Today, the U.S. Treasury and the IRS announced that the federal government will recognize all same-sex marriages for federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. purposes, provided those couples were “legally married in jurisdictions that recognize their marriages…regardless of whether the couple lives in a jurisdiction that recognizes same-sex marriage or a jurisdiction that does not recognize same-sex marriage.”

Further (emphasis added),

“Today’s ruling provides certainty and clear, coherent tax filing guidance for all legally married same-sex couples nationwide. It provides access to benefits, responsibilities and protections under federal tax law that all Americans deserve,” said Secretary Jacob J. Lew. “This ruling also assures legally married same-sex couples that they can move freely throughout the country knowing that their federal filing status will not change.”

In legal-speak, this means that for federal tax purposes, a “state of celebration” standard will be used, rather than a “state of residency” standard. What does this mean? My colleague Joseph Henchman just wrote an excellent explanatory example of this in our new report on how the ruling will affect state taxation:

To illustrate, take two same-sex couples, one living in Maryland (which recognizes same-sex marriage) and one living in Virginia (which does not). The Maryland couple, in the past, has been able to file a joint state return but has had to file separate federal returns. (Because Maryland’s return references information on the federal return, Maryland and other same-sex marriage states have permitted taxpayers to prepare a “dummy” federal joint return to reference when preparing the state return.) Under either a “state of celebration” or “state of residency” rule, the Maryland couple would now be able to file joint returns at both the federal and state levels.

The Virginia couple has never been able to file joint returns at the federal or state levels, but because the IRS has adopted a “state of celebration” standard, they may now file a joint federal return so long as they have a marriage certificate issued by another state that recognizes same-sex marriage. Under a “state of residence” standard, state law defining marriage would apply and the couple would not be able to file federal or state joint returns. But under a “state of celebration” standard, the couple can file jointly at the federal level but must continue to file separately at the state level.

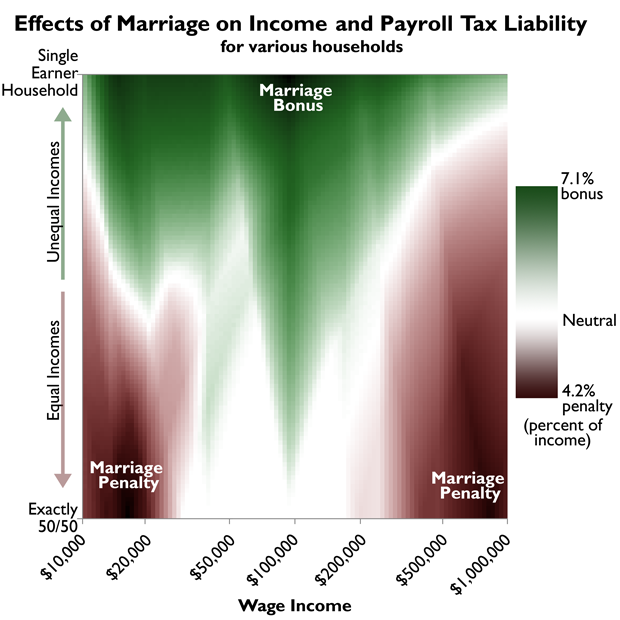

Marriage can have a significant impact on the amount of taxes owed by creating what is known as a "marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. " (or alternatively, a "marriage bonusA marriage bonus is when a household’s overall tax bill decreases due to a couple marrying and filing taxes jointly. Marriage bonuses typically occur when two individuals with disparate incomes marry. Marriage penalties are also possible. ). Earlier this year, my colleague Nick Kasprak made a nifty chart demonstrating the effects of marriage on payroll and income tax liability (check out more on this topic here):

The next natural question is what this means for states and how they tax same-sex couples. For the 13 states (and D.C.) that allow same-sex marriage, there isn’t much to consider because now both the state and the federal governments recognize the marriage and there is now no ambiguity when it comes to taxation.

The 24 states that don’t recognize same-sex marriage and require reference to a federal return for state tax purposes, however, will need to do a bit more work. As Joe notes in his report, “Same-sex couples in those states will be able to file a joint federal income tax return but need guidance on how to prepare their state income tax return.” They have three viable options (assuming the state doesn’t legalize gay marriage before the 2014 filing season):

- Allow taxpayers to reference a “dummy” federal return that reflects single filing status for their state return;

- Allow taxpayers to “split” a joint federal return and use one-half for each single state return;

- Create a brand-new filing status that allows any taxpayer filing jointly on the federal level to file jointly on the state level, “especially if the state presently recognizes civil unions or domestic partnerships.”

One thing states absolutely shouldn’t do is decouple from the federal system to avoid recognizing same-sex marriages. This would impose undue complicated administrative costs on all taxpayers in the state and would be a poor tax policy move.

Be sure to check out Joseph Henchman’s piece on how this IRS announcement will affect state taxation. It can be found in full here.

Our discussion of the U.S Supreme Court’s Defense of Marriage Act (DOMA) ruling (United States vs. Windsor) can be found here.

Follow Liz on Twitter @elizabeth_malm.

Share