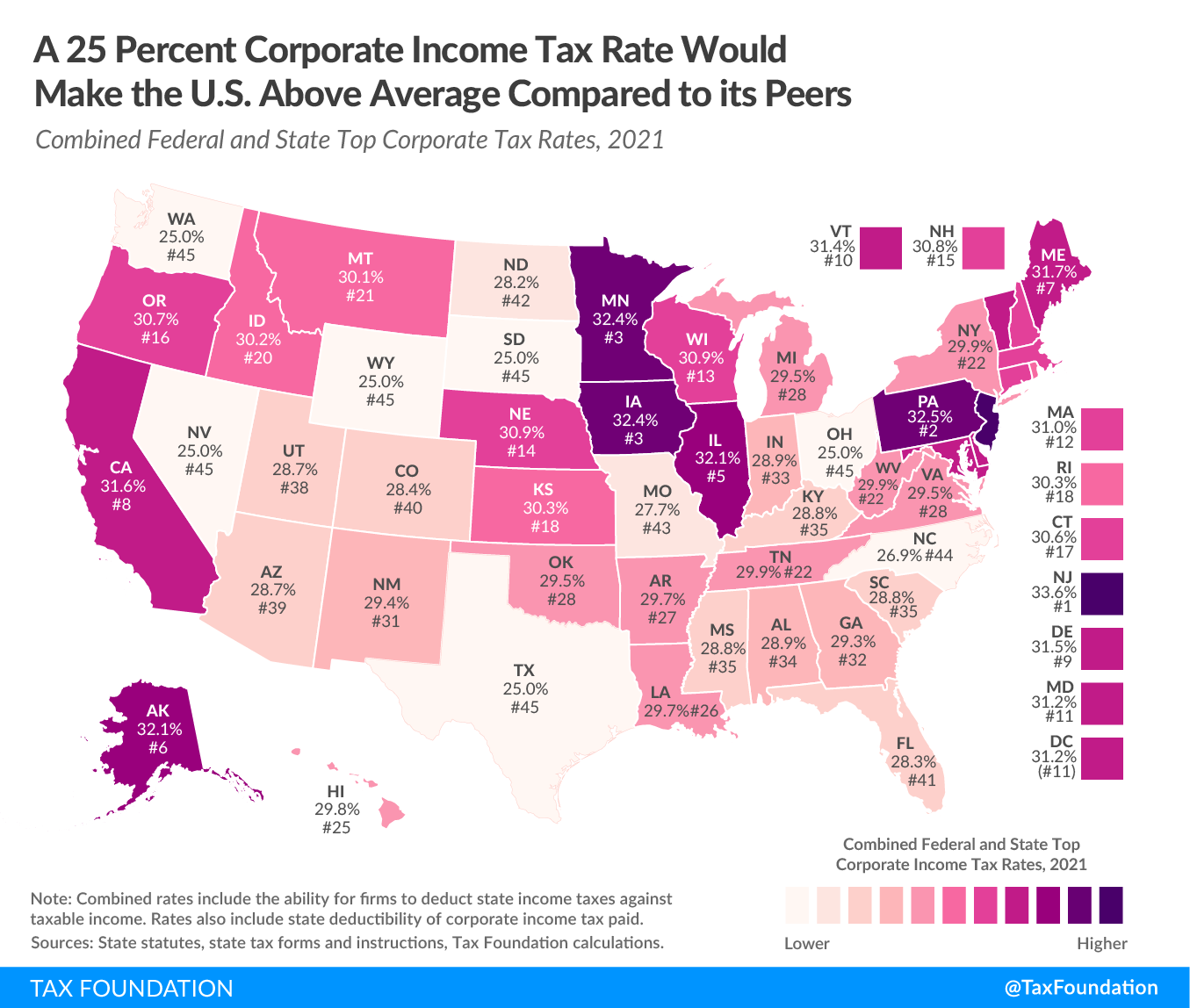

Some lawmakers have expressed concerns about President Biden’s proposal to raise the federal corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate from 21 percent to 28 percent, and instead suggest raising the rate to 25 percent. Including state corporate taxes, a 25 percent federal corporate income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate would result in a combined average top corporate tax rate of 29.53 percent—higher than the 23.51 average among industrialized countries in the OECD. In some states, the combined top corporate tax rate would be higher than in any other country in the industrialized world.

Under current law, corporations in the United States pay federal corporate income taxes levied at a 21 percent rate plus state corporate taxes that range from zero to 11.5 percent, resulting in a combined average top tax rate of 25.8 percent in 2021.

The highest combined corporate tax rate in the OECD is levied by France, at 32 percent. Next year, France will lower its corporate tax rate to 25.8 percent, leaving Portugal with the highest corporate tax rate in the OECD at 31.5 percent. If the federal corporate tax rate were increased to 25 percent, nine states would have combined federal-state top corporate income tax rates exceeding 31.5 percent.

Corporations may deduct state corporate income tax paid against federal taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. , lowering the effective federal corporate income tax rate. For example, a corporation in Michigan may deduct tax paid at a 6 percent flat rate against a 25 percent federal corporate income tax, reducing its effective top federal rate to 23.5 percent and producing a combined rate of 29.5 percent.

Additionally, three states allow corporations to deduct federal corporate income tax against some portion of state corporate income tax. Alabama and Louisiana allow full deductibility of federal corporate income tax liability against state liability, while Missouri permits a 50 percent deduction of federal corporate income tax liability, lowering the effective corporate income tax rate faced by corporations there. Iowa previously permitted a 50 percent deduction for federal corporate income taxes but repealed the provision while lowering its corporate tax rate from 12 percent to 9.8 percent in 2021.

It is important to include state corporate income taxes when considering how raising the federal rate would impact U.S. competitiveness. A higher corporate tax rate would make the U.S. less competitive as a location for corporate investment and would reduce economic output, jobs, and wages across the income spectrum.