Labor Share of Net Income is Within Its Historical Range

As increased political attention focuses on the state of the American worker, expect to see a resurgence of the argument that the labor share of income is in decline.

5 min read

As increased political attention focuses on the state of the American worker, expect to see a resurgence of the argument that the labor share of income is in decline.

5 min read

While President Biden has many proposals aimed at increasing the supply of affordable housing, including tax credits, his plans to raise business taxes could hinder that goal.

4 min read

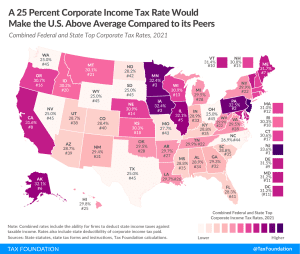

Some lawmakers have expressed concerns about President Biden’s proposal to raise the federal corporate income tax rate from 21 percent to 28 percent, and instead suggest raising the rate to 25 percent.

3 min read

The international corporate tax changes in President Biden’s tax plan would increase tax rates on domestic income more than on foreign income, resulting in a net increase in profit shifting out of the US, according to our Multinational Tax Model.

33 min read

The Options guide presents the economic effects we estimate would occur in the long term, or 20 to 30 years from now, but we can also use our model to show the cumulative effects of the policy change—providing more context, for instance, about how the effects of a higher corporate income tax rate compound over time, which we estimate would reduce GDP by a cumulative $720 billion over the next 10 years.

4 min read