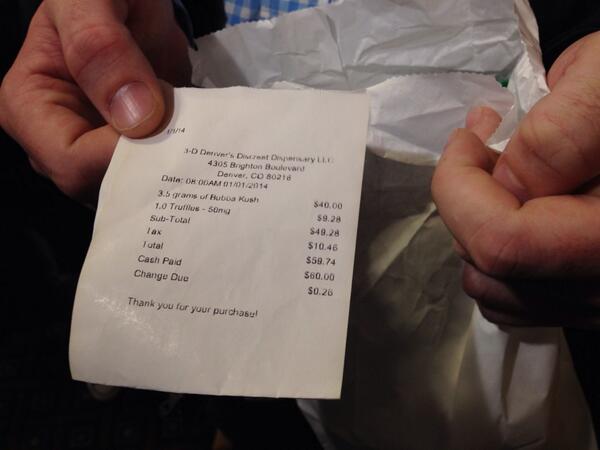

Courtesy Twitter user @john_ingold

At 8:00 AM this morning, the world's only legal retail marijuana sales began in Colorado:

At least 37 stores across the state were fully licensed and opened to sell marijuana to anyone 21 or over for any purpose, according to official lists and Denver Post research. Sales began at 8 a.m., and activists — who passed the marijuana-legalization measure in November 2012 that made the sales possible — arranged a ceremonial "first purchase" at the stroke of 8 at the Denver store 3D Cannabis.

The customer was Sean Azzariti, an Iraq War veteran from Denver who was featured in pro-legalization campaign ads in which he said he hoped to use marijuana to alleviate post-traumatic stress disorder. The cost of the ceremonial first sale was $59.74.

130 retailer licenses have been issued, but not all were ready to open their doors on the first day.

State officials project $67 million a year from taxes on marijuana sales. These consist of the existing 2.9 percent state sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. (plus local taxes), an additional 10 percent state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on retail marijuana sales, and a 15 percent excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on the "average market rate" of wholesale marijuana. In Denver, that means a $30 eighth of pot (1/8 oz.) will have about $8.59 in taxes tacked onto it, or about a 29 percent overall tax rate.

Share this article