Blog Articles

Tax Nicotine Products By Quantity

2 min read

States Move on Recreational Marijuana

5 min read

UK Taxes: Potential for Growth

3 min read

Retail Glitch Awaits Congressional Fix

2 min read

Next Steps from the OECD on BEPS 2.0

The continuation of this work is important, but the OECD and policymakers around the world should carefully consider whether these proposals will lead to more certainty, or if they will undermine that goal by simply be a step toward more unilateralism. The impact on cross-border investment will also be a critical issue to consider, and the ongoing impact assessment by the OECD is an important part of the work.

6 min read

Better than the Rest

2 min read

Legislation Introduced to Cancel R&D Amortization

Canceling the amortization of research and development costs would reduce federal revenue, but policymakers have a variety of options to offset the costs.

3 min read

Booker’s Plan to Eliminate Step-up in Basis and Expand the Estate Tax

Removing step-up in basis would encourage taxpayers to realize capital gains and it would plug a hole in the current income tax, while increasing federal revenue. Combined, however, with the estate tax, this would result in a significant tax burden on certain saving by requiring both the appreciation in and total value of transferred property to be taxed at death

2 min read

Senator Sanders Proposes a Tax on “Extreme” Wealth

Bernie Sanders recently became the second major Democratic presidential candidate to propose a wealth tax.

2 min read

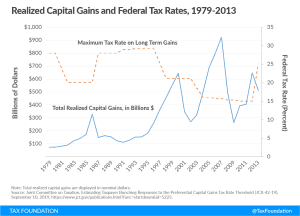

JCT Report Shows Capital Gains are Sensitive to Taxation

JCT’s report on capital gains elasticities reminds us that capital gains realizations, at least under a tax system that allows deferral, are sensitive to tax rates. Moving to mark-to-market taxation of all capital gains would remove this sensitivity by taxing capital gains annually.

4 min read