Since June 1, 2020, Massachusetts has banned the sale of flavored tobacco products, including menthol cigarettes. When signing the ban into law, Gov. Charlie Baker (R) argued that the ban, which is the broadest in the country, was enacted to limit youth uptake of nicotine products. While youth uptake is a very real concern which deserves the public’s attention, outright bans could impede historically high smoking cessation rates. Lawmakers must thread the needle between protecting adult smokers’ ability to switch and barring minors’ access to nicotine products.

Aside from public health concerns, a ban on flavored tobacco, especially when including cigarettes, has significant taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. implications and could result in unintended consequences such as increased smuggling. In Massachusetts, more than 21 percent of cigarettes smoked were purchased out of state in 2018 (latest data).

Tobacco excise taxes are already an unstable source of tax revenue. Further narrowing the tobacco tax base by banning a portion of tobacco sales altogether could worsen the instability of this revenue source while driving up the costs of administration and law enforcement associated with the ban, especially if the lost revenue is made up by raising the tax rate on the remaining tobacco tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. .

Other states that are considering implementing a similar ban may want to consider the lessons from Massachusetts. Maryland is one of these states, but if its experience mirrors Massachusetts, it could prove an extraordinarily expensive exercise. In fact, the bill could be even larger in Maryland than in Massachusetts as, according to industry data, 55 percent of smokers in the state smoke menthol products (in Massachusetts that figure was only 34 percent).

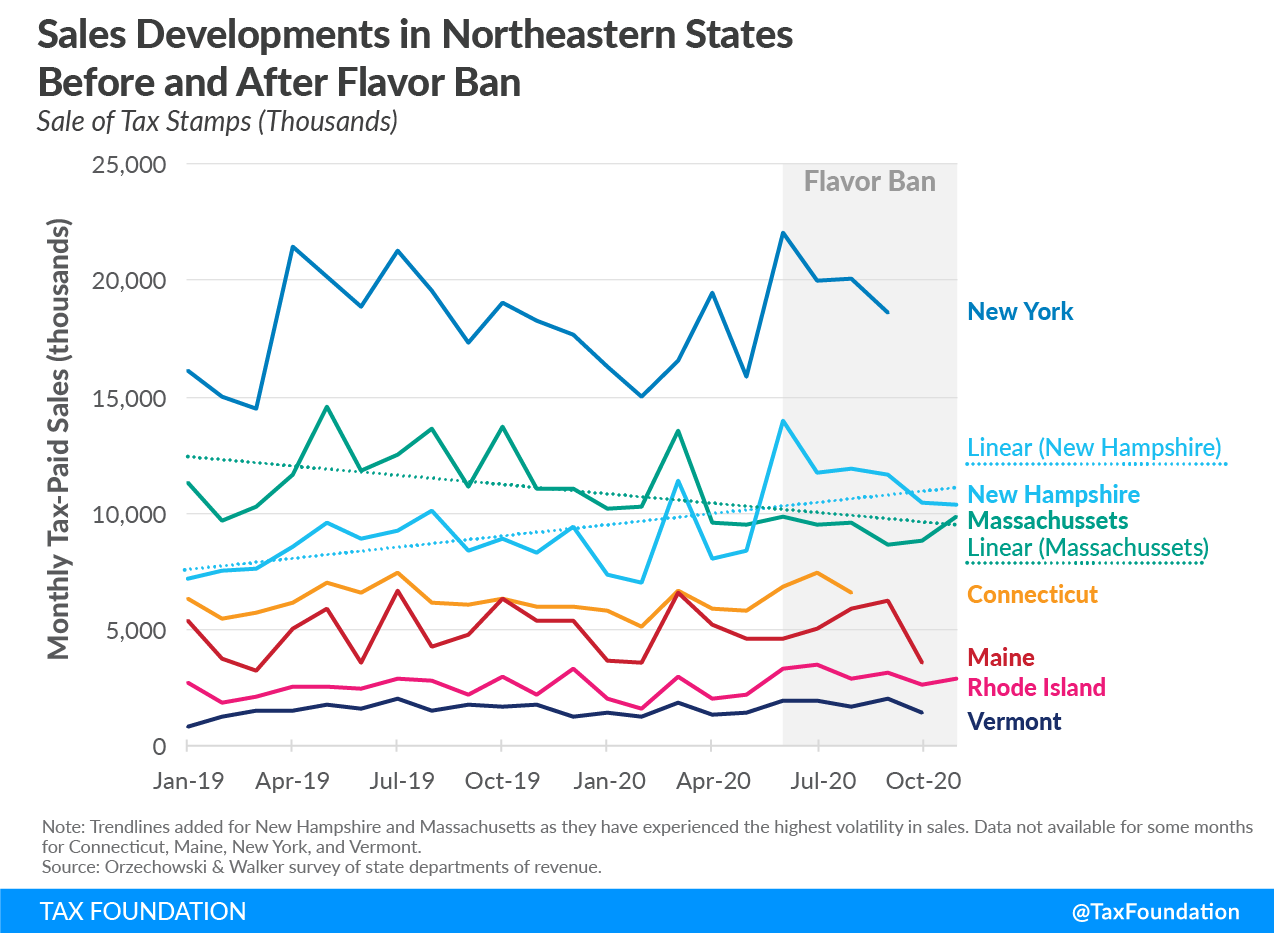

Seven months into Massachusetts’ flavor ban, early data is available for the real-world effects. If we only look at Massachusetts, the figures may look like a public health success story at first: sales of cigarette tax stamps in the Bay State have declined 24 percent comparing June-November 2020 to the same months of 2019. In the first half of 2020, Massachusetts only experienced a decline of roughly 10 percent compared to the first half of 2019.

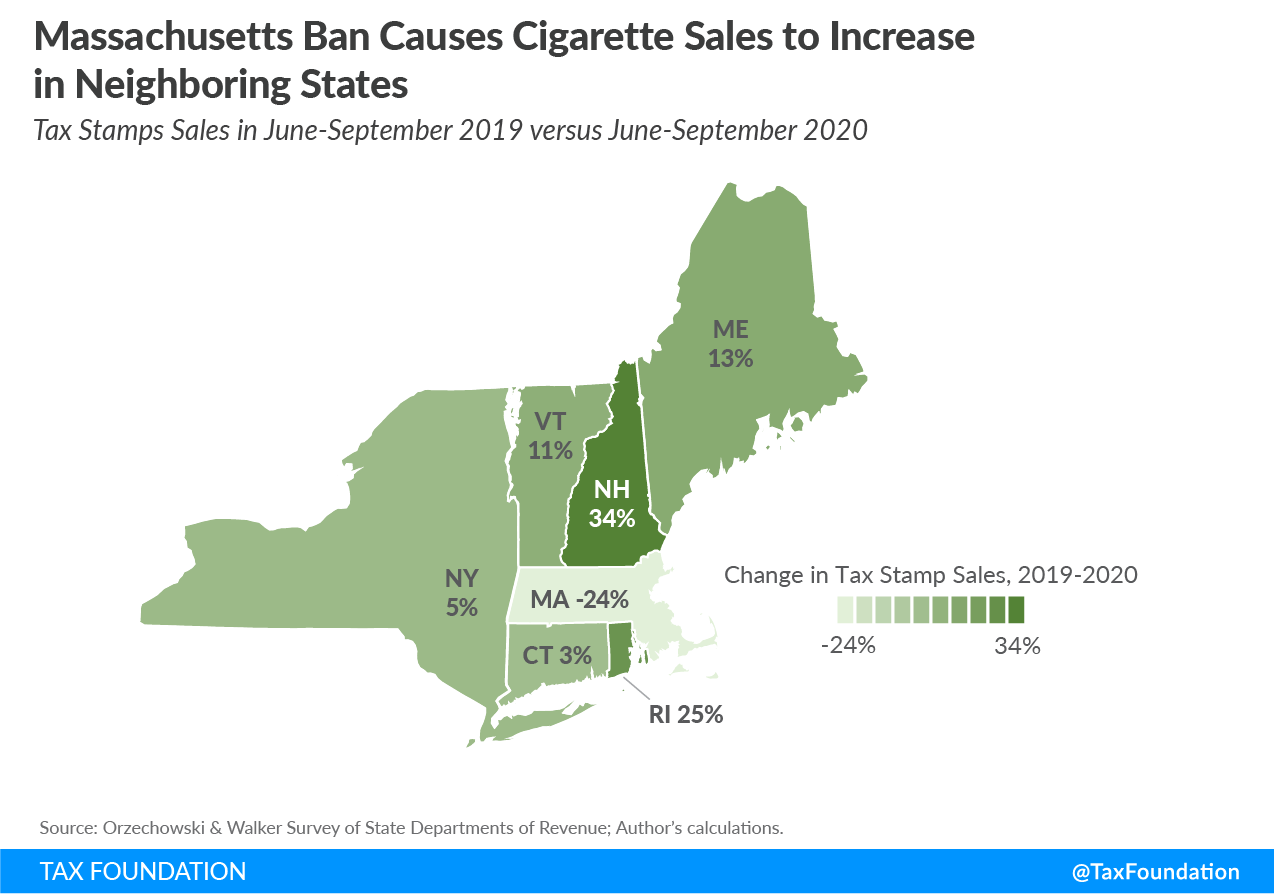

Those numbers would seem to back up the best argument for implementing a ban: limiting use of tobacco and nicotine. Unfortunately, if we dig a little deeper, it becomes evident that Massachusetts’ flavor ban has not limited use, just changed where Bay Staters purchase cigarettes. In fact, sales of cigarette tax stamps in the Northeast (Massachusetts as well as Connecticut, Maine, New Hampshire, New York, Rhode Island, and Vermont) have stayed remarkably stable, even increased a bit, following Massachusetts’ ban when compared to sales in 2019.

From June 1, 2020 to September 30, 2020, 230,797,000 stamps were sold in the region. For the same period in 2019, that number was 225,897,000. This slight increase trends against the national figures, where sales in 2020 were projected to decline around 2 percent. In other words, Massachusetts sales plummeted, but not because people quit smoking—only because those sales went elsewhere.

If we look at individual states, we can see that increases are skewed. The increase in sales in the Northeast region is most notable in Rhode Island and New Hampshire, but all have seen increased sales immediately following the ban. Unsurprisingly, New Hampshire benefits the most as that is already the state in the nation with the highest outflow of cigarettes.

The declining and increasing sales obviously impact excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. revenue in all these states. Massachusetts collected $557 million in cigarette and other tobacco products (OTP) excise taxes in FY 2019 ($515 million from cigarettes). For FY 2020, sales decreased 10 percent in the first half of 2020 which translates to a decline in revenue of roughly $50 million.

While this is still in the early days, assuming FY 2021’s accelerated decline of over 20 percent continues through the rest of the fiscal year, the cost of the flavor ban could end up being approximately $120 million for FY 2021 (not including sales tax losses). Over $100 million is a significant cost to the state, especially considering that sales are simply shifting to other states, not actually being eliminated.

In December 2019, the Massachusetts Department of Revenue estimated the ban would decrease collections by the slightly lower $93 million in FY 2021. Whichever proves right, that revenue is now being collected by Massachusetts neighbors.

Furthermore, these figures only account for cigarettes. According to Massachusetts’ own Illegal Tobacco Task Force, smokeless tobacco is commonly smuggled into the state due to the state’s high excise rates (210 percent of wholesale value). Because of the flavor ban, this smuggling activity is expected to increase. The available data for FY 2021 (through November 2020) indicates that legal sale of smokeless tobacco and OTP in the state is already down 35 percent compared to the previous year.

State tax coffers are not all that is impacted by this ban, however. Bans impact the large number of small business owners operating vape shops, convenience stores, and gas stations. Policymakers should not lose sight of the law of unintended consequences as they set tax rates and regulatory regimes for nicotine products.

All in all, early signs indicate that the ban will not decrease tobacco consumption in the state. It is not in the interest of Massachusetts to pursue a public health measure that merely sends tax revenue to its neighboring states without improving public health—nor should this approach be copied by other states. In addition, the ban on flavored tobacco highlights the complications of contradictory tax and regulatory policy, the instability of excise taxes that go beyond pricing in the cost of externalities, and the public risks of driving consumers into the black market through excessive taxation or regulation.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe