Morgan was a Policy Analyst with the Center for State Tax Policy at the Tax Foundation where she researched tax trends across the country. Morgan also managed the chartbook and weekly map programs for the state team. Her research has been featured in national and state-based publications, including the Associated Press, Bloomberg BNA, CNN Money, Fox Business, NPR, and the Washington Post. She has testified or presented to officials in four states: Kentucky, Maine, Minnesota, and Ohio.

Latest Work

Minnesota’s Tax Plans Make Modest Improvements

In response to the new federal tax law, the governor and lawmakers in both houses have proposed plans for updating Minnesota’s tax code.

2 min read

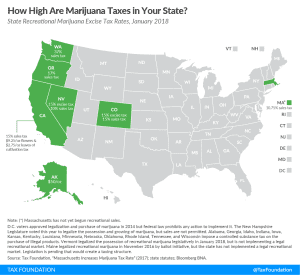

Recreational Marijuana Taxes by State, 2018

As public opinion increasingly favors the legalization of recreational marijuana, a growing number of states must determine how to structure marijuana taxes.

3 min read

Kentucky Legislature Overrides Governor’s Veto to Pass Tax Reform Package

By broadening bases while lowering rates, policymakers in Kentucky took a responsible approach to comprehensive tax reform.

2 min read

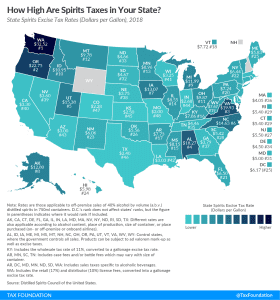

Distilled Spirits Taxes by State, 2018

2 min read

Governor Dayton’s Budget Proposal: Some Pro-Growth Provisions, but Misses the Mark on Others

The proposal includes some good reforms, including conforming to the federal full expensing provision, but also rolls back some recent positive changes.

2 min read

Facts and Figures 2018: How Does Your State Compare?

Facts and Figures is a one-stop data resource comparing the 50 states on over 40 measures of individual and corporate income taxes, sales taxes, excise taxes, property taxes, business tax climates, and more.

1 min read

Maine Tax Conformity Bill a Step Toward Better Policy

In the wake of the Tax Cuts and Jobs Act, Maine is considering conformity legislation that would improve the competitiveness of the state’s tax code.

3 min read

State Individual Income Tax Rates and Brackets, 2018

Individual income tax rates and brackets vary widely by state. Keep track of top marginal income tax rates in your state and others with our new guide.

4 min read

Tax Reform Moving Quickly in Georgia

In response to federal tax reform, Georgia is poised to reform its own tax code in a way that would make the state more competitive with its neighbors.

3 min read

State Corporate Income Tax Rates and Brackets, 2018

State corporate income tax rates range from 3 percent in North Carolina to 12 percent in Iowa. Download and compare each state’s 2018 rates and brackets here.

6 min read

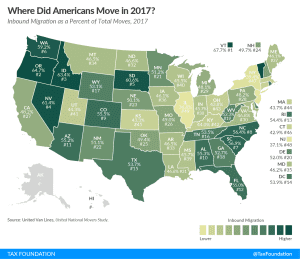

Where Did Americans Move in 2017?

There are many ways that states can compete with one another for residents, and tax rates and structures should certainly be part of the conversation for states looking to attract new residents.

2 min read

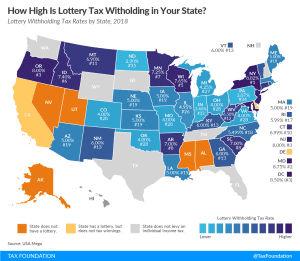

What Percentage of Lottery Winnings Would be Withheld in Your State?

You probably aren’t going to win the Powerball jackpot, but your state already has. Here’s a look at lottery withholding tax rates by state.

2 min read