The White House and congressional lawmakers are weighing policies to include in the next round of coronavirus response legislation. Some policies are geared toward helping people and businesses struggling in the short run due to the economic effects of the health crisis, while other policies are aimed at helping people and businesses work and invest when the health crisis abates. A neutral cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. system (NCRS) for structures falls under the latter and is reportedly being considered by the White House, along with other tax changes like permanent full expensing for machinery and equipment and a capital gains tax cut.

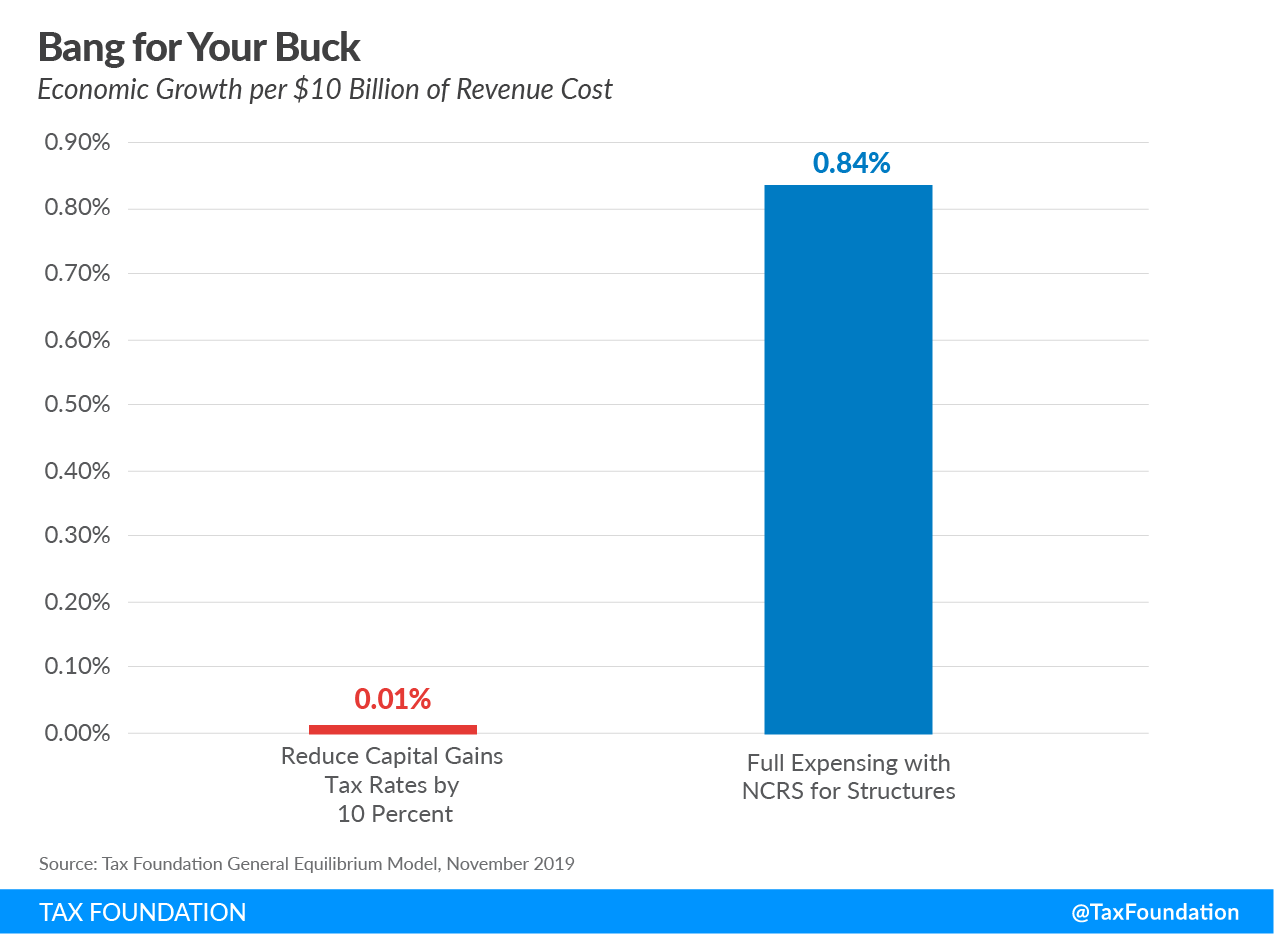

In weighing these options, it is important to remember that some taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. changes are more efficient than others, meaning they provide more economic benefit for less revenue loss. Policymakers ought to be asking, “How can I get the most bang for my buck?” as they consider how to respond to the economic downturn. For example, a capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. cut of 10 percent (lowering the current 20 percent and 15 percent brackets to 18 percent and 13.5 percent, respectively) would provide a negligible increase to economic growth compared to full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. with a NCRS for structures. Simply put, a capital gains tax cut is not well-suited to increase investment. While a capital gains cut may encourage saving, in today’s low interest rate environment the primary hurdle to new investment is the user cost of capital faced by businesses.

In contrast, full expensing and neutral cost recovery are superior for increasing investment because they lower the user cost of capital for businesses; this change would provide more long-run economic output and larger increases in after-tax income per dollar of forgone revenue than many other tax changes.

The Case for Improving Cost Recovery for Structures

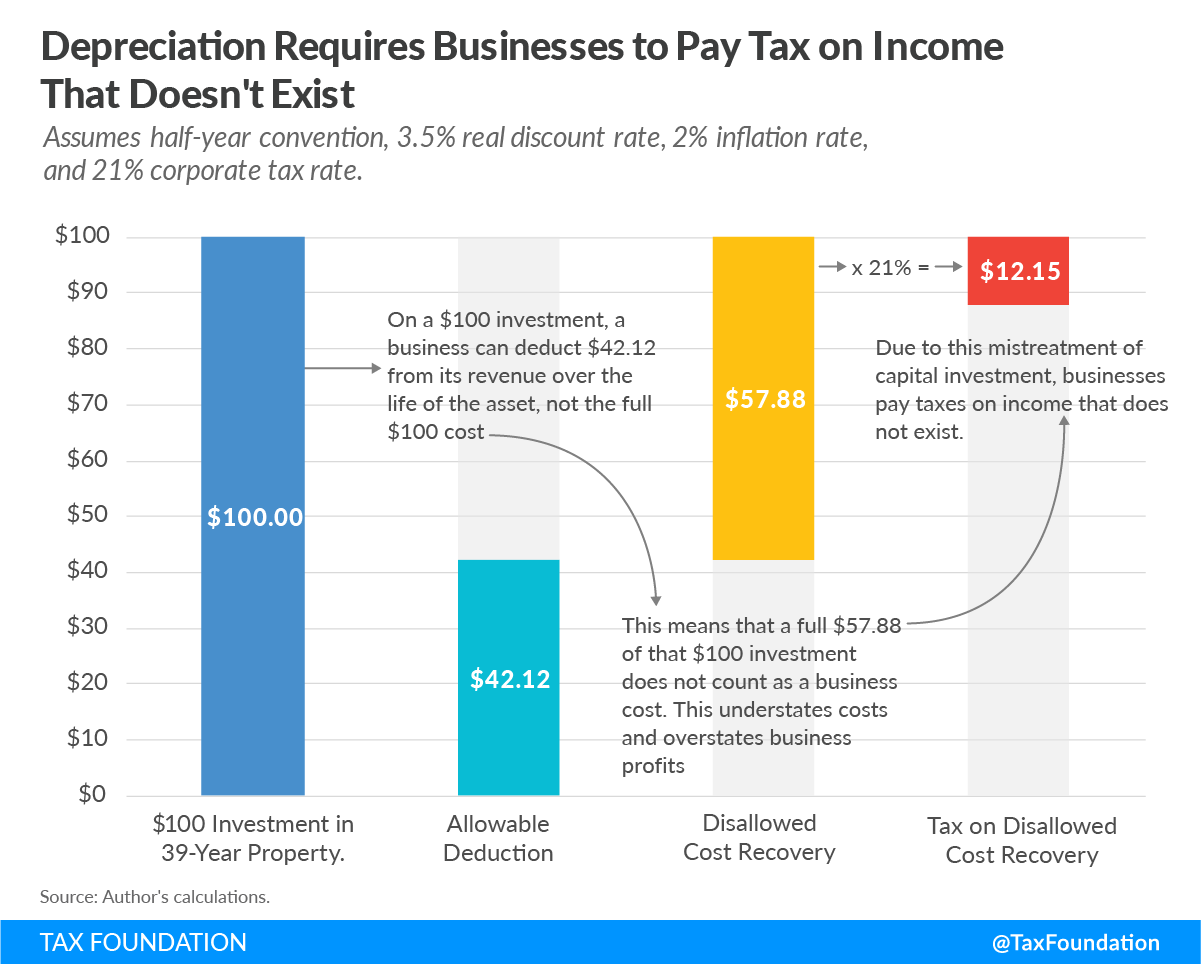

Implementing a NCRS for structures would be an improvement to the tax treatment of investments in buildings and factories. Under current tax law, when a business makes a capital expenditure on a building or structure, such as when building a factory, that outlay is not fully recognized as a business expense on the firm’s tax return in the same year it built the factory. Instead, the business has to deduct small shares of the cost in future years on future tax returns. Because the deductions for the investment costs are delayed, the present value of the write-offs (adjusted for inflation and the time value of money) would be less than the original investment cost.

This understates investment costs, overstates business profits, and reduces the after-tax return on the investment—resulting in less capital formation, productivity growth, and economic output.

While the most straightforward remedy to this issue is allowing businesses to immediately deduct the cost of capital expenditures, there are several challenges to implementing a policy of full expensing for structures.

First, investments in building and structures are large and lumpy. In some cases, the outlay for building a new structure might be larger than a business’s income stream, meaning it could not fully deduct the expense even if it were permitted to do so. In the cases where revenues are not enough to absorb the deduction, it would generate a net operating loss for the business and reduce the present value of the deduction.

A second challenge is that the transition to allowing full expensing for new structures has a large upfront cost to the government. While new structures would be permitted a full deduction, businesses would also be taking deductions for old structures, and this combination of old and new deductions would be large in the first several years until old deductions are used up.

Weighing the Neutral Cost Recovery Approach

A neutral cost recovery system offers a solution to both challenges. Under a NCRS, the current system of depreciation (Modified Accelerated Cost Recovery System, or MACRS) would be retained, but the depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. deductions would be adjusted to maintain the present value of the write-offs over time.

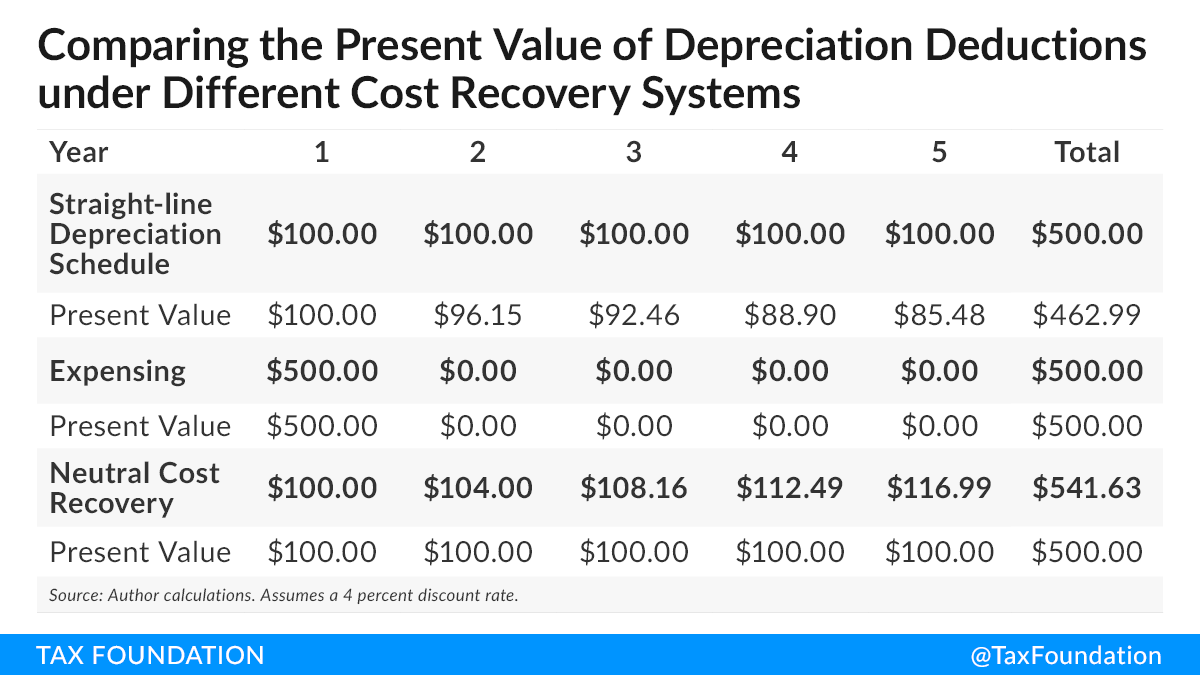

Indexing depreciation deductions to inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and a real rate of return would greatly reduce the penalty of waiting to recognize the cost for tax purposes. In real terms, this indexing provides equal treatment to immediate expensing in most cases. In the figure below, a business makes a $500 capital expenditure. If the business were required to use straight-line depreciation deductions, the present discounted value of the deductions to the business would total to $462, less than the $500 expenditure. Under full expensing, the firm could immediately deduct the full $500, receiving a deduction equal to the expenditure in present value terms. Under neutral cost recovery, the business would still stretch its deductions out over time, but they would be adjusted each year for the time value of money. The nominal amount of deductions under the NCRS add up to more than the capital expenditure, but importantly, the present value of the deductions is exactly equal to the $500 capital expenditure.

The Tax Foundation General Equilibrium Model estimates that moving to a system of full expensing that uses a NCRS for structures would increase economic output by 5.1 percent, boost wages by 4.3 percent, and create more than 1 million full-time equivalent jobs in the long run. On a conventional basis, the policy would reduce federal revenue by $1.26 trillion between 2021 and 2030 ($386 billion on a dynamic basis). On a conventional basis, using a NCRS for structures as part of a full expensing policy saves nearly $400 billion over 10 years compared to using full expensing for everything, including structures.

The short-term cost savings arises because write-offs under a NCRS are low initially and rise over time. Companies would not start taking significantly larger deductions until later years, so while the cost within the first 10-year budget window is lower, the cost in later years would be higher.

However, there are some economic imperfections with neutral cost recovery as compared to full expensing. A NCRS would apply a uniform discount rate to all firms, even though discount rates can vary by firm. Additionally, a NCRS may not have the equivalent economic effect as full expensing if firms are uncertain about its viability going forward; permanent full and immediate expensing offers firms certainty that they can recover the cost of their investment and that future maintenance and replacement of that capital will receive the same tax treatment. Nevertheless, neutral cost recovery would drastically improve the cost recovery treatment of structures, provide nearly equivalent economic incentives as full expensing, and reduce the upfront cost of the policy.

Conclusion

While the debate for appropriate policies to implement for the economic recovery continues, policymakers ought to weigh the relative cost-effectiveness of different tax policy options. Specifically, when considering long-term policies for increasing long-run levels of investment and economic growth, full expensing and neutral cost recovery are better targeted than policies like a capital gains cut.

Share this article