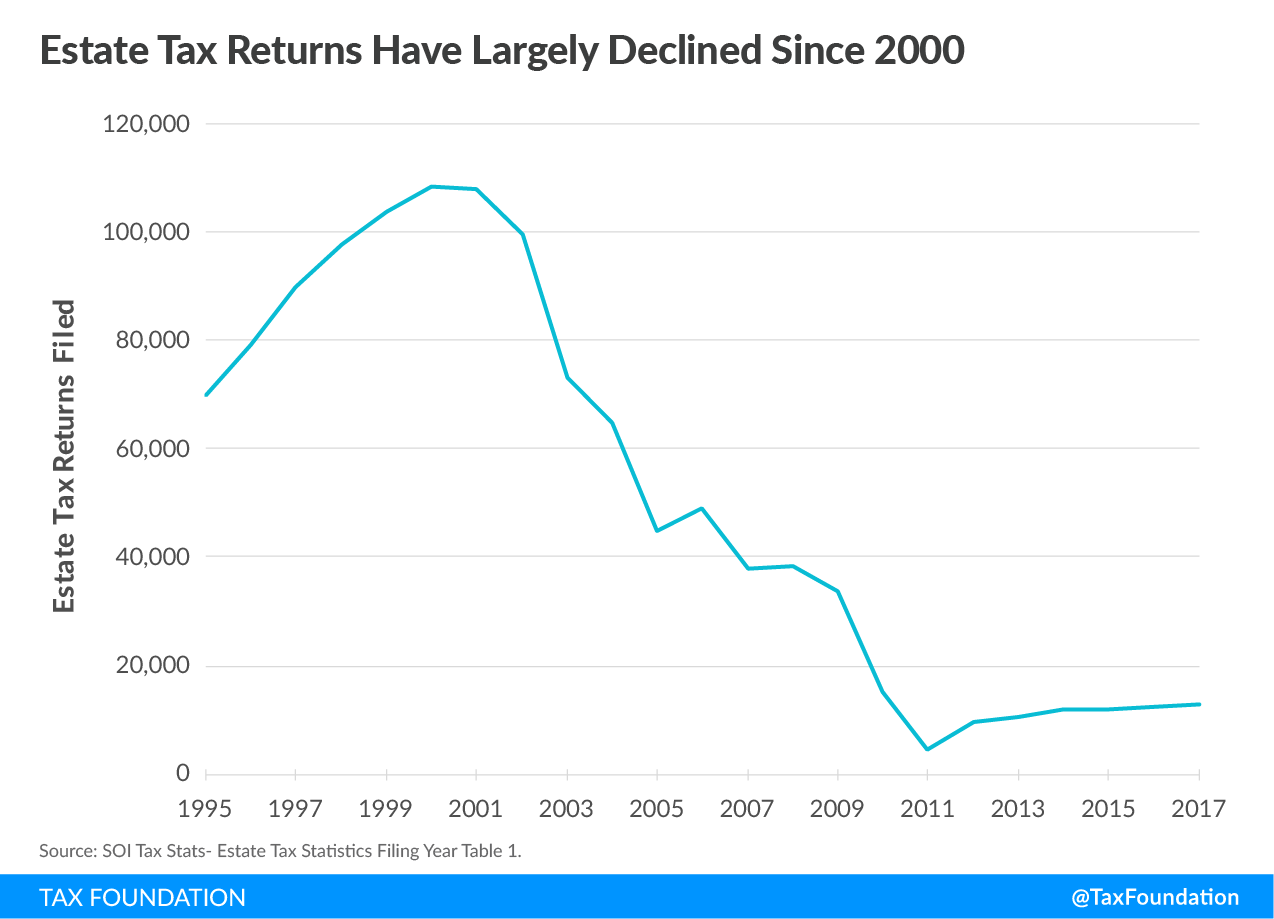

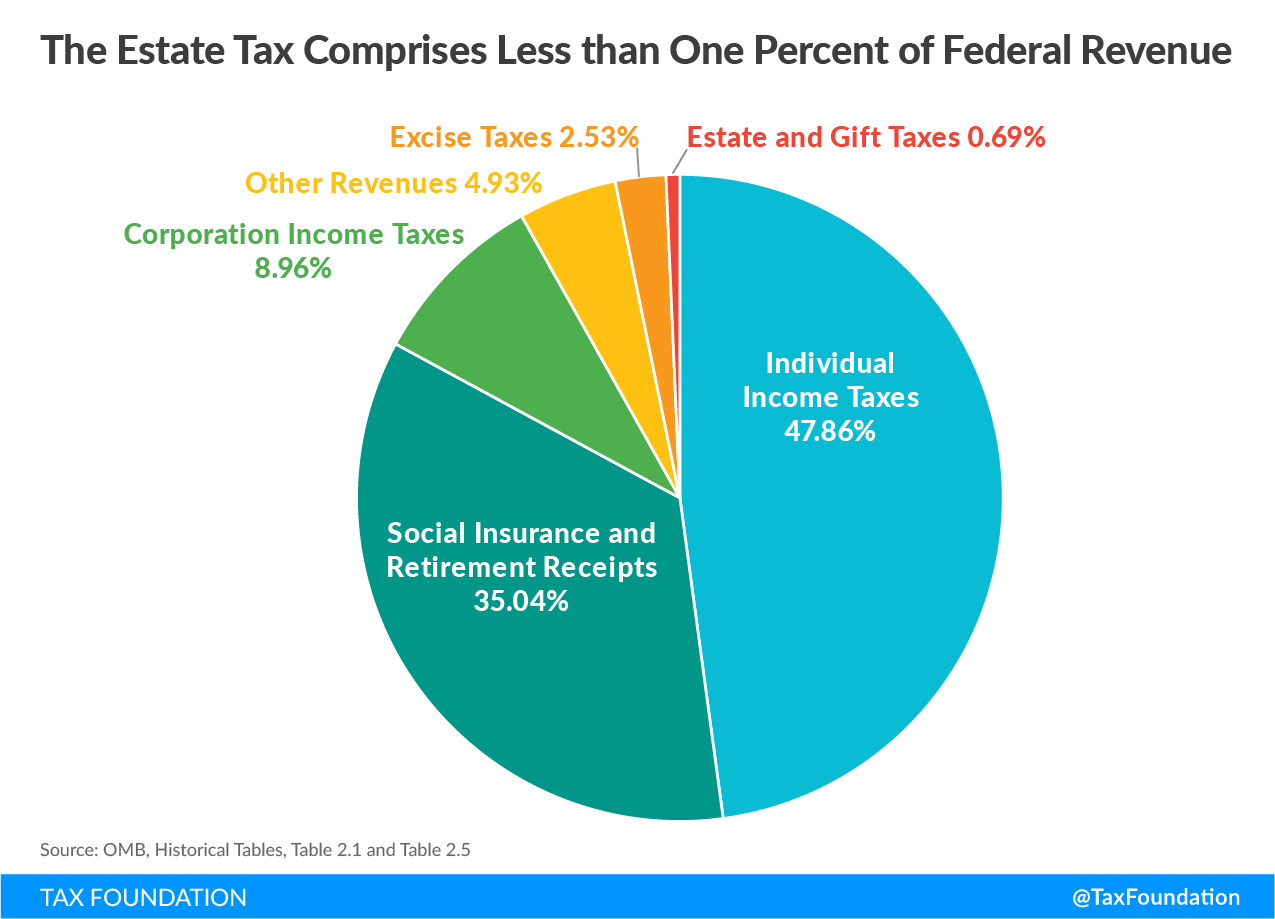

The Internal Revenue Service (IRS) recently released federal estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. data for 2017. This data continues to show relatively few taxpayers pay the estate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. —the number of estate tax filers has declined by 88 percent since 2000—and that it generates little federal revenue compared to other taxes. Changes to the filing threshold in the recent Tax Cuts and Jobs Act (TCJA) almost ensures a further decline in the number of estate tax payers.

By way of background, the federal estate tax is levied on the value of a deceased individual’s assets above the filing threshold at a rate of 40 percent. Estate tax filers technically pay taxes on the entire value of their estate, but take what’s called the “unified credit,” which completely offsets taxes paid on the value of the estate below the filing threshold ($5.49 million in 2017).

An efficient tax both generates revenue to fund government functions and minimizes economic harm to taxpayers in the process. This new data, as well as years of economic evidence, shows the estate tax is not that.

1. The estate tax’s narrow base and high rate limit its ability to generate revenue.

First, as the IRS has noted, estate tax returns have declined in recent years because of increases to the tax’s filing threshold, or “exemption.” In 2017, $5.49 million of a taxpayer’s estate was exempt from taxation, and slightly more than 12,700 estate tax returns were filed. This is down from more than 108,000 in 2000 and 2001 when the exemption was $675,000. And, the number of estate tax filers will likely decrease moving forward because the TCJA more than doubled the filing threshold to $11.2 million for 2018 through 2025.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

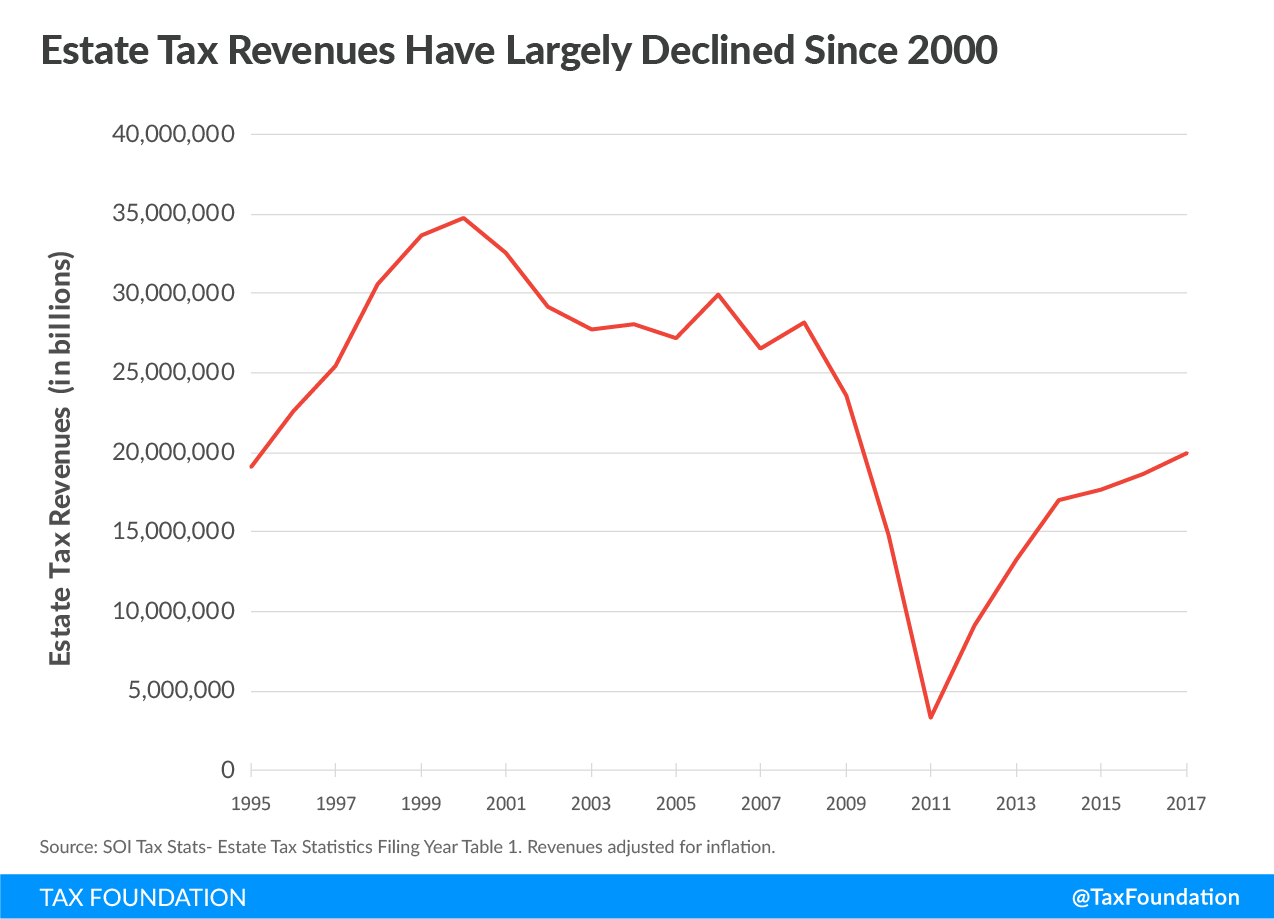

SubscribeThe estate tax’s high 40 percent rate encourages taxpayers to avoid the tax. This has real economic costs, as taxpayers spend time and money on tax planning instead of on more productive activities, such as work or investment. Taxpayer avoidance also limits the estate tax’s ability to generate revenue. The estate tax generated only $20 billion in 2017, or about 0.7 percent of all federal revenues.

The sharp decline in revenue in 2011 was due to the estate tax expiring for one year in 2010, after gradually being reduced from 2005 to 2009 as a part of the “Bush tax cuts” passed in 2001. The estate tax was revived in 2011 at a rate of 35 percent and an exemption of $5 million, and revenues have gradually increased since then.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe2. The estate tax discourages economic growth by discouraging investment.

Second, the estate tax primarily falls on the domestic capital stock, which discourages investment in capital such as commercial structures and business equipment that enhance labor productivity. Thus, the estate tax, as well as other taxes that discourage capital investment, negatively impact economic growth. This means fewer jobs, lower wages, and less economic output. And don’t forget, the estate tax creates other unseen losses because it encourages tax avoidance. These resources could also be spent on capital investment that would generate economic growth.

The estate tax raises little revenue, discourages capital investment, and hinders economic growth. In other words, the estate tax violates principles of sound tax policy.

Share this article