Sources of U.S. Tax Revenue by Tax Type, 2022

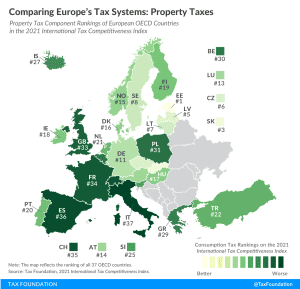

Compared to other industrialized countries, the United States relies more on individual income taxes and property taxes and less on consumption taxes.

4 min read

Compared to other industrialized countries, the United States relies more on individual income taxes and property taxes and less on consumption taxes.

4 min readDesigning tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

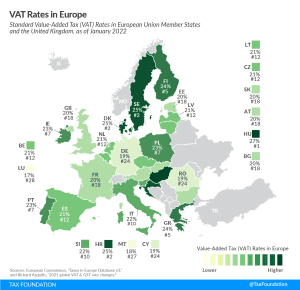

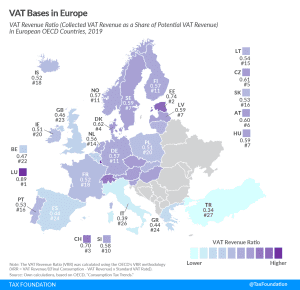

The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

4 min read

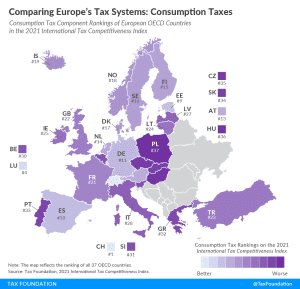

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

Policymakers and taxpayers should understand the scope of tax changes necessary to fully pay for the large-scale social spending programs that would be initiated under the Build Back Better Act.

6 min read

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

Tax Foundation testimony on the diversity of tax systems within the EU, three important ways to consider reforms by Member States, and several recommendations for the EU Parliament’s Subcommittee on Tax Matters to consider.

A VAT tax reform that eliminates VAT reduced rates would decrease compliance costs and allow for a more rapid economic recovery. Policymakers should focus on simplifying VAT rules and making them more efficient and neutral by broadening their tax bases and eliminating reduced rates and unnecessary tax exemptions.

4 min read

While Congress continues to debate how to pay for President Biden’s spending proposals in the fiscal year 2022 budget, it is useful to consider the economic impact of a range of financing options in addition to the President’s proposed tax increases.

3 min read

As economies are starting to recover and growth is expected to rebound in the region during 2021, Asian and Pacific countries should start exploring changes to their fiscal tax policies while carefully evaluating the optimal time for eliminating fiscal stimulus and temporary tax relief.

4 min read

As economic activity resumes and the task of accounting for the deficits incurred in navigating the crisis of the past year becomes the focus of fiscal policy deliberations, a greater reliance on VAT could be an important tool in ensuring fiscal stability going forward. Countries should use this as an opportunity to improve VAT systems by re-examining carveouts in the form of exemptions and reduced rates.

2 min read

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

21 min read

There’s a useful contrast between two revenue options related to President Biden’s infrastructure push. The president’s American Jobs Plan includes a proposal to raise the corporate tax rate to 28 percent. Meanwhile, historically, the gas tax is the main revenue source for transportation funding.

8 min read

Taxes on goods and services were on average the greatest source of tax revenue for Latin American and Caribbean countries

5 min read

Tax hikes implemented in the near term might undermine Spain’s economic recovery. Spain should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting private investment and employment while increasing its internal and international tax competitiveness.

5 min read

To help countries face the pandemic-related financing needs while reducing inequality, the International Monetary Fund (IMF) has released a series of policy recommendations based on a temporary COVID-19 tax, levied on high incomes or wealth.

4 min read

A year ago, it seemed possible that New Hampshire was headed toward a triggered tax increase. Instead, lawmakers may trim business tax rates and begin the phaseout of the state’s tax on interest and dividend income, which would take away the asterisk and make New Hampshire the ninth state to forgo an individual income tax altogether.

4 min read

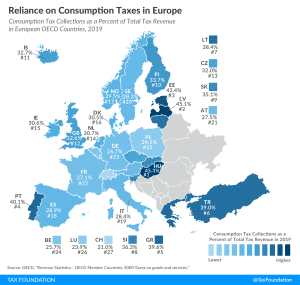

Hungary relies the most on consumption tax revenue, at 45.3 percent of total tax revenue, followed by Latvia and Estonia at 45.1 percent and 42.4 percent, respectively.

2 min read

The UK’s Chancellor of the Exchequer Rishi Sunak released the 2021 budget, and most important for near-term growth is the significant boost to capital allowances.

5 min read

Tax hikes or spending cuts implemented early in the year might undermine the desirable rapid recovery of the economy. The UK should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting business investment and employment while increasing its international tax competitiveness.

4 min read