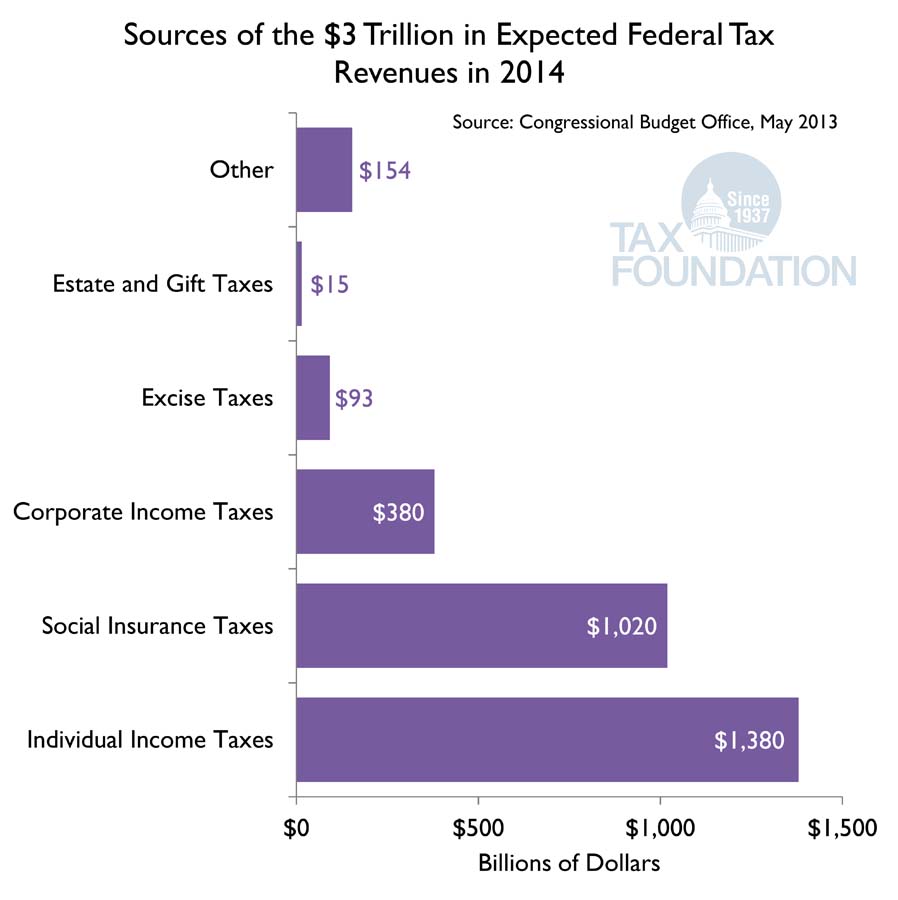

When politicians talk about overhauling the nation’s tax code, they are typically only talking about reforming the corporate and individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. systems. Combined, these two sources comprise about 58 percent of all federal revenue in any given year. But it should be noted that the category of “individual income taxes” is comprised not only of collections from wages and salaries, but also includes revenues collected from taxes on other sources such as savings, capital gains, dividends, rents, and business income (including sole proprietors, S corporations, LLCs, and partnerships).

Social insurance taxes are dedicated to funding Social Security and Medicare programs and are generally considered outside the scope of most taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reform proposals.

For more charts like the one below, see the second edition of our chart book, Putting a Face on America’s Tax Returns.

Share this article