Among the many other taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. proposals being considered in Washington State this year, policymakers have proposed separate bills that would impose a carbon tax on cigarettes and implement a state-wide flavor ban on tobacco products. A carbon taxA carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them. on cigarettes is novel, while the idea for a flavor ban is not. Massachusetts and California have already banned flavored tobacco products in their states, and the experiences have been so negative that the Biden administration backed off its own plan for a nationwide flavor ban.

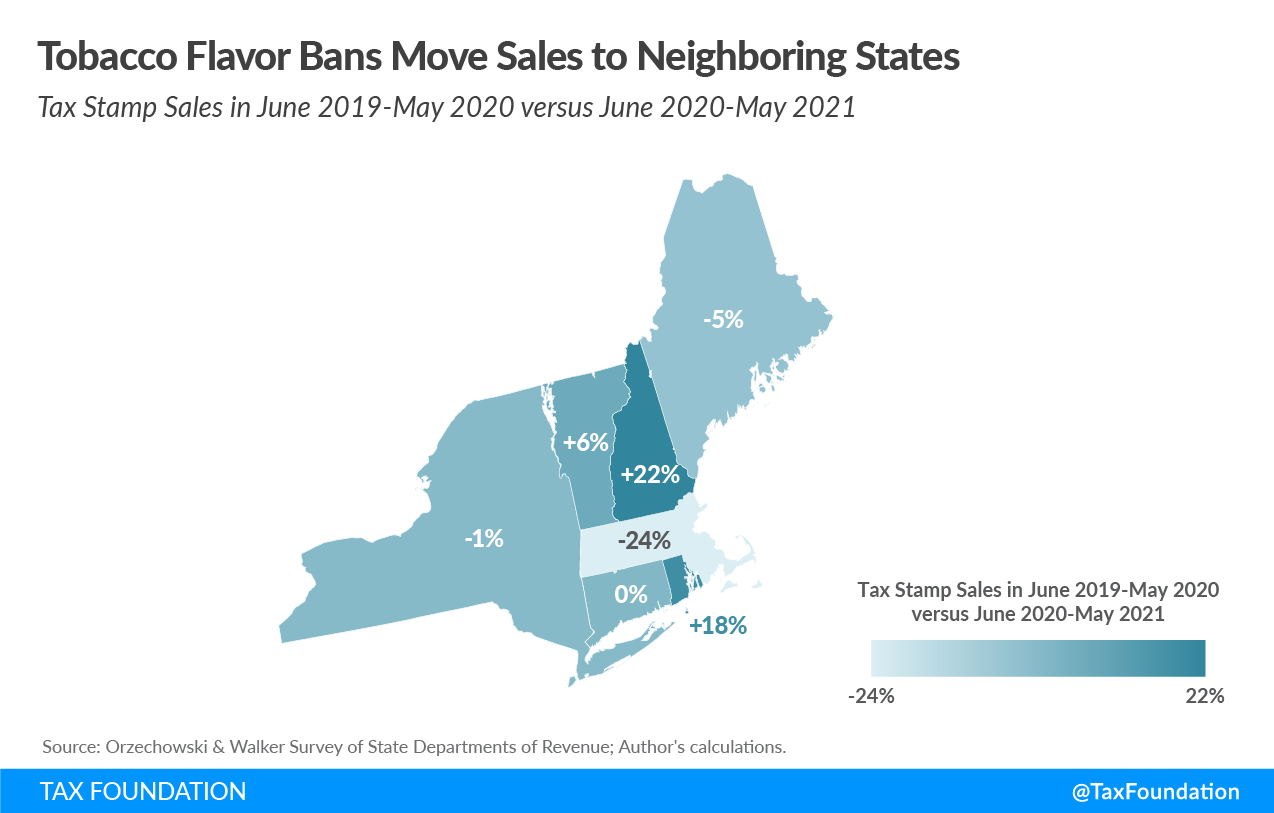

Both Massachusetts and California experienced massive tax revenue declines, incredible growth in illicit market activity, and little to no change in smoking rates. Following its flavor ban in 2020, Massachusetts saw cigarette excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. revenue decline by more than $100 million dollars and revenue has persisted at the lower level. Unfortunately, fewer legal sales don’t necessarily translate to less consumption. Our previous work identified that about 90 percent of the reduction in sales in Massachusetts was offset by increases in legal sales in neighboring states. Illicit product seizures and smuggling estimates have skyrocketed.

California has fared no better. Following its flavor ban in December 2022, state cigarette sales and excise taxes fell by more than $230 million. Unlike Massachusetts where many sales moved to neighboring states, Californians turned to illicit and international markets to replace their legal purchases.

One study collected details on 15,000 discarded cigarette packs from public trash containers across 10 major California cities in May and June of 2023. These data showed that 21.1 percent of the discarded packs were menthol-style cigarettes, a mere 3-percentage-point drop in menthol market share estimates from before the flavor ban.

The same data found foreign and illicit market share spiked. Non-US packs comprised 27.6 percent of the sample, compared to an estimated foreign market share of only 17 percent previously.

Plunging revenues and growing illicit trade are what Washington State taxpayers can expect from a state-wide flavored tobacco ban. The state’s own fiscal analysis predicts revenues would decline by more than $100 million per year.

The proposed carbon tax on cigarettes would only offset about one percent of that decline. At $0.03 per pack, the tax is estimated to generate about a million dollars per year. If implemented, the carbon tax on cigarettes would increase every five years by 25 percent plus the rate of inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. .

The justification for applying a carbon tax on top of existing cigarette taxes is weak. Secondhand smoke certainly harms others nearby who are forced to inhale it, and cigarette smoking releases carbon dioxide, but classifying cigarettes as a broad state-wide pollutant is a stretch. One study reportedly estimated that the combined effect of all cigarettes smoked globally is between 27,540 and 90,260 metric tons of pollutants emitted each year. By comparison, Seattle alone emits 3,000,000 metric tons of climate emissions per year.

These haphazard policies appear to be part of a “try-anything” effort to close the state’s projected $15 billion budget shortfall. Washington State taxpayers deserve sound fiscal policy reforms that will provide stable long-run revenue for the government. Narrow-based and patchwork fixes only kick the can down the road to the next set of elected officials.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe