Washington lawmakers have proposed a bill (SB5266) that would make it the second state to ban all flavored tobacco and the first to impose a nicotine cap on vapor products, and would increase taxes on vapor to among the highest in the nation.

The excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on vapor products will, if enacted, be levied at retail level at 45 percent of retail price. Although several states have higher statutory rates on vapor products, most levy these taxes at the wholesale level. Washington levying the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. at the retail level would make it one of the highest effective rates in the country. The new tax would take effect January 1, 2022.

The proposed tax would be a significant increase to the existing levy on volume at a rate of $0.27 per milliliter for closed tanks and $0.09 per milliliter for open tanks containing more than five milliliters. In addition to increasing the tax burden on the state’s vapers and vapor businesses, the change also makes the tax design less equitable. A price-based (ad valorem) design results in inequitable treatment because products with similar qualities and in similar quantities should have equal tax liability regardless of design or price. Ad valorem taxes also incentivize downtrading, which is when consumers move from premium products to cheaper alternatives. Downtrading effects do not reduce harm and have no relation to any externality the tax is seeking to capture.

The volume-based tax was superior because volume is a better proxy for the harm associated with consumption (the negative externalityAn externality, in economic terms, is a side effect or consequence of an activity that is not reflected in the cost of that activity, and not primarily borne by those directly involved in said activity. Externalities can be caused by either the production or consumption of a good or service and can be positive or negative. ). In addition to capturing the externality, it is the administratively simplest and most straightforward way for governments to tax a good as it does not require valuation and as such does not require expensive tax administration. Ad valorem taxes add unnecessary complexity to the system, which complicates enforcement. For instance, in vertically integrated companies (for example, those that are both manufacturers and wholesalers), taxable value must be computed to estimate tax liability. Making sure these companies’ internal prices (transfer pricing) are close to market value is an expensive and time-consuming effort for tax authorities.

In addition to increasing the excise tax on vapor products, the bill also bans all flavored tobacco products. Tobacco and vapor products excise taxes are, due to their narrow design, unstable sources of tax revenue to begin with. Further narrowing the tax base by banning a portion of tobacco and vapor sales altogether could worsen the instability of this revenue source. At the same time, a ban could drive up the costs of tax administration and law enforcement, especially if the lost revenue is made up by raising the tax rate on the remaining tobacco tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. .

The excise tax on vapor products does not generate significant revenue and the fiscal impact on banning flavored vaping products would likely be manageable. However, the bill also bans menthol cigarettes. Recent figures from Massachusetts, the only state to ban menthol statewide, indicate that menthol bans are both expensive and ineffective.

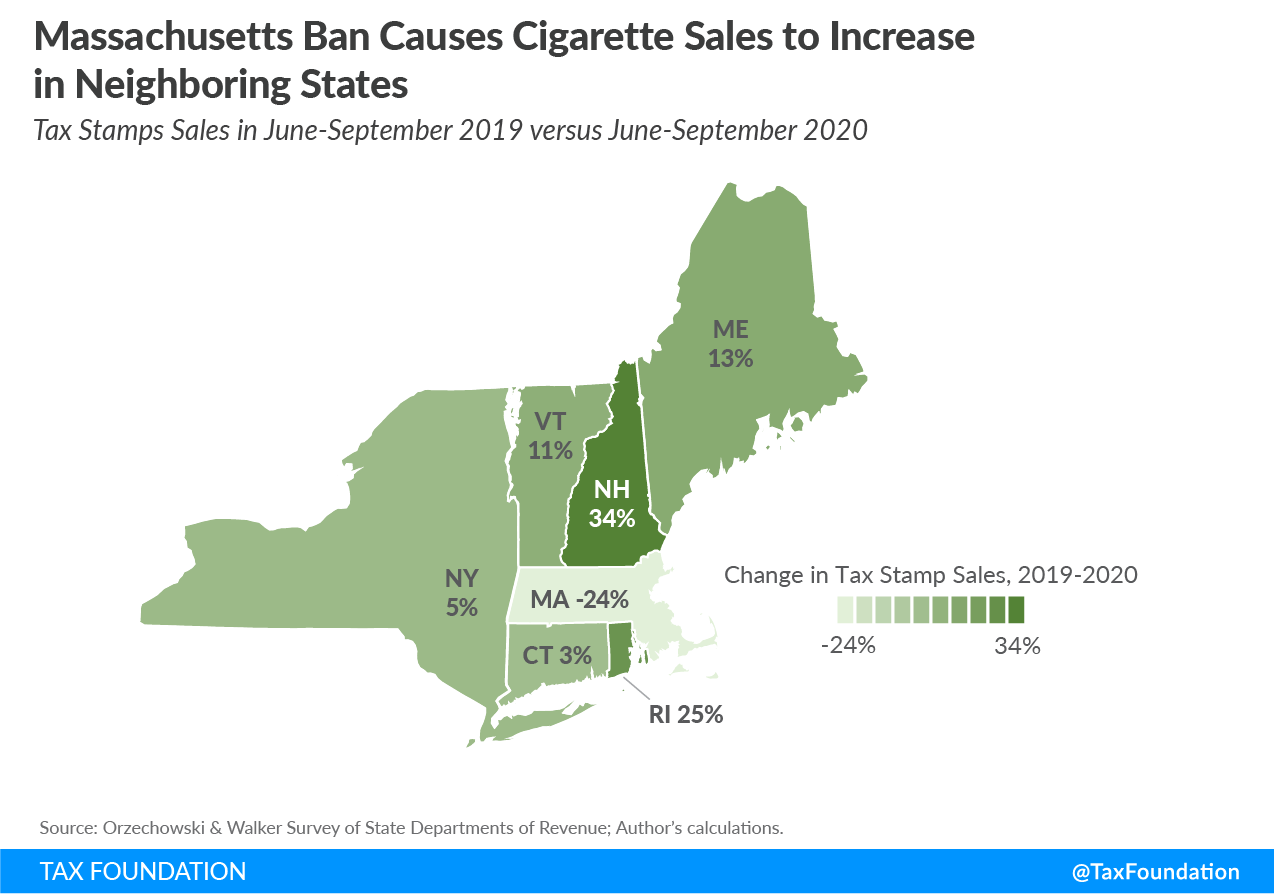

In Massachusetts, the sale of cigarettes did decline after the ban, but for every pack that was not sold in the state, a pack was sold in a neighboring state. From June to September of last year, 230,797,000 stamps were sold in the region. For the same period in 2019, that number was 225,897,000. This slight increase trends against the national figures, where sales in 2020 were projected to decline around 2 percent. In other words, Massachusetts sales plummeted, but not because people quit smoking—only because those sales went elsewhere.

In the first half of 2020, sales declined 10 percent in Massachusetts. While the ban is still in its early days, assuming FY 2021’s accelerating decline of over 20 percent continues through the rest of the fiscal year, the cost of the flavor ban could end up being approximately $120 million for FY 2021 (not including sales tax losses). For the first six months of FY 2021, Massachusetts has lost more than $60 million in excise tax revenue—more if we add sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. revenue. Conservatively, the loss will end up being at least $100 million this fiscal year. That is a significant cost to the state, especially considering that sales are simply shifting to other states, not actually being eliminated.

If Washington has a similar experience, the state stands to lose $90 million in excise tax revenue in the first full fiscal year after implementation. This is revenue that is allocated to the state’s general fund and any losses will have to be made up by taxpayers through other taxes, or through spending cuts. The fiscal note to the bill does not estimate the impact on excise revenue.

Flavored products are not alone in being banned by the bill. Any vapor product containing nicotine exceeding 20 milligrams per milliliter (2 percent) will also be banned. This would ban most currently available popular closed systems. Beside the flavor ban and nicotine cap, the bill also limits the number of cartridges that can be delivered to a consumer (16 per month) and adds new fees on businesses.

To make matters worse, Washington already has rampant inflow of untaxed cigarettes. In 2018, over 40 percent of cigarettes consumed in the state were not taxed by the state. That means well-established networks of illicit providers of tobacco products stand ready to add a new product to their inventory. In other words, banning a popular and widely consumed product will only make smuggling worse. A $90 million decline in revenue may be setting expectations low.

Maybe these negative consequences on revenue are well understood by the legislature given that they propose to exempt all marijuana products from the restrictions. Washington raises more revenue from taxes on marijuana than from taxes on tobacco products.

The only positive part of the bill is the appropriation. Revenue from the vapor tax is allocated to health-care spending, which is somewhat associated with the harm caused by consumption of nicotine products rather than being dedicated to the general fund. However, given the multitude of bans offered in SB5266, it is unclear how much revenue the excise tax may eventually generate.

All in all, data from Massachusetts indicate that a flavor ban will not decrease tobacco consumption, and it is not in the interest of other states to pursue a public health measure that merely sends tax revenue to its neighboring states without improving public health. In addition, bans on flavored tobacco highlight the complications of contradictory tax and regulatory policy, the instability of excise taxes that go beyond pricing in the cost of externalities, and the public risks of driving consumers into the black market through excessive taxation or regulation.

Share this article