Options for Navigating the 2025 Tax Cuts and Jobs Act Expirations

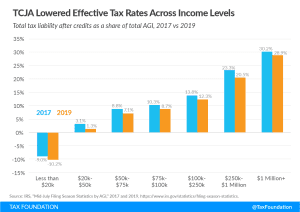

Policymakers should have two priorities in the upcoming economic policy debates: a larger economy and fiscal responsibility. Principled, pro-growth tax policy can help accomplish both.

21 min read