All Related Articles

National Taxpayer Advocate’s Report Is a Road Map to Simpler Pandemic Relief Provisions

The size and scope of the tax changes within the CARES Act created significant administrative challenges for the IRS. Lawmakers should prioritize simplicity in the next round of relief.

3 min read

Two Years After Passage, Treasury Regulations for the Tax Cuts and Jobs Act Surpass 1,000 Pages

Treasury released final regulations on the base erosion and anti-abuse tax (BEAT), which is meant to dissuade firms from engaging in profit shifting abroad. Other high-profile releases from 2019 include final regulations guiding enforcement of Section 199A, commonly known as the pass-through deduction; final regulations on enforcing the new tax on global intangible low-tax income (GILTI); and final regulations on state-level workarounds to the $10,000 limit on the state and local tax deduction (SALT).

5 min read

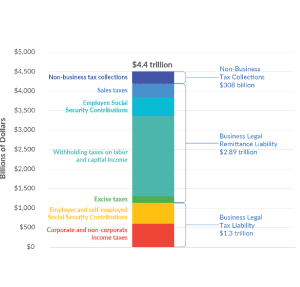

U.S. Businesses Pay or Remit 93 Percent of All Taxes Collected in America

Setting aside the debate over whether a low tax bill is fair, what is missed in such stories is that American businesses are critical to the tax collection system at every level of government—federal, state, and local. Businesses either pay or remit more than 93 percent of all the taxes collected by governments in the U.S. Without businesses as their taxpayers and tax collectors, American governments would not have the resources to provide even the most basic services.

5 min read

Tax Foundation Brief in Wayfair Online Sales Tax Case: SCOTUS Should Set Meaningful Limits on State Taxing Power

In the South Dakota v. Wayfair online sales tax case, the U.S. Supreme Court should ensure that state sales tax laws don’t burden interstate commerce.

3 min read