Details and Analysis of Canceling the Scheduled Business Tax Increases in Tax Cuts and Jobs Act

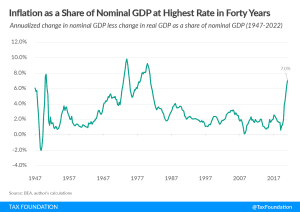

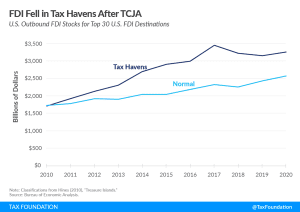

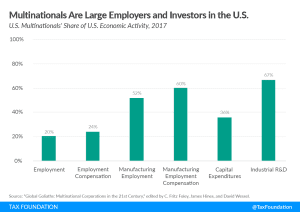

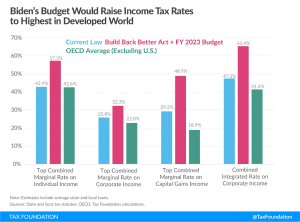

The business tax changes originally introduced in the TCJA are scheduled to increase tax burdens on businesses at a time when economic headwinds and broader uncertainty are higher than they have been in decades.

12 min read