Two pieces of tobacco legislation in Michigan have the potential to decrease state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections by $320 million per year, deter smokers from switching to less harmful products, and increase illicit trade and crime. Senate Bill 649 bans the sale of all flavored tobacco products, including menthol cigarettes. Senate Bill 648 would increase the tax on cigarettes by $1.50 per pack, hike the tax on snuff by 15 percentage points of the wholesale price, and impose new taxes on vapor and modern oral products at a rate of 57 percent of the wholesale price.

The Great Lakes State collected more than a billion dollars in revenue in 2022 from excise and sales taxes on cigarettes and other tobacco products (OTP). A flavor ban would decrease those collections by almost one-third.

Flavor bans primarily target menthol smokers, and Michigan has one of the nation’s largest shares of menthol cigarette smokers. Nationwide, menthol-flavored cigarette sales comprise roughly 30 percent of cigarette sales. In Michigan, menthol cigarettes are 41 percent of the cigarette market.

To estimate the effects of a statewide flavor ban, we use data from Massachusetts as a baseline. In 2020, Massachusetts banned the sale of flavored tobacco products. Prior to the ban, menthol cigarettes made up roughly 31.3 percent of the market in the state. After the ban, cigarette sales fell by 27.4 percent. Of the decline in legal sales, roughly three-quarters of those sales left the state, primarily going to neighboring states. The other quarter switched to nonflavored products still sold in Massachusetts after the flavor ban.

Applying similar assumptions to Michigan, where menthol sales made up about 41 percent of market sales in 2022, we estimate that total cigarette sales would fall by 31.3 percent. The decline in tax collection from lower cigarette sales would be slightly more than $231 million, with another $53 million decline in sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. collections. Similarly, OTP excise and sales tax collections would fall by about $36 million, for a total revenue loss of $320 million annually.

And this revenue decline would not primarily be the result of reduced tobacco consumption. Instead, it would open the floodgates for smuggling. Michigan already has a net inbound smuggling rate of more than 18 percent, missing out on $176 million in cigarette tax revenue from packs that are consumed in the state but on which Michigan taxes have not been paid.

The bills proposed in Michigan would have the state emulate Massachusetts. Smuggling nearly doubled in Massachusetts following their menthol ban. A similar effect in Michigan would result in a market where more than one-third of all cigarettes consumed in the state are not purchased legally in the state.

A $1.50 per pack tax hike would have an even greater effect on smuggling, one that would stack on top of the effects of a menthol ban if both policies are enacted. At $3.50 per pack, Michigan would have the 6th-highest cigarette tax in the country, one cent less than Massachusetts. The combination of a flavor ban and a higher tax rate could see Michigan take the crown from New York as the highest cigarette smuggling destination in the United States.

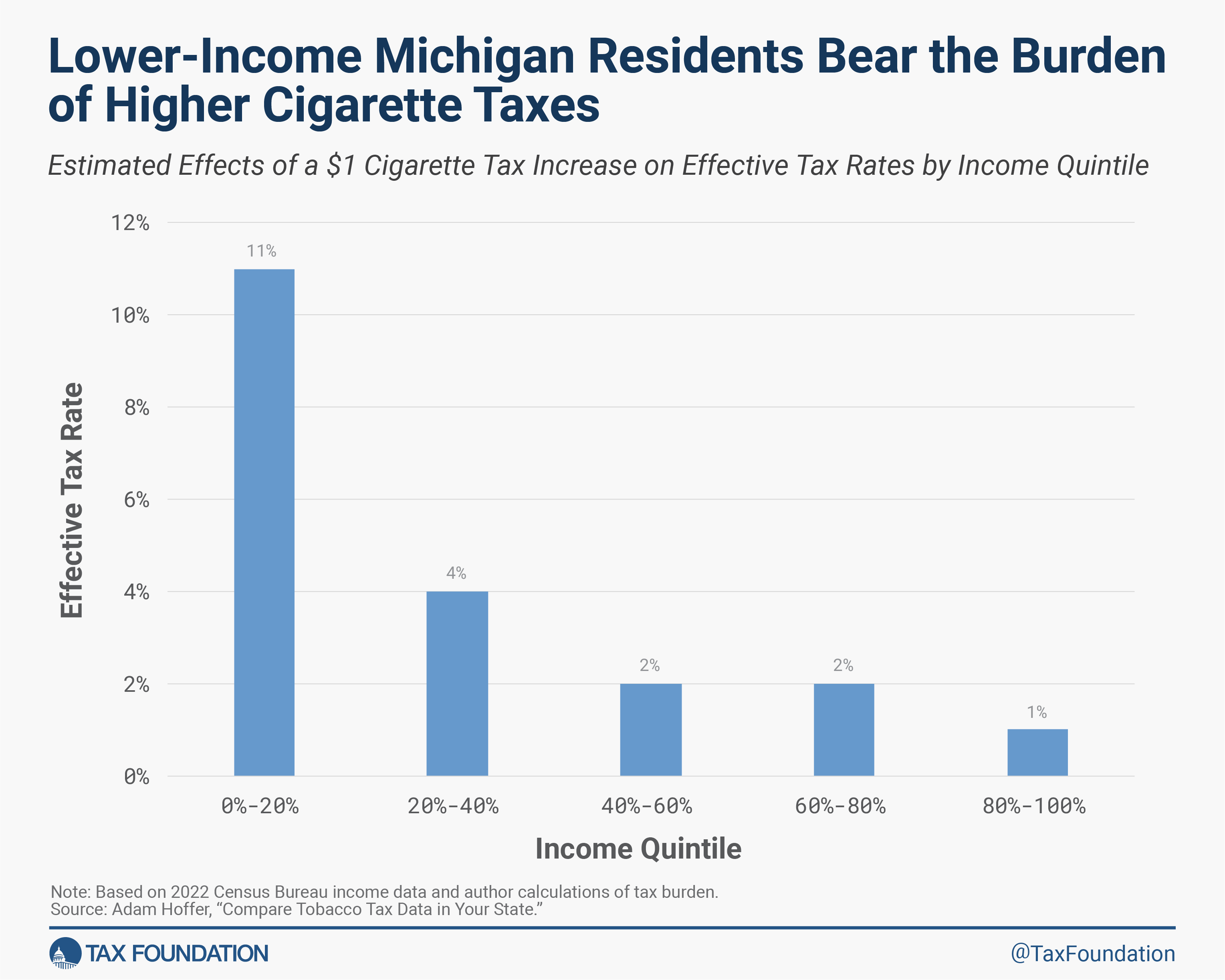

The revenue from the tax hike could offset most of the losses from a flavor ban and sales that move to the black market, but most of that revenue would come from lower-income Michigan residents. Cigarette taxes produce volatile revenue and are regressive. Our estimates suggest that the lowest-income groups would bear the greatest tax burden.

Senate Bill 649 also imposes large tax rate increases on modern oral tobacco, vapor, and snuff, despite evidence that these products are substantially less harmful than combustible cigarettes. Best practices for tax policy on alternative tobacco products (ATPs) suggest substantially discounted tax rates for less harmful products.

As the tax-induced price for ATPs increases, fewer smokers switch to ATPs from more harmful combustible products. Any legislator who wishes to reduce tobacco-related deaths should support a tax policy that incorporates relative harm into the rates set for both combustible cigarettes and ATPs.

Flavor bans and tobacco taxes are complex issues for legislatures to consider. In addition to unintended consequences—including increases in crime and black-market activity—they have significant effects on state budgets. Policymakers should carefully consider these consequences as they set rates and regulatory regimes for all tobacco and nicotine products.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe