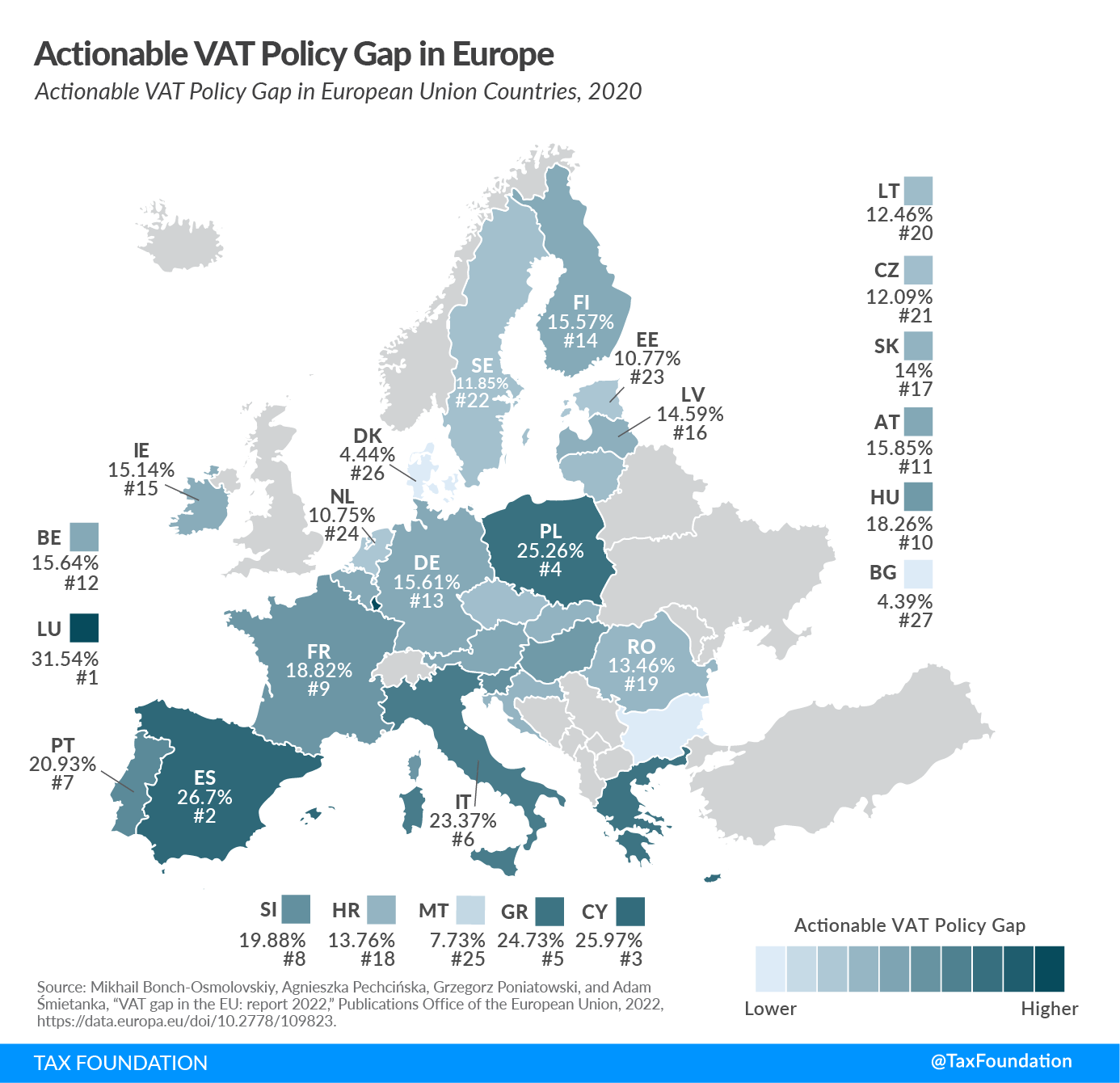

Actionable VAT Policy Gap in Europe, 2023

4 min readBy:Value-added taxes (VAT) make up approximately one-fifth of total taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenues in European Union countries. However, countries differ significantly in how efficiently they raise VAT revenue. One way to measure a country’s VAT efficiency is the VAT Gap—the difference between revenue that should be collected under an ideal VAT system and the amount that gets collected. The difference in actual and potential VAT revenues is due to 1) a lack of VAT compliance (the “Compliance Gap”), and 2) policy choices to exempt certain goods and services from the VAT or tax them at a reduced rate (the “Policy Gap”).

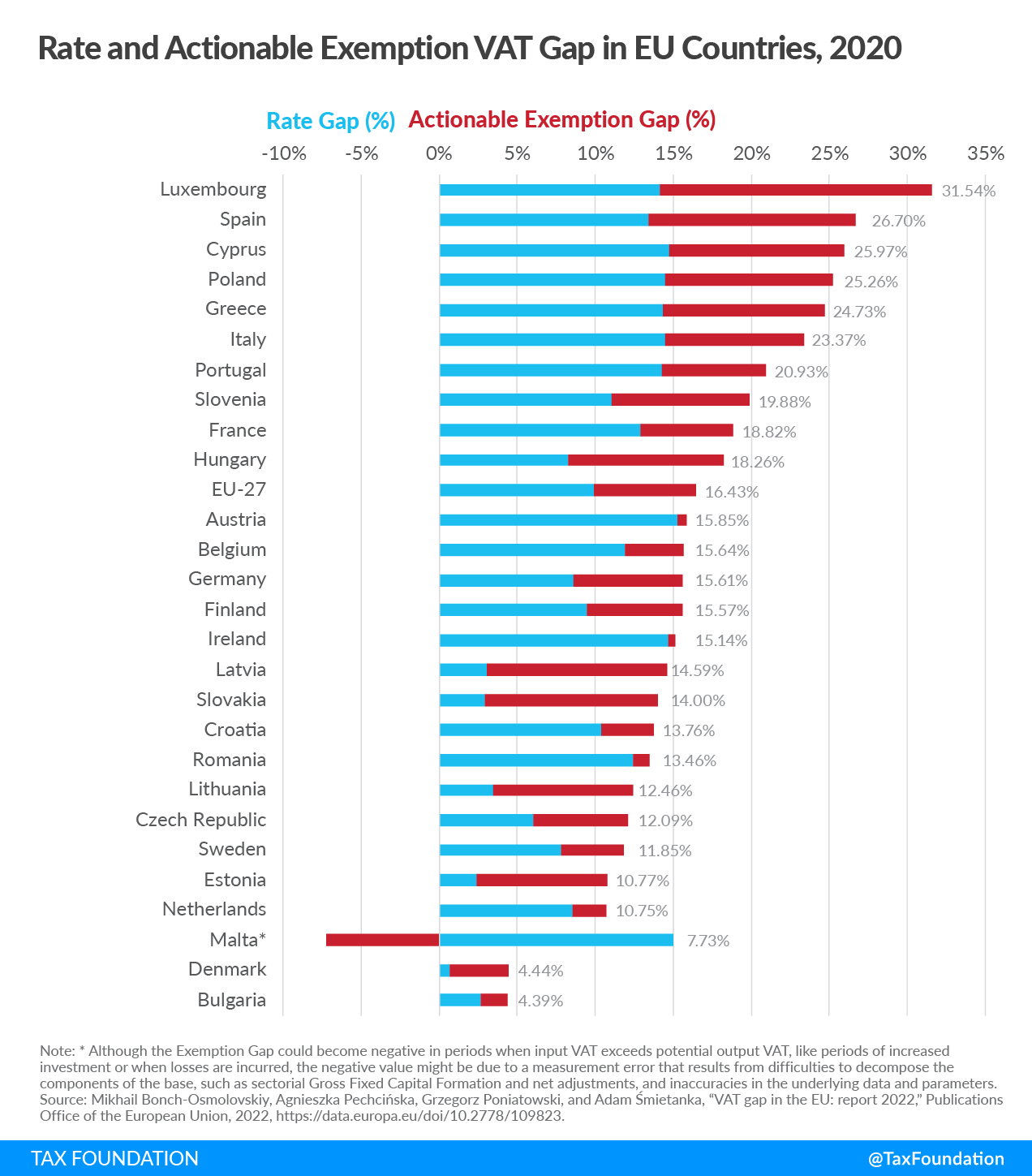

Today’s map will focus on the Policy Gap, showing the additional VAT revenue that could theoretically be collected if lawmakers applied a uniform VAT rate on the final domestic use of all goods and services. It is made up of two components: the Rate Gap and the Exemption Gap. The former represents the loss in VAT revenue due to reduced VAT rates, and the latter is due to certain goods and services being exempt from the VAT.

However, there are some services—namely, imputed rents, the provision of public goods, and financial services—that are VAT-exempt because it would be difficult to levy a VAT on them. Subtracting the amount of lost VAT revenue caused by these services from the general Policy Gap leaves us with the Actionable Policy Gap (the Actionable Exemption Gap plus the Rate Gap), which is the amount of additional VAT revenue lawmakers could realistically raise by eliminating reduced rates and certain exemptions.

The average Actionable Policy Gap for the EU in 2020 was 16.43 percent—of which 9.9 percent was due to reduced rates (Rate Gap) and 6.53 percent to the actionable portion of the Exemption Gap.

The Rate Gap is smaller in countries that rely on reduced rates less, such as Denmark (0.72 percent), Estonia (2.42 percent), Bulgaria (2.64 percent), Slovakia (2.91 percent), and Latvia (3.04 percent). On the other hand, the Rate Gap in Austria (15.27 percent), Malta (14.98 percent), Cyprus (14.72 percent), Ireland (14.67 percent), Poland and Italy (both at 14.45 percent), Greece (14.34 percent), Portugal (14.31 percent), and Luxembourg (14.12 percent) show significant revenue forgone because of reduced rates. The highest Actionable Exemption Gaps are observed in Luxembourg (17.42 percent), Spain (13.26 percent), Latvia (11.56 percent), Cyprus (11.25 percent), Slovakia (11.09 percent), Poland (10.81 percent), and Greece (10.39 percent). Spain’s Actionable Exemption Gap is due to the application of different indirect taxes in the Canary Islands, Ceuta, and Melilla.

If value-added taxes continue to be a significant source of revenue in the future, policymakers will need to invest in reforming VAT systems to close gaps in ways that improve the overall efficiency of tax systems.

| Actionable VAT Policy Gap (%) | Rate Gap (%) | Actionable Exemption Gap (%) | |

|---|---|---|---|

| Austria (AT) | 15.85 | 15.27 | 0.58 |

| Belgium (BE) | 15.64 | 11.89 | 3.75 |

| Bulgaria (BG) | 4.39 | 2.64 | 1.75 |

| Croatia (HR) | 13.76 | 10.42 | 3.33 |

| Cyprus (CY) | 25.97 | 14.72 | 11.25 |

| Czech Republic (CZ) | 12.09 | 6.03 | 6.05 |

| Denmark (DK) | 4.44 | 0.72 | 3.72 |

| Estonia (EE) | 10.77 | 2.42 | 8.35 |

| Finland (FI) | 15.57 | 9.45 | 6.12 |

| France (FR) | 18.82 | 12.87 | 5.95 |

| Germany (DE) | 15.61 | 8.62 | 6.99 |

| Greece (EL) | 24.73 | 14.34 | 10.39 |

| Hungary (HU) | 18.26 | 8.28 | 9.97 |

| Ireland (IE) | 15.14 | 14.67 | 0.47 |

| Italy (IT) | 23.37 | 14.45 | 8.92 |

| Latvia (LV) | 14.59 | 3.04 | 11.56 |

| Lithuania (LT) | 12.46 | 3.43 | 9.03 |

| Luxembourg (LU) | 31.54 | 14.12 | 17.42 |

| Malta (MT)* | 7.73 | 14.98 | -7.24 |

| Netherlands (NL) | 10.75 | 8.51 | 2.24 |

| Poland (PL) | 25.26 | 14.45 | 10.81 |

| Portugal (PT) | 20.93 | 14.31 | 6.61 |

| Romania (RO) | 13.46 | 12.42 | 1.04 |

| Slovakia (SK) | 14 | 2.91 | 11.09 |

| Slovenia (SI) | 19.88 | 11.07 | 8.81 |

| Spain (ES) | 26.7 | 13.44 | 13.26 |

| Sweden (SE) | 11.85 | 7.84 | 4.01 |

| EU-27 | 16.43 | 9.9 | 6.53 |

|

Note: *Although the Exemption Gap could become negative in periods when input VAT exceeds potential output VAT, like periods of increased investment or when losses are incurred, the negative value might be due to a measurement error that results from difficulties to decompose the components of the base, such as sectorial Gross Fixed Capital Formation and net adjustments, and inaccuracies in the underlying data and parameters. Source: Mikhail Bonch-Osmolovskiy, Agnieszka Pechcińska, Grzegorz Poniatowski, and Adam Śmietanka, “VAT gap in the EU: report 2022,” Publications Office of the European Union, 2022, |

|||