The Tax Cuts and Jobs Act (TCJA) reduced the U.S. federal corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate from 35 percent to 21 percent. However, corporations operating in the United States face another layer of corporate income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. levied by states. As such, the statutory corporate income tax rate in the United States, including an average of state corporate income taxes, is 25.7 percent. This rate puts the United States in line with the average among Organisation for Economic Co-operation and Development (OECD) member nations.

In addition to the 21 percent federal corporate income tax rate, 44 of the 50 U.S. states levy corporate income taxes. State corporate tax rates range from 3 percent in North Carolina to 12 percent in Iowa. The average state corporate income tax rate (weighted by population) is 6 percent. (See Table 1, below)

Under current law, state and local income taxes are fully deductible for corporations. As such, the effective statutory tax rate for each state is lower than the “headline” tax rate. Four states (Alabama, Iowa, Louisiana, and Missouri) also allow corporations to deduct some portion of their federal tax liability against their state liability, reducing the effective statutory rate even further.

Combined with the federal rate of 21 percent, corporations face marginal rates from 21 percent in states with no corporate income tax to as high as 29.6 percent in Iowa, where the corporate tax rate is 12 percent. The weighted average (by population) combined corporate income tax rate in the United States under current law is 25.7 percent.

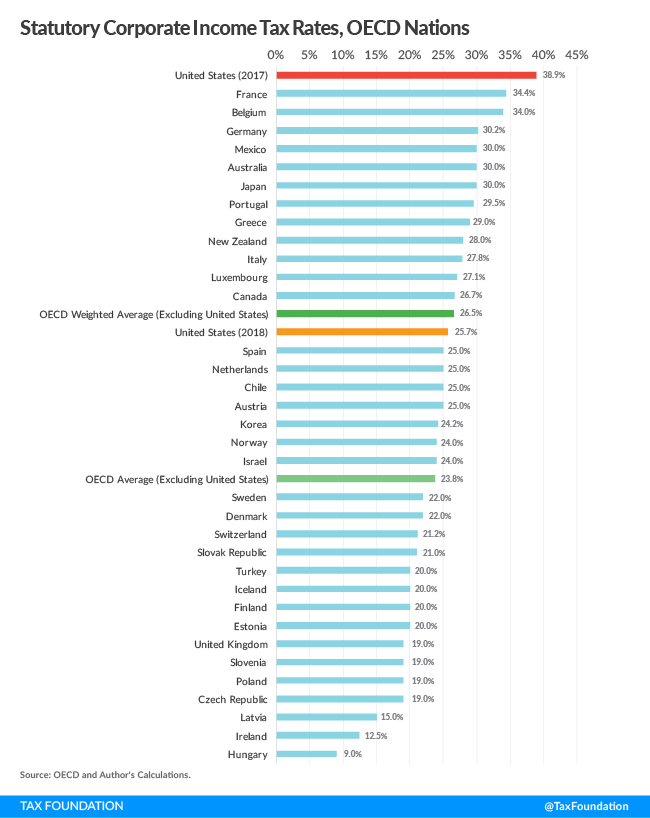

Before the TCJA passed, the United States had the highest combined statutory corporate income tax rate among the OECD nations at 38.9 percent (35 percent plus the average of state corporate income tax rates). This was approximately 15 percentage points higher than the OECD average, excluding the United States at 23.8 percent (26.5 percent weighted by GDP). (Figure 1)

2018 Corporate Tax Rates Around the World

After the passage of TCJA, the U.S. combined rate dropped from 38.9 percent to 25.7 percent. This puts the United States slightly above the OECD average of 24 percent, but slightly below the average weighted by GDP.

The TCJA significantly reduced the federal statutory corporate income tax rate. When combined with state and local taxes, it put the U.S.’s corporate tax rate in line with the average among OECD nations.

| Note: Combined rates include the ability for corporations to deduct state income taxes against federal taxable income. Weighted by population. | ||

| *State allows a deduction against taxable income for federal liability | ||

| State | Corporate Tax Rate | Combined States and Federal Corporate Tax Rate |

|---|---|---|

| Alabama* | 6.5% | 25.1% |

| Alaska | 9.4% | 28.4% |

| Arizona | 4.9% | 24.9% |

| Arkansas | 6.5% | 26.1% |

| California | 8.8% | 28.0% |

| Colorado | 4.6% | 24.7% |

| Connecticut | 8.3% | 27.5% |

| Delaware | 8.7% | 27.9% |

| District of Columbia | 9.0% | 28.1% |

| Florida | 5.5% | 25.3% |

| Georgia | 6.0% | 25.7% |

| Hawaii | 6.4% | 26.1% |

| Idaho | 7.4% | 26.8% |

| Illinois | 9.5% | 28.5% |

| Indiana | 6.0% | 25.7% |

| Iowa* | 12.0% | 29.5% |

| Kansas | 7.0% | 26.5% |

| Kentucky | 6.0% | 25.7% |

| Louisiana* | 8.0% | 26.0% |

| Maine | 8.9% | 28.1% |

| Maryland | 8.3% | 27.5% |

| Massachusetts | 8.0% | 27.3% |

| Michigan | 6.0% | 25.7% |

| Minnesota | 9.8% | 28.7% |

| Mississippi | 5.0% | 25.0% |

| Missouri* | 6.3% | 25.4% |

| Montana | 6.8% | 26.3% |

| Nebraska | 7.8% | 27.2% |

| Nevada | 0.0% | 21.0% |

| New Hampshire | 8.2% | 27.5% |

| New Jersey | 9.0% | 28.1% |

| New Mexico | 5.9% | 25.7% |

| New York | 6.5% | 26.1% |

| North Carolina | 3.0% | 23.4% |

| North Dakota | 4.3% | 24.4% |

| Ohio | 0.0% | 21.0% |

| Oklahoma | 6.0% | 25.7% |

| Oregon | 7.6% | 27.0% |

| Pennsylvania | 9.99% | 28.9% |

| Rhode Island | 7.0% | 26.5% |

| South Carolina | 5.0% | 25.0% |

| South Dakota | 0.0% | 21.0% |

| Tennessee | 6.5% | 26.1% |

| Texas | 0.0% | 21.0% |

| Utah | 5.0% | 25.0% |

| Vermont | 8.5% | 27.7% |

| Virginia | 6.0% | 25.7% |

| Washington | 0.0% | 21.0% |

| West Virginia | 6.5% | 26.1% |

| Wisconsin | 7.9% | 27.2% |

| Wyoming | 0.0% | 21.0% |

| Average | 6.3% | 25.9% |

| Weighted Average | 6.0% | 25.7% |

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe