Will Colorado Spend Millions on Flavored Tobacco and Nicotine Prohibition?

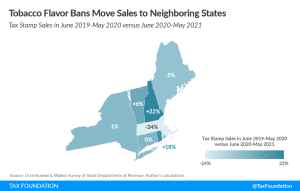

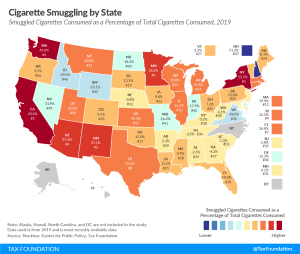

Lawmakers in Colorado, and in the several other states considering flavor bans, should think twice before following in the footsteps of Massachusetts. A statewide ban on flavored tobacco products is more than likely to costs millions of dollars, increase smuggling, and have a negligible effect on public health.

5 min read