Every once in a while we see blog posts from other tax research organizations, or even congressional offices, puzzled over the low collection of corporate taxes relative to GDP or relative to other taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenues. Today we have another such post, from Citizens for Tax Justice. I believe I can allay that confusion.

Let me try to cover this issue again, since our previous attempts appear to have failed:

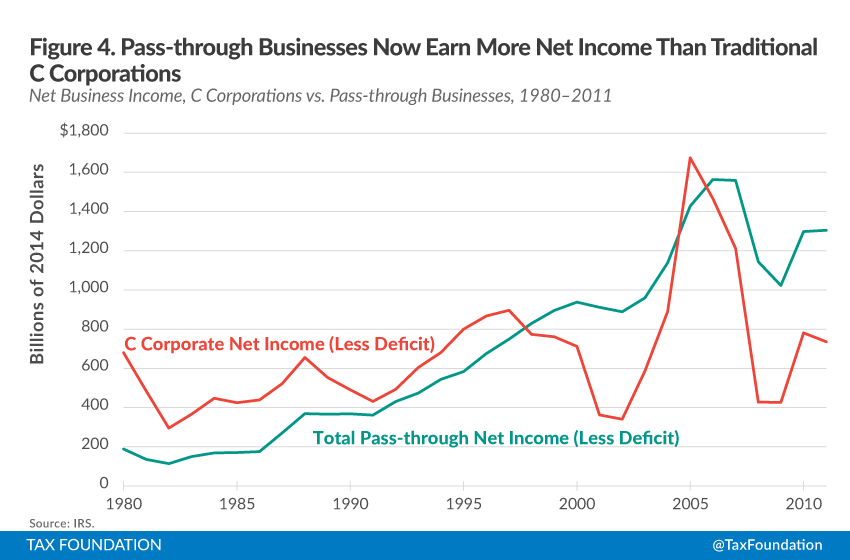

The United States has two different systems for taxing businesses. Some businesses, known as C corporations, file their taxes through the corporate tax code. Other businesses file their taxes through the individual tax code, on the returns of the owner. Over time, the C corporation structure has become less prominent, and the pass through structure, filed on the individual code, has become more prominent. (More on the pass through structure here.)

Measurement of taxes on C corporations alone doesn't give a complete picture of how businesses are paying tax. A majority of business income now comes from businesses filing through the individual tax code. We even made charts to show how this works.

It would be much more informative if CTJ were to measure both kinds of businesses – or, at a minimum, acknowledge that two different kinds of business exist.

Share this article