While many Americans are in a panic to pay their taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. bill today, millions of others are getting a generous "refund" check back from the IRS, which is not much different from a welfare check except that it's run through the tax code instead of through the Department of Health and Human Services.

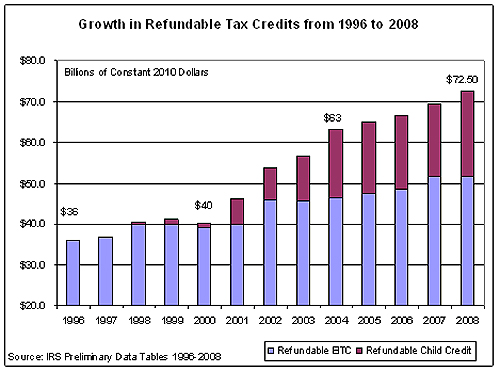

According to the latest IRS data, the amount of refundable credits paid out by the IRS has doubled in real terms since 1996. Most tax credits can only reduce a taxpayer's amount due to zero, but the EITC and the child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. are also refundable, meaning that taxpayers are eligible to receive a check even if they have paid no income tax during the year.

In 2008, 25 million tax filers received $51.6 billion in EITC benefits. Of this amount, $50.5 billion was refundable in excess of their income tax liability. Also in 2008, some 25.3 million filers received $30.7 billion in child tax credit benefits, with more than 18 million of these filers getting $20.5 billion in refundable checks. Many families are eligible for both the EITC and the child credit. These are not refunds of overpaid tax; they are payments to people who have already gotten back everything that was withheld from their paychecks during the year.

Quite aside from the fact that these refundable credits remove millions of people from the roster of Americans who support the government by paying the income tax, these credits have other undesirable effects such as added tax complexity.

According to the annual report of the IRS's National Taxpayer Advocate, about 62 percent of all taxpayers use tax return preparers, and the percentage climbs to about 73 percent for those claiming the EITC.[2] Moreover, the complexity of EITC eligibility is a contributing factor to the estimated $10 billion to $12 billion in erroneous overpayments out of nearly $44 billion of total EITC claims in 2006.[3]

Share this article