A payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue.

What Are the Largest Payroll Taxes?

In the U.S., the largest payroll taxes are a 12.4 percent tax to fund Social Security and a 2.9 percent tax to fund Medicare, for a combined rate of 15.3 percent. Half of payroll taxes (7.65 percent) are remitted directly by employers, with the other half withheld from employees’ paychecks. This withholding shows up as FICA (Federal Insurance Contributions Act) and MEDFICA (Medicare Federal Insurance Contributions Act) on payroll stubs. Self-employed individuals remit both the employer and employee side of payroll taxes.

Whereas FICA taxes for Social Security are capped, applying to a wage base of no more than $132,900 in 2019, there is no similar cap on MEDFICA tax liability, meaning that the 2.9 percent Medicare tax applies to all wage and salary income. States also impose payroll taxes to fund unemployment insurance (UI) programs; these taxes are paid by employers, not employees.

Who Really Pays Payroll Taxes?

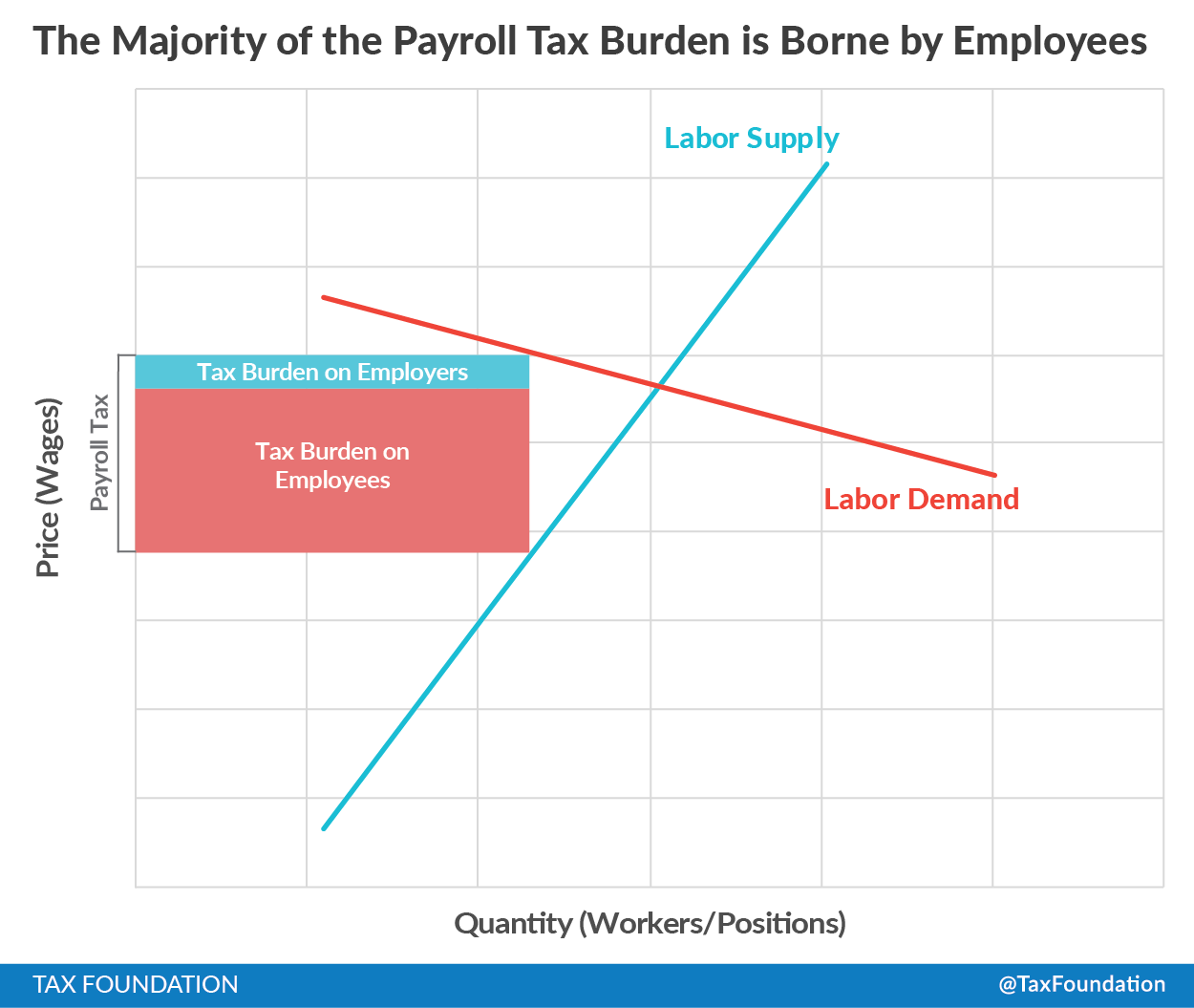

While payroll taxes are legally imposed partially or wholly on employers, employees effectively pay almost the entire tax, instead of splitting the burden with their employers.

This is because tax incidence is not determined by law, but by markets. In fact, the person who is required to pay a tax to the federal government is often different than the person who bears the tax burden. Usually, the marketplace decides how the tax burden is divided between buyers and sellers, based on which party is more sensitive to changes in prices (economists call this “relative price elasticities”).

The supply of labor (that is, workers’ willingness to work) is much less sensitive to taxes than the demand for labor, or employers’ willingness to hire. This is because workers who need a job are not as responsive to changes in wages, but businesses are able to “shop around” for the best workers or shift production to different locations. Ultimately, therefore, employees pay not only their own share of the payroll tax but also most of the employer share in the form of lower wages. The graph below roughly illustrates how the labor market distributes the payroll tax burden. The fact that the labor supply line is steeper than the labor demand line is a way of showing that workers are less sensitive to changes in wages than employers.

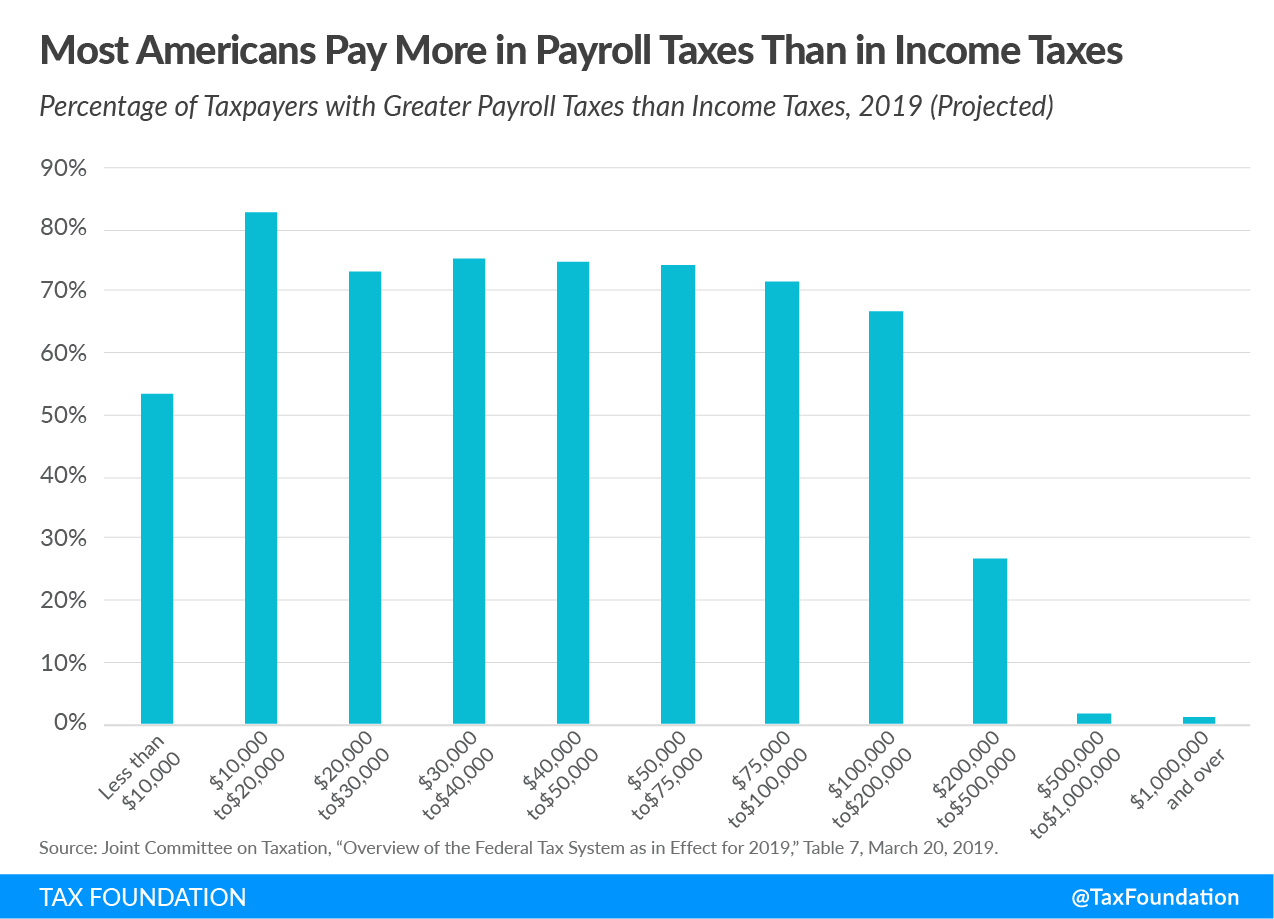

Because roughly half of the payroll taxes that fund Social Security and Medicare are paid by employers but borne by workers in the form of lower wages, rather than being fully enumerated on pay stubs, taxpayers may underestimate the true budgetary impact of these social programs.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe