Earlier this week, a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. omnibus bill—Senate Bill 1398—advanced out of the Arizona Senate Finance Committee with a favorable recommendation. This bill includes many tax changes, but one particularly notable provision would conform Arizona’s corporate tax code to the 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. allowance under Internal Revenue Code (IRC) § 168(k). Offering full expensing is one of the most valuable tax changes Arizona could make to improve tax competitiveness and make the state more attractive as a destination for business investment.

Currently, Arizona is one of the states conforming to the net interest limitation under IRC § 163(j) but not offering the 100 percent bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. allowance under § 168(k). When the Tax Cuts and Jobs Act (TCJA) was enacted in late 2017, these two provisions were meant to counterbalance each other. The 100 percent bonus depreciation allowance removed the tax penalty on qualified machinery and equipment investments, but, as a partial offset, 163(j) limited the deductibility of interest on business debts. One of the goals of this pairing was to reduce the tax code’s bias toward debt over equity financing.

After the TCJA was enacted, Arizona held off on updating its conformity statute to a post-TCJA version of the IRC until nearly a year and a half after the federal reforms were adopted. Despite being late to the game, when Arizona did eventually update its conformity statute with enactment of House Bill 2757 in May 2019, policymakers used that as an opportunity to consolidate the state’s individual income tax brackets, lower rates, and increase the standard deduction, among other meaningful reforms. Notably omitted from H.B. 2757, though, was any decisive action pertaining specifically to §§ 168(k) or 163(j). As a result, merely updating Arizona’s conformity date brought the § 163(j) net interest limitation into Arizona’s code. Full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. was not brought into the code, however, because Arizona law modifies the federal treatment of depreciation, functionally capping bonus depreciation at 50 percent.

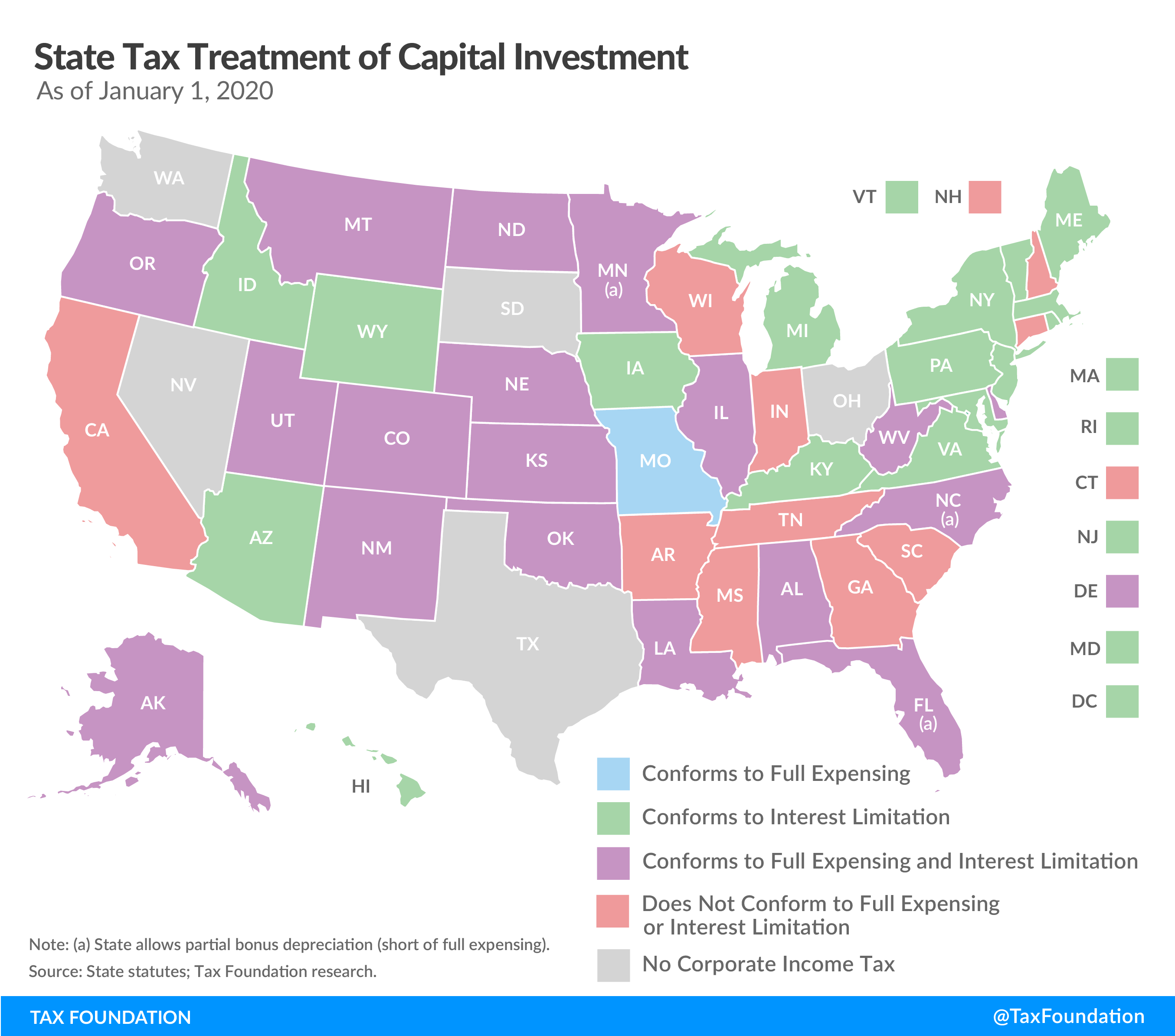

Arizona is one of 16 states and the District of Columbia (shown in green on the map below) that currently conforms to the net interest limitation without offering full expensing. As a result, there are many cases in which business expenses, on net, are treated less favorably for income tax purposes by these states now than they were pre-TCJA. Moving forward, Arizona and other states in this position have the opportunity to mitigate this unfavorable treatment either by conforming directly to IRC § 168(k) or by offering a permanent, rather than temporary, 100 percent expensing provision of their own.

Currently, Missouri is the state with the most favorable treatment of expensing, conforming to 168(k) while not conforming to 163(j). Eighteen states (shown in purple on the map) mimic the TCJA’s intent by conforming to both §§ 168(k) and 163(j), although Florida, Minnesota, and North Carolina offer only given percentages of bonus depreciation rather than 100 percent bonus depreciation. Ten states (shown in pink) currently conform to neither provision but still have the opportunity to do so.

Conforming to § 168(k) is a pro-growth tax change states should consider making if they want to remove their tax code’s bias against capital investment. States that forgo full expensing not only treat machinery and equipment at a disadvantage compared to other business expenses (like labor, advertising, and supplies, which are written off in the first year) but they also impose a tax disadvantage on in-state investment, which is especially harmful to manufacturers and businesses in other capital-intensive industries.

When businesses are forced to wait years or decades to recoup major capital expenses against their income tax liability, the result, on a national level, is less capital formation, less output, and lower productivity and wages. At the state level, states with stingy expensing provisions are less attractive for in-state investment, all else being equal, than those offering full expensing. Among the five states sharing a border with Arizona, three offer full expensing.

The 100 percent bonus depreciation allowance is scheduled to begin phasing down in 2023, but state conformity to § 168(k) would nevertheless provide short-term benefits for in-state investors. Thinking ahead to the medium and long term, to provide an even more attractive and stable environment for in-state investors and would-be investors, states ought to consider making their own full expensing provisions permanent rather than waiting on Congress to act.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe