Sales Tax Holidays by State, 2018

Sales tax holidays are not sound tax policy as they create complexities for all involved, while inserting the political process into consumer decisions.

45 min readJoe Bishop-Henchman was Executive Vice President at the Tax Foundation, where he analyzed state tax trends, constitutional issues, and tax law developments. He has testified or presented to officials in 36 states, testified before Congress six times, has written more than 90 major studies on tax policy. He holds a law degree from George Washington University and a bachelor’s degree in Political Science with a minor in Public Policy from the University of California, Berkeley.

In 2010, he was identified in State Tax Notes as among four people who “will likely dominate the field in the next 10 years,” and the Tax Foundation’s state policy program was honored as most influential in state tax policy by State Tax Notes for 2011, 2012, and 2013. His expertise has been cited by The Economist, The New York Times, The Wall Street Journal, USA TODAY, The Washington Post, the Los Angeles Times, The (Baltimore) Sun, The Orange County Register, The Philadelphia Inquirer, The Christian Science Monitor, CNN, NPR, ABC News, Bloomberg, C-SPAN, CNBC, Fox, Forbes, Fortune, Governing, Barron’s, Kiplinger’s, Stateline, Reuters, the Associated Press, and by 75 law review articles.

He is the author of a book on distinguishing taxes from fees and the co-author of books on tax policy in North Carolina, Nebraska, and Nevada. The U.S. Supreme Court in South Dakota v. Wayfair (2018) twice cited the Tax Foundation brief he authored and adopted the analysis it had recommended. In his pre-DC life before joining the Tax Foundation in 2005, he worked in the historic 2003 California recall election as press/policy aide to gubernatorial candidate and former baseball commissioner Peter Ueberroth, helped organize rallies against wasteful spending and the curfew law in his native San Diego County, and interned with the Office of the DC Attorney General, Citizens Against Government Waste, and University of California outreach in California’s Central Valley. His college activities included the Cal Libertarians and student government, and his law school activities included student government, Lambda Law, and the Federalist Society.

He is admitted to practice law in New York, Maryland, the District of Columbia, and before the U.S. Supreme Court.

Sales tax holidays are not sound tax policy as they create complexities for all involved, while inserting the political process into consumer decisions.

45 min read

Various interpretations of the recent Wayfair decision from the U.S. Supreme Court has led to confusion about its impact for online sellers and consumers. We clear up that confusion with this Q&A.

8 min read

The U.S. Supreme Court handed down its decision in South Dakota v. Wayfair. Thirty-one states that currently tax internet sales will be impacted.

3 min read

The threatened lawsuit may be more a political exercise than a legal one, as a judge is unlikely to rule that the SALT deduction cap violates either the Equal Protection Clause or the Tenth Amendment

14 min readThe U.S. Supreme Court is hearing a case on the constitutionality of a South Dakota law requiring internet vendors collect online sales tax, but should Congress fix the problem first?

13 min read

In the South Dakota v. Wayfair online sales tax case, the U.S. Supreme Court should ensure that state sales tax laws don’t burden interstate commerce.

3 min read

The U.S. Supreme Court has agreed to take South Dakota v. Wayfair Inc., which could result in a ruling that settles the years-long debate over how to apply sales taxes to online retail activity.

1 min read

The National Conference of State Legislatures may revisit a decision to reject tax reform that repeals the state and local tax deduction.

2 min read

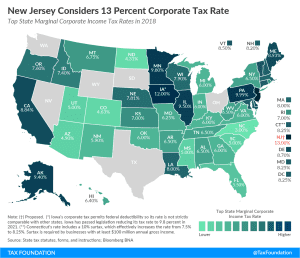

New Jersey has the worst state business tax climate of the 50 states and the third highest state and local tax burden. If federal tax reform prompts New Jersey to overhaul its tax code, it’s long overdue.

3 min read

A typical American household with four wireless phones paying $100 per month for wireless voice service can expect to pay about $221 per year in wireless taxes, fees, and surcharges.

34 min read

For 15 years, our State Business Tax Climate Index has been the standard for legislators and taxpayers to understand how their state’s tax code compares and how it can be improved. Now, for the first time ever, you can explore our Index’s 100+ variables in an easy to use, interactive format.

16 min read