Americans Abroad Need Compliance Cost Relief

Trump’s proposal would bring the US more in line with most other developed economies, which tax only those who live and work within their borders.

4 min read

Trump’s proposal would bring the US more in line with most other developed economies, which tax only those who live and work within their borders.

4 min read

Georgia should focus on policies that restrict the overall growth of property taxes, not policies that functionally freeze property taxes for current owners by shifting costs onto new owners and into the sales tax.

6 min read

Sports stadium subsidies are salient political gimmicks designed to appear as if politicians are providing tangible benefits to taxpayers. The empirical evidence shows repeatedly that stadium subsidies fail to generate new tax revenue and new jobs or attract new businesses.

6 min read

With a changing economy—the law is about companies selling tangible products, but our economy is increasingly service-oriented—and state-level tests to the ongoing validity of the law, perhaps the time has come for Congress to update and expand upon these protections, which are designed to limit states from imposing substantial tax remittance and compliance burdens on businesses with only the most minimal of contacts with the state.

5 min read

Under the tax created by Measure 118, Oregon businesses would be significantly disadvantaged against their larger and out-of-state rivals.

6 min read

Oregon’s Measure 118, though presented as a tax on big business, would function as an aggressive sales tax on consumers.

7 min read

Nationwide, property owners have experienced surges in valuations and are demanding tax relief. Lawmakers are right to find ways to provide it, but should do so with sound tax principles in mind.

5 min read

Utah is the only state to earmark the entirety of one of its major taxes, but a measure on the ballot this November might change that.

4 min read

In her campaign for president, VP Kamala Harris has embraced all the tax increases President Biden proposed in the White House FY 2025 budget—including a new idea that would require taxpayers with net wealth above $100 million to pay a minimum tax on their unrealized capital gains from assets such as stocks, bonds, or privately held companies.

5 min read

Not every change in the Tax Cuts and Jobs Act simplified the tax code. However, the TCJA reduced compliance costs overall for individual filers, and allowing fundamental structural improvements to expire would make the tax code worse.

5 min read

Americans will spend more than 7.9 billion hours complying with IRS tax filing and reporting requirements in 2024. This is equal to 3.8 million full-time workers doing nothing but tax return paperwork—roughly equal to the population of Los Angeles.

7 min read

Tax cuts vs. tax reform: what’s the real difference, and why does it matter?

Taxing wealth has become a hot-button issue in today’s political discourse, promising to reshape economic equality. But what are the real-world implications of such policies?

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

To make sound financial decisions and support better tax policy, taxpayers should understand the taxes they face. Unfortunately, most U.S. taxpayers do not know or are unsure of basic tax concepts.

6 min read

When Caitlin Clark and Angel Reese made their WNBA preseason debuts, basketball fans across the country tuned in. But there’s another audience that also follows along: state revenue officials, who will expect their piece of the pie each time these star athletes—and their teammates—come to town.

3 min read

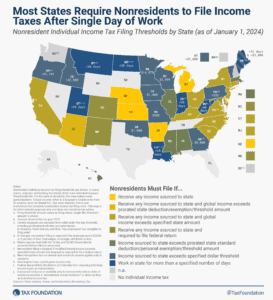

One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

Despite taxes playing a significant role in personal finances and being levied on a sizable portion of the U.S. population, most Americans are not just unhappy with the current tax code but also do not understand it.

4 min read

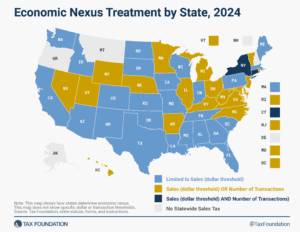

Reforming economic nexus thresholds would not only be better for businesses but for states as well. It is more cost-effective for states to focus on—and simplify—compliance for a reasonable number of sellers than to impose rules that have low compliance and are costly to administer.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read