In West Virginia, both Senate Republicans and Gov. Jim Justice (R) have offered proposals for reductions to the state’s income tax. In both of the proposals, excise taxes on tobacco and nicotine products are part of the pay-fors that are supposed to make up revenue lost due to lower income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates. Given that West Virginia leads the nation in smokers (over 25 percent of adults in the state smoke), it is understandable that lawmakers are tempted to rely on this source of revenue.

The governor proposes to increase the rate on a pack of cigarettes from $1.20 to $2.25 per pack and the rate of vapor products tenfold from $0.075 per milliliter to $0.75 per milliliter. The Senate plan is milder with a $1 increase on a pack of cigarettes and a new vapor tax rate of $0.35 per milliliter. The plans also differ on revenue allocations. The governor’s plan allocates all the additional excise tax revenue to the general fund, whereas the Senate plan allocates the revenue to a new trust fund to facilitate the further phasedown of the individual income tax.

There are several issues with relying on a narrow excise tax as revenue replacement for the income tax. By definition, such taxes are narrow and selective, and they lack revenue stability, especially when imposed on declining markets. Tobacco tax revenue, for instance, has been declining for decades. (The governor’s plan raises a projected $86 million from higher tobacco taxes.) Every year, more people quit and fewer people take up smoking, so while an increase in excise taxes could raise more revenue in the short term, it should not be relied upon as a long-term mechanism for general fund revenue.

In addition to the decline in consumption of tobacco products, a narrow base is also vulnerable to regulatory or technological disruption. For example, if new tobacco regulation is adopted at the state or federal level, West Virginia could be without the revenue needed to fund essential services.

The Senate at least partly acknowledges this revenue instability by depositing increased revenues from excise taxes into a fund rather than using them directly to pay down rate reductions. Yet, since fund excess balances are used to pay down permanent rate reductions, it is not clear that this provides much protection against volatility beyond the $50 million to $100 million reserve balance in the fund.

In addition to revenue instability, excise taxes tend to be regressive, and some more so than others. Tobacco is especially regressive because consumption usually increases as income decreases—contrary to regular consumption. This results in higher consumption among young people, low-income earners, racial and ethnic minorities, and those without a college education.

This effect can be observed in the numbers: in 2019, 37.9 percent of West Virginia adults over 25 with incomes below $25,000 a year smoked, compared to just 13 percent of those with incomes over $75,000. The discrepancies are even higher in educational attainment: 40.3 percent of those with less than a high school education reported smoking, whereas only 10.4 percent of college graduates smoked that year.

By itself, the fact that some excise taxes have regressive effects is not an argument against levying them. Excise taxes can be levied when internalizing social costs, called externalities, or when functioning as a user-pays system. The regressive effect does, however, underscore the importance of not relying on regressive excise taxes to generate significant tax revenue above and beyond the legitimate aims of excise taxation.

Finally, the proposed changes to the vapor tax violates the harm reduction principle. The current tax of $0.075 per milliliter is well-designed: based on volume at a moderate rate. Such a tax design encourages smokers to switch from the more harmful cigarettes to less harmful vapor products. The governor’s plan would increase the tax rate by 1,000 percent and be well above the rate charged on combustible cigarettes—even with a proposed tax increase on cigarettes as well. Rather than encouraging harm-reducing behavior, the tax code would encourage harm-increasing behavior. Even at the lower Senate rate, vapor taxes would be on par with cigarette taxes and risk having the same effect.

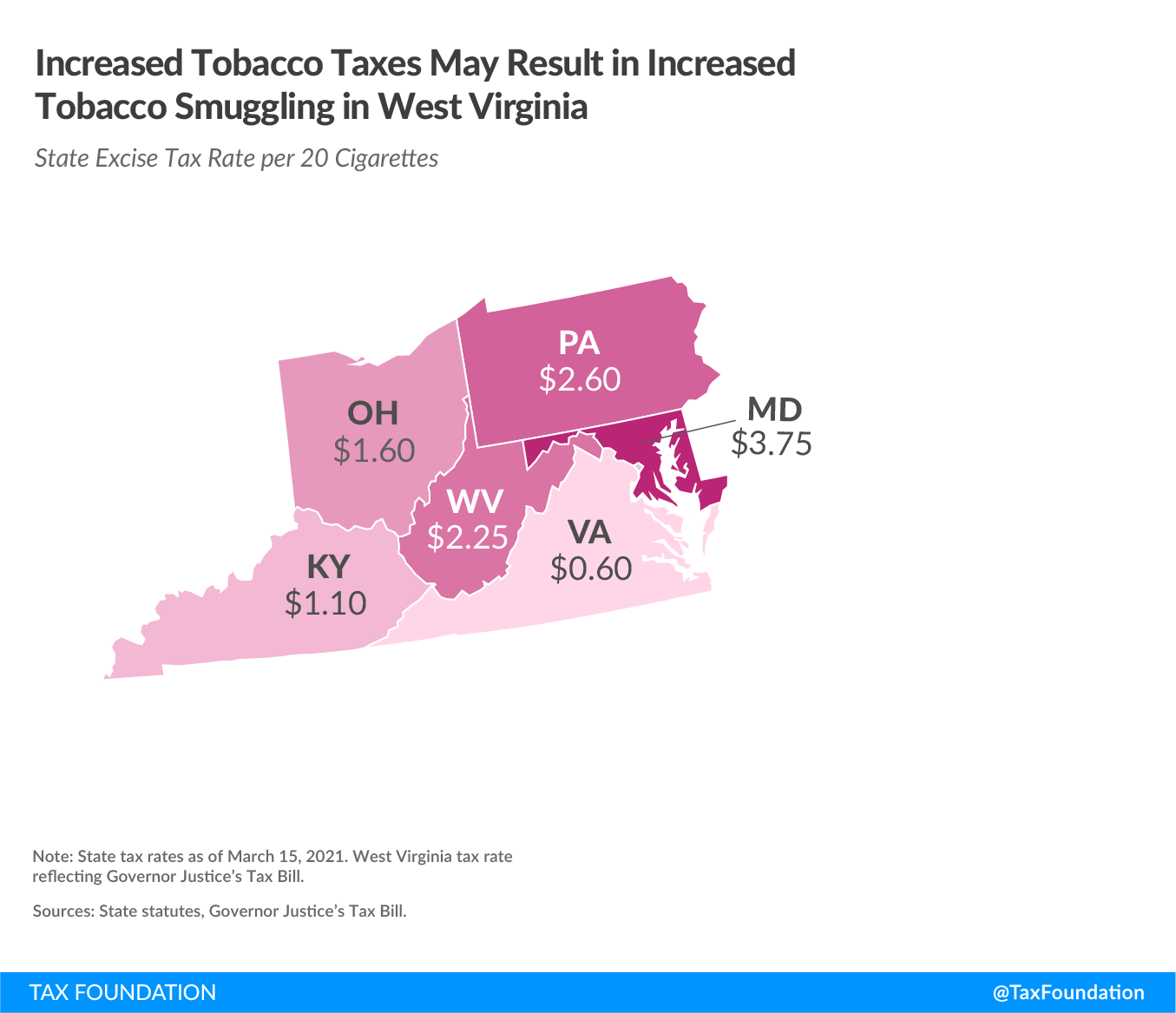

At $2.25 or $2.20 per 20 cigarettes, moreover, West Virginia would have a higher rate than most of its neighbors and would risk increasing levels of inflow of cigarettes from low-tax neighbors Virginia and Kentucky.

Policymakers should be cautious about relying too heavily on excise tax increases to pay down tax reductions elsewhere. Ideally, revenue offsets would come from more stable, broader-based revenue sources.

Share this article