Blog Articles

U.S.-China Trade War Hurt American Industries and Workers

While the U.S. tariffs were intended to protect American industries, they have largely hurt the U.S. economy. Rather than pass on the tariffs to Chinese consumers, analysis shows that most U.S. firms simply bore the costs.

5 min read

Evaluating Wyoming’s Business Tax Competitiveness

Wyoming’s low taxes are highly attractive, but policymakers are still hard at work helping the state achieve broader economic development goals.

13 min read

The Aftermath of Arizona’s Proposition 208 and the Potential for a Flat Tax

Arizona now joins a growing cohort of states that are moving toward a flat income tax. Pending revenue triggers, the income tax rate will be reduced to 2.5 percent giving Arizona one of the lowest individual income tax rates in the country.

7 min read

FDA Menthol Ban Would Boost Smuggling, Reduce Revenues, with Few Health Benefits

Learn more about the FDA’s proposal to ban the sale of menthol cigarettes and flavored cigars. Including its effect on revenue & public health measures.

4 min read

Tax Filing Season: Options for Improvement

Efforts to improve the taxpayer experience should focus on the IRS’s operations and include structural improvements to the tax code.

4 min read

Remembering Senator Orrin Hatch’s Historic Tax Legacy

Among the many achievements in the illustrious career of former Sen. Orrin Hatch (R-UT) was his commitment to bipartisan tax reform.

3 min read

Kansas Policymakers Should Improve Food Credit, Not Exempt Groceries

This legislative session, the sales tax on food has garnered a great deal of attention in Kansas, with policymakers on both sides of the aisle proposing the removal of groceries from the sales tax base.

7 min read

The Misguided Notion of Government-Set Prices for Prescription Drugs

Government-set pricing of prescription drugs is not a fix for today’s rampant inflation and further, it would give rise to new problems of its own.

6 min read

Missouri Tax Reform Could Give State Competitive Edge

Tax reform has become a major focus for state legislatures this session, and Missouri lawmakers are tuned in to the action: after adjusting individual income tax triggers in 2021, the legislature is exploring further tax reform options.

6 min read

Chaotic IRS Filing Season Shows the Perils of Running Social Policy Through the Tax Code

As the deadline for tax filing nears, the IRS faces scrutiny for its backlog of returns, inaccessible taxpayer service, and delays in issuing certain refunds.

5 min read

Personal Income Tax Adjusts for Inflation, But It Could Do Better

In times of inflation, a review of the tax code shows that some provisions are automatically indexed, or adjusted, to match inflation, while others are not. And that creates unfair burdens for taxpayers. But it’s not always as simple as just “adjusting for inflation.”

4 min read

Georgia Makes Strides Toward Tax Competitiveness

Lawmakers can be proud of the steps that they have taken toward a better tax code but should consider revisiting the design of the bill’s tax triggers in order to better accomplish their goal of responsible improvement.

6 min read

President Biden’s 61 Percent Tax on Wealth

As part of President Biden’s proposed budget for fiscal year 2023, the White House has once again endorsed a major tax increase on accumulated wealth, adding up to a 61 percent tax on wealth of high-earning taxpayers.

4 min read

Can Taxes Predict the UEFA Champions League Winner?

Before competing in the UEFA Champions League, football clubs in Europe also compete to lure the best players.

5 min read

Which Global Minimum Tax Will We Get?

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have been debated in recent months, there are clear divides between U.S. proposals and the global minimum tax rules.

5 min read

Kentucky Legislature Sends Pro-Growth Tax Changes to Governor

Kentucky is making commendable progress toward a more modern and competitive tax code, but more work on comprehensive tax reform should be prioritized next session.

7 min read

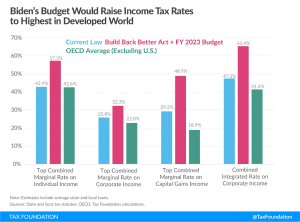

Biden Budget Would Raise Income Tax Rates to Highest in Developed World

The FY 2023 budget proposes several new tax increases, which in combination with the Build Back Better Act, would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

4 min read

Sustainable Tax Reform a Win for Mississippians

Mississippi policymakers delivered the largest tax cut in state history, providing meaningful relief for taxpayers by cutting individual income tax rates.

7 min read

Will Colorado Spend Millions on Flavored Tobacco and Nicotine Prohibition?

Lawmakers in Colorado, and in the several other states considering flavor bans, should think twice before following in the footsteps of Massachusetts. A statewide ban on flavored tobacco products is more than likely to costs millions of dollars, increase smuggling, and have a negligible effect on public health.

5 min read