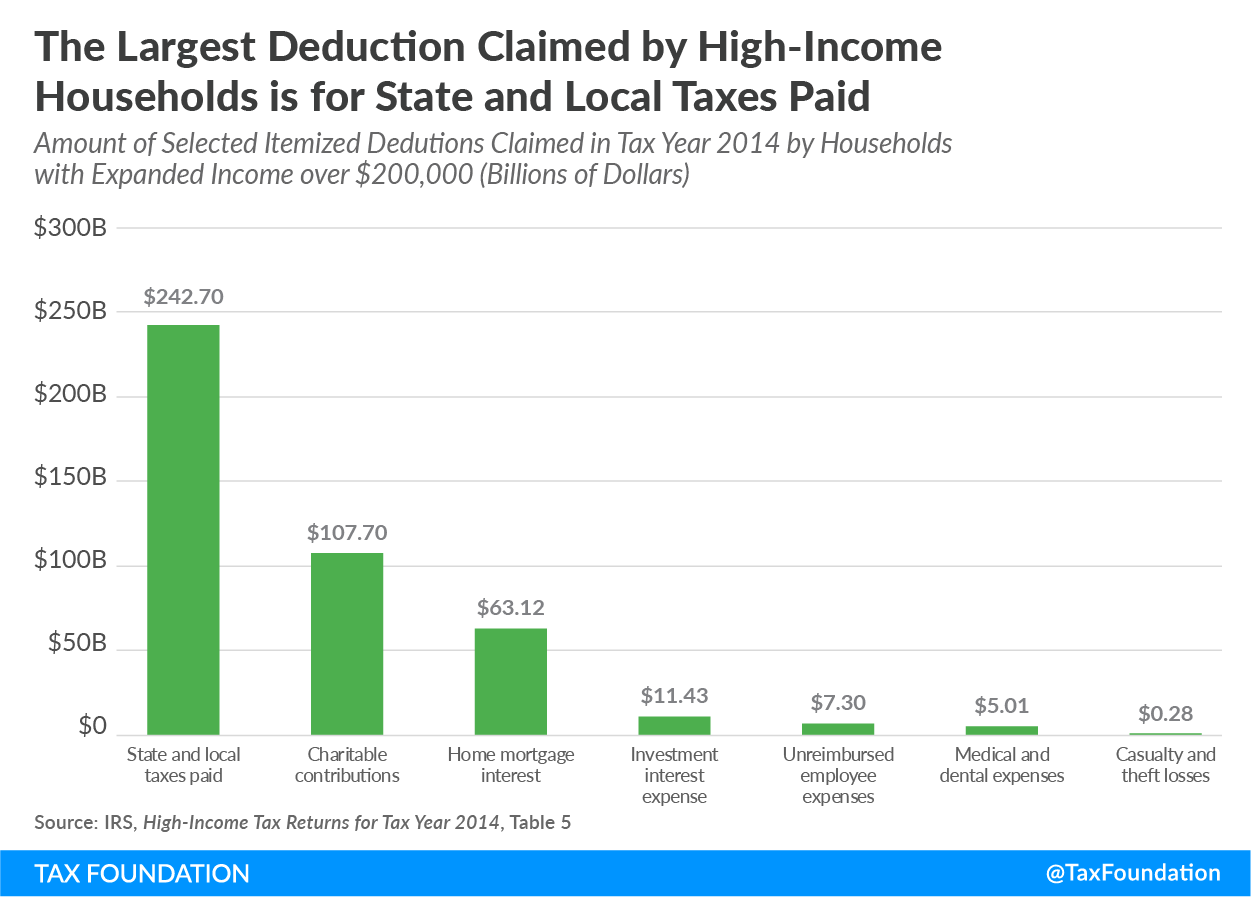

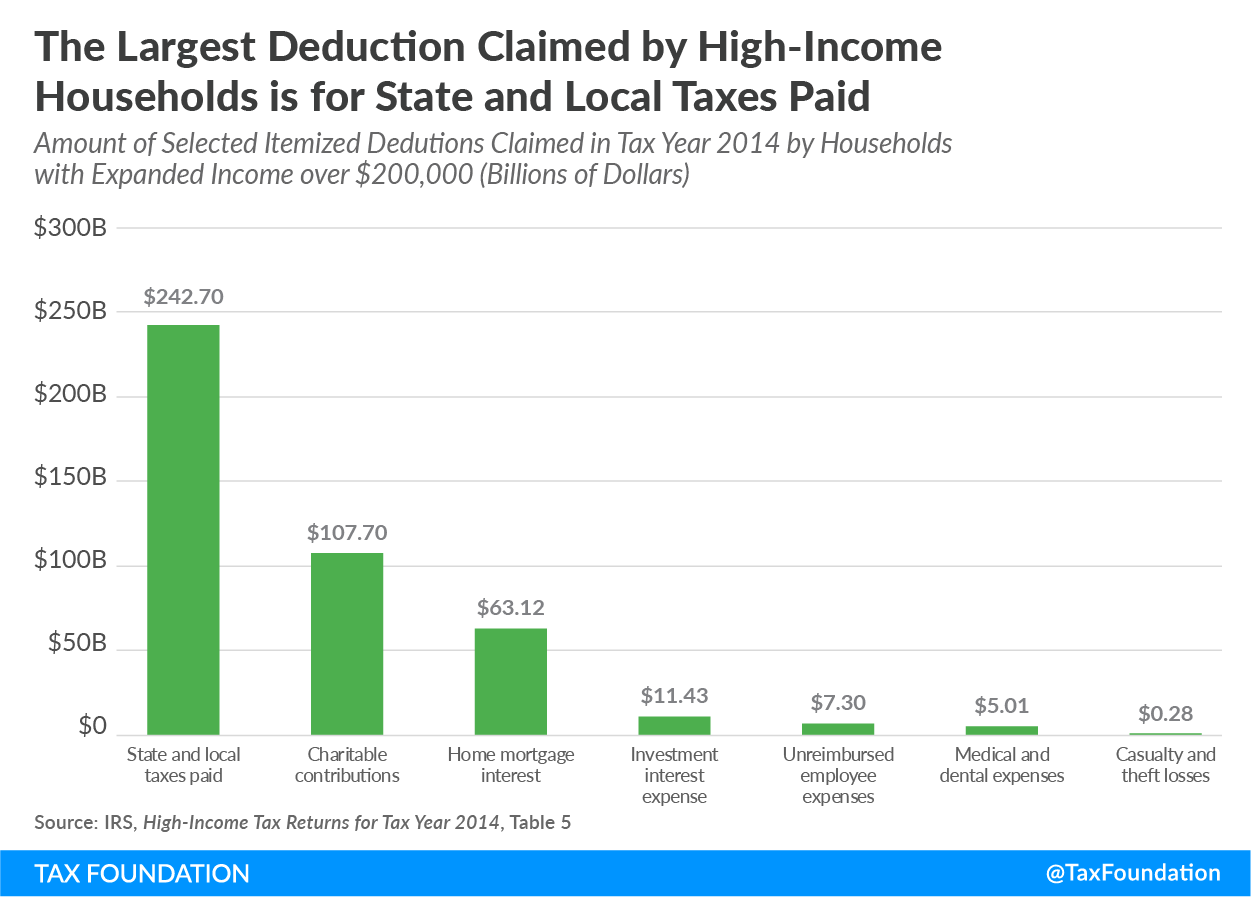

The deduction for state and local taxes is the single largest deduction claimed by households making over $200,000. These households deducted $243 billion in state and local taxes in 2014 – accounting for 47 percent of all state and local taxes deducted by U.S. households that year. In recent years, several lawmakers have proposed eliminating the state and local tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage interest, and charitable contributions. altogether; this data shows that doing so would mainly impact high-income households.

The next two largest deductions claimed by high-income households in 2014 were the charitable deduction ($108 billion) and the home mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. ($63 billion). These deductions tend to be popular with lawmakers, and are rarely targeted for outright elimination in tax reform plans. However, these deductions are also tilted toward high-income households, with 51 percent of all charitable deductions and 22 percent of all mortgage interest deductions claimed by households making over $200,000.

Together, these three provisions account for the vast majority of deductions claimed by high-income households. While a number of other deductions are also available to high-income households – for medical expenses, casualty and theft losses, and some investment costs, to name a few – these provisions are relatively minor.[2]

This data has a clear takeaway: if lawmakers are interested in reducing the amount of deductions taken by high-income households, they only have a few major provisions to work with. In particular, if policymakers take the state and local tax deduction off the table, they will have a very hard time finding other ways to broaden the individual income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. enough to allow for substantial rate cuts.

[1] Unlike other IRS datasets, this report looks at several different definitions of income, including adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” (which serves as the basis for calculating how much households owe in taxes) and “expanded income” (which tries to measure how much households have actually earned, by adjusting for a number of exclusions and other tax preferences).

[2] Notably, many high-income households are also subject to the Pease limitation on itemized deductions, which slightly reduces the total amount of itemized deductions that these households can claim.

Share