Top Personal Income Tax Rates in Europe, 2021

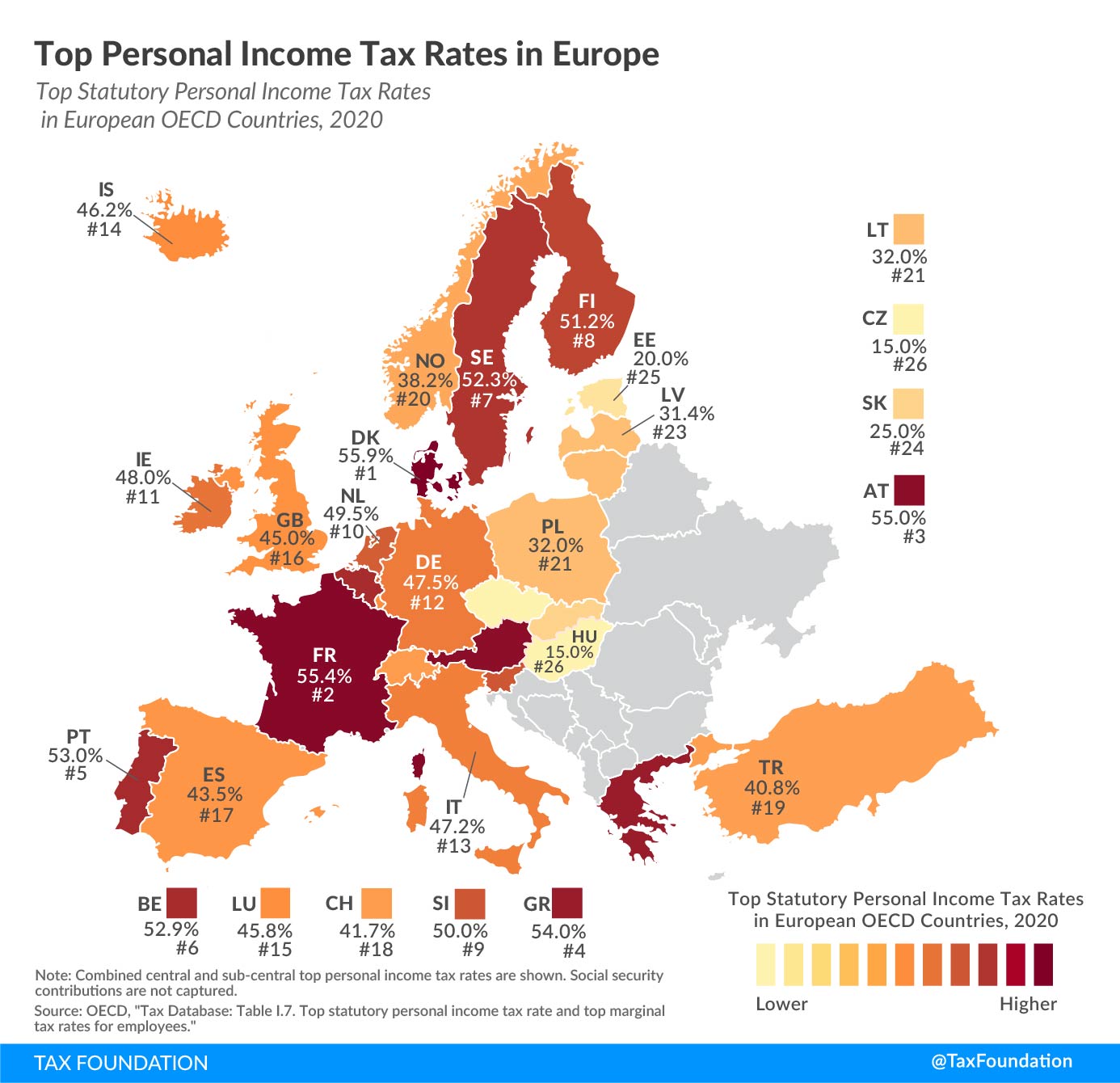

3 min readBy:Most countries’ personal income taxes have a progressive structure, meaning that the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate paid by individuals increases as they earn higher wages. The highest tax rate individuals pay differs significantly across European OECD countries—as shown in today’s map.

The top statutory personal income tax rate applies to the share of income that falls into the highest tax bracket. For instance, if a country has five tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. , and the top income tax rate of 50 percent has a threshold of €1 million, each additional euro of income over €1 million would be taxed at 50 percent.

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) had the highest top statutory personal income tax rates among European OECD countries in 2020. The Czech Republic (15 percent), Hungary (15 percent), and Estonia (20 percent) had the lowest top rates.

The income level at which the top statutory personal income tax rates apply also varies significantly across the countries covered. Expressed as a multiple of a country’s average wage, the threshold ranges from 0 in the Czech Republic, Hungary, and Latvia to 22.5 in Austria. The Czech Republic, Hungary, and Latvia apply their flat personal income tax on all income earned. In contrast, Austria’s top statutory rate of 55 percent only applies to income above €1 million.

| European OECD Country | Top Statutory Personal Income Tax Rate | Threshold of the Top Statutory Personal Income Tax Rate | |||

|---|---|---|---|---|---|

| As a Multiple of the Average Wage | In National Currency* | In Euros* | In USD (PPP)* | ||

| Austria (AT) | 55.0% | 22.5 | EUR 1,097,040 | €1,097,040 | $1,441,954 |

| Belgium (BE) | 52.9% | 1.1 | EUR 52,848 | €52,848 | $70,549 |

| Czech Republic (CZ) | 15.0% | 0.0 | CZK 1 | €0 | $0 |

| Denmark (DK) | 55.9% | 1.3 | DKK 577,174 | €77,429 | $85,763 |

| Estonia (EE) | 20.0% | 0.4 | EUR 6,097 | €6,097 | $11,540 |

| Finland (FI) | 51.2% | 1.9 | EUR 87,647 | €87,647 | $102,910 |

| France (FR) | 55.4% | 15.4 | EUR 587,696 | €587,696 | $800,033 |

| Germany (DE) | 47.5% | 5.4 | EUR 282,934 | €282,934 | $382,578 |

| Greece (GR) | 54.0% | 11.1 | EUR 234,111 | €234,111 | $429,201 |

| Hungary (HU) | 15.0% | 0.0 | HUF 0 | €0 | $0 |

| Iceland (IS) | 46.2% | 1.3 | ISK 11,823,418 | €76,522 | $84,299 |

| Ireland (IE) | 48.0% | 1.5 | EUR 70,044 | €70,044 | $86,585 |

| Italy (IT) | 47.2% | 2.8 | EUR 83,261 | €83,261 | $123,255 |

| Latvia (LV) | 31.4% | 0.0 | EUR 1 | €1 | $2 |

| Lithuania (LT) | 32.0% | 6.3 | EUR 104,278 | €104,278 | $231,442 |

| Luxembourg (LU) | 45.8% | 3.7 | EUR 215,226 | €215,226 | $248,426 |

| Netherlands (NL) | 49.5% | 1.3 | EUR 72,376 | €72,376 | $91,340 |

| Norway (NO) | 38.2% | 1.6 | NOK 999,550 | €93,238 | $100,750 |

| Poland (PL) | 32.0% | 1.7 | PLN 102,594 | €23,091 | $57,161 |

| Portugal (PT) | 53.0% | 14.4 | EUR 280,899 | €280,899 | $483,677 |

| Slovakia (SK) | 25.0% | 3.3 | EUR 42,914 | €42,914 | $84,355 |

| Slovenia (SI) | 50.0% | 4.7 | EUR 96,920 | €96,920 | $169,789 |

| Spain (ES) | 43.5% | 2.4 | EUR 65,102 | €65,102 | $104,083 |

| Sweden (SE) | 52.3% | 1.1 | SEK 523,159 | €49,897 | $59,725 |

| Switzerland (CH) | 41.7% | 3.5 | CHF 301,774 | €281,900 | $265,696 |

| Turkey (TR) | 40.8% | 8.6 | TRY 639,731 | €79,423 | $316,448 |

| United Kingdom (GB) | 45.0% | 3.6 | GBP 150,000 | €168,596 | $207,577 |

|

Source: OECD, “Tax Database: Table I.7. Top statutory personal income tax rates and top marginal tax rates for employees,” April 2021, https://www.stats.oecd.org/index.aspx?DataSetCode=TABLE_I7. * These thresholds have been calculated by multiplying the threshold expressed as a multiple of the average wage with the average wage expressed in the national currency and in US$ Purchasing Power Parity (PPP). Thus, they are approximations of the statutory thresholds. For non-Euro countries, the thresholds were converted into euros using the average 2020 exchange rates provided by the European Central Bank (ECB). |

|||||