School property taxes in Pennsylvania totaled $12.3 billion in 2014-2015, or 69 percent of all property taxes collected in the state. Legislators are set to reintroduce a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. swap, known as the Property TaxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. Independence Act, which would eliminate local school property taxes and would increase its general education aid to localities to offset the loss of property tax revenue. The state would replace the lost revenue with higher individual income taxes and higher sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. at the state level. My colleague, Jared Walczak, has been critical of this proposal previously, including when it was attempted in 2015. While this seems like a win for taxpayers, there are a number of fundamental flaws with this proposal.

First, contrary to how it is described, this wouldn’t eliminate property taxes in Pennsylvania. School districts are just one of several property tax taxing authorities in Pennsylvania. Counties and municipalities also assess property tax, comprising 31 percent of property tax collections. Even under this proposal, local education property taxes won’t disappear. School districts would still collect property taxes to pay for their outstanding debt obligations. According to data from the Independent Fiscal Office in Pennsylvania, debt service represents approximately 17 percent of school property tax collections. Debt service will actually grow to 18 percent of local school property tax collections by 2021-22. This would just shift some of the local school district tax collections to the state; it’s not an elimination.

Second, the bill would raise other taxes to fill the gap. The state would raise the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. and sales tax. The previous version of the bill raised the individual income tax from 3.07 to 4.95 percent and the sales tax from 6 to 7 percent. (Rates might be different in the forthcoming legislation.)

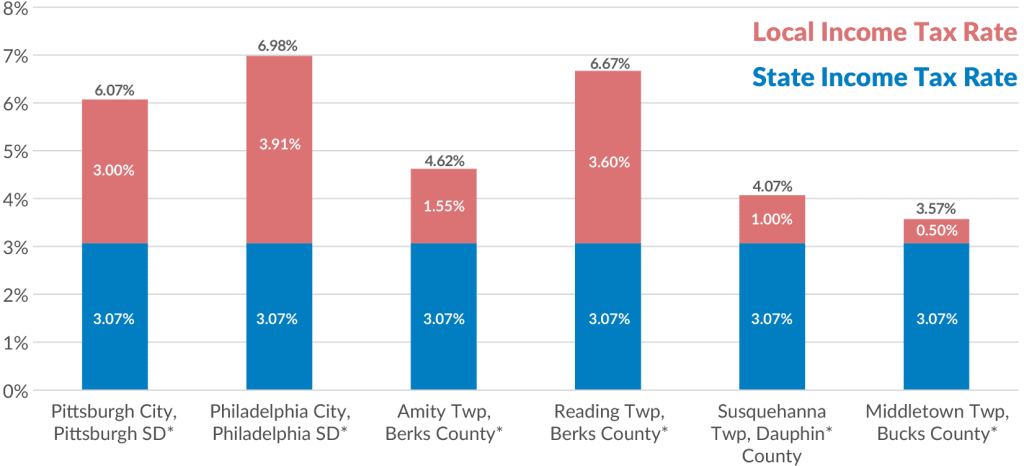

Raising the individual income tax is particularly alarming. The individual income tax rate of 3.07 percent in Pennsylvania is quite low. It’s the second lowest of any state that taxes individual income, but that ignores local income taxes in Pennsylvania, with rates as high as 3.91 percent. The chart below shows the combined state and local income tax rates in selected Pennsylvania cities and townships.

Source: Combined State and Local Income Tax Rates, Pennsylvania Illustrated: A Visual Guide to Taxes & the Economy

Source: Combined State and Local Income Tax Rates, Pennsylvania Illustrated: A Visual Guide to Taxes & the Economy

But even more than the rates in Pennsylvania, the individual income tax suffers under immense complexity. The state has more than 3,000 local income tax jurisdictions. Ohio has the second most, with approximately 600. Pennsylvania has made some progress in recent years to simplify tax collections, but there is still a long way to go. This proposal does nothing to fix the individual income tax structure in Pennsylvania; instead, it doubles down on it with higher state-level rates.

Similarly, this plan would do nothing to fix the issues within Pennsylvania’s sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , such as the lack of tax on personal services or the taxation of business inputs.

Finally, other states have tried similar property tax swaps, but the results have not been lower property taxes. In Minnesota, for instance, localities simply raised their education levies due to the “spare capacity” now available in property taxation. Mark Haveman, executive director of the Center for Fiscal Excellence in Minnesota, described this phenomenon well:

The moral of the tale is this: state aids are very important to local governments and community health, but they are not and never will be a magic bullet for restraining levies. It may put a temporary dent in a longstanding trend but local governments still spend that money. The result: higher levels of spending and higher government cost structures for which the property tax will always remain the “go to” source of support in the future. And once government programs and cost structures are in place, they can be extremely difficult to unwind.

I understand that residents in Pennsylvania (and in other states) don’t like paying property taxes, but this sort of tax swap is not a good idea.

For more information on Pennsylvania’s tax code, please review our chart book, Pennsylvania Illustrated: A Visual Guide to Taxes & the Economy.

Follow Nicole on Twitter.

Share this article