Banning Flavored Tobacco Could Have Unintended Consequences

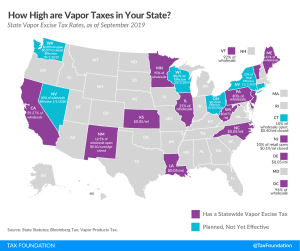

The prospect of a ban on flavored tobacco and nicotine products highlights the complications of contradictory tax and regulatory policy, the instability of excise taxes that go beyond pricing in the cost of externalities, and the public risks of driving consumers into the black market through excessive taxation or regulation.

6 min read