Last week, the Austrian cabinet met to plan the political agenda for 2019 and outline plans for changes to taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy that will take place over the next few years. The current government has been in place since the end of 2017, and tax reform has been a main part of the agenda since. At the close of the cabinet meetings, the government reaffirmed its commitment to tax relief for low-income workers and efforts to make Austria more attractive to business investment. The government plans to reduce the tax and social security contribution share of GDP to 40 percent by 2022. In total, Austria collected 41.8 percent of GDP in tax revenue in 2017.

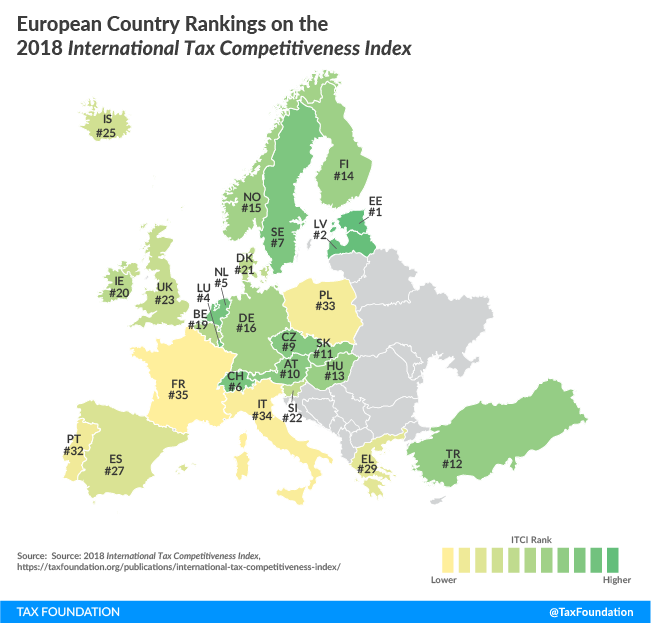

Austria currently ranks 10th on our International Tax Competitiveness Index, but weaknesses in business taxation (ranked 15th) and personal income taxation (ranked 21st) present opportunities for Austria to reform its tax system to be more neutral and pro-growth.

[global_newsletter_inline_widget campaign=”//TaxFoundation.us1.list-manage.com/subscribe/post?u=fefb55dc846b4d629857464f8&id=6c6b782bd7&SIGNUP=ITCI”]

In total, the government plans to provide €6 billion (US $6.9 billion) in tax relief from 2019-2022, €1.5 billion ($1.7 billion) of which went into effect on January 1 as part of changes to tax benefits for families. In 2020, another €700 million ($803 million) in tax relief for low-income workers will be put in place. The remaining tax relief will come in changes to the current tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. and system of business taxation. The details of these proposals will come later, but eliminating bracket creepBracket creep occurs when inflation, or real income growth, pushes taxpayers into higher income tax brackets. Bracket creep results in an increase in income taxes without an increase in real income. Many tax provisions—both at the federal and state levels—are adjusted for inflation. Over time, bracket creep can increase how much income tax people owe as their income grows, either due to inflation or economic growth. To prevent inflation-driven bracket creep, many tax provisions at the federal and state levels are adjusted for inflation. and providing tax relief for reinvested earnings are included in the plans.

In all, by 2022, the government expects 4.5 million taxpayers to benefit from reforms. Beyond lesser tax burdens, there will also be measures to simplify taxation to minimize the burden of filing—especially for small businesses and lower-income individuals.

A separate tax proposal that is included in the agenda is a tax on digital advertisers. Currently, Austria levies a 5 percent sales tax on advertising, but this applies to ads placed in traditional forms of media (print, tv) rather than online advertising.

Under the new proposal, the rate on ad sales would be lowered to 3 percent and would apply to the current tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. as well as sales of digital advertisements by some large companies. Companies that have at least €750 million ($860 million) in worldwide revenue and €10 million ($11.5 million) in revenue from sales in Austria would be required to pay the tax on digital ad sales. Chancellor Kurz has specifically stated that the tax on digital ad sales will not apply to Austrian businesses. However, this tax would be a burden faced by those who purchase ads from large foreign digital advertising companies rather than the companies themselves.

The proposal to target digital companies is not surprising given that Austria worked last year to get agreement on the digital services tax proposal at the European level. Some of the same criticisms of that broader proposal from the European Commission would apply to the new Austrian proposal. It seems counterproductive to be designing new ways to tax digital giants at the same time that Austria is trying to promote digitalization. The ultimate burden of a sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. falls on consumers, so the government is really proposing to raise taxes on those who purchase digital ads rather than the companies that supply those ads.

In all, the Austrian government has laid out a strong vision for tax policy changes over the next few years. It will be important to keep the agenda focused on making the system more neutral and competitive rather than creating new distortions, and we’ll continue to monitor developments and update our analysis over the coming days.

Share this article