Taxes and Migration: New Evidence from Academic Research

Do taxes affect individuals’ decisions regarding where to live and work? Can high taxes cause the outmigration of wealthy individuals?

5 min readAndrey Yushkov is a Senior Policy Analyst with the Center for State Tax Policy at the Tax Foundation. He holds a PhD in public policy from Indiana University, an MS in economics from the University of Bonn, and a BS from St. Petersburg University.

Prior to joining the Tax Foundation, Andrey worked as a consultant at Leontief Centre, participated in several World Bank and other international development projects dealing with the issues of public financial management and project evaluation in the public sector, and taught public budgeting and finance at Indiana University. His scholarly work on fiscal federalism was published in Public Finance Review and Eurasian Geography and Economics, among other outlets. In his free time, Andrey enjoys traveling, playing chess, biking, and listening to new classical recordings.

Do taxes affect individuals’ decisions regarding where to live and work? Can high taxes cause the outmigration of wealthy individuals?

5 min read

Expanding Virginia’s sales tax base to include B2B digital transactions could lead to tax pyramiding, hide the true cost of government, and make the sales tax system much less neutral and transparent.

5 min read

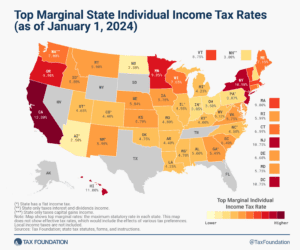

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

Local income taxes in Maryland constitute about 35 percent of local tax collections and more than 17 percent of local revenue, giving Maryland’s localities the highest dependence on income taxes in the nation.

5 min read

As policymakers continue efforts to improve Kentucky’s tax structure and competitiveness, they should keep in mind that not all offsets are created equal.

59 min read

While some recommendations follow the principles of sound tax policy and may improve the District’s tax climate, some proposals make the tax code more complex and less neutral, potentially disincentivizing investment and business activity.

6 min read

Virginia Governor Youngkin unveiled the contours of a tax reform plan incorporated into his forthcoming budget, which includes three major structural elements: a reduction in the individual income tax rate, a 0.9 percentage point increase in the sales tax rate, and the broadening of the sales tax base to include some “new economy” digital services.

6 min read

When it comes to comprehensive tax reform, poorly designed local tax policies can offset any improvements brought about by state tax policies.

6 min read

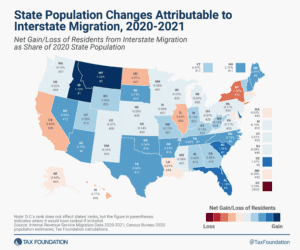

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

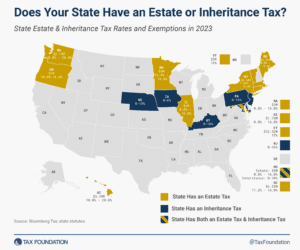

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

4 min read

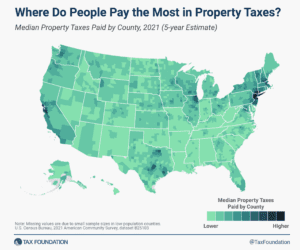

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

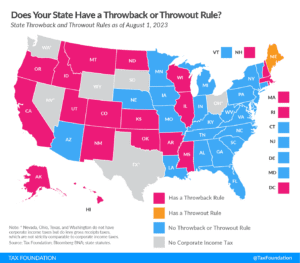

As more and more states move away from throwback or throwout rules, those states that still impose these rules are becoming less attractive for businesses, which are incentivized to relocate their sales activities to non-throwback states.

6 min read