FAQ: The One Big Beautiful Bill Act Tax Changes

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

38 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

The ongoing economic uncertainty from Russia’s war in Ukraine, economic recovery, supply chain disruptions, and rising interest rates have highlighted the importance of business investment.

30 min read

As lawmakers consider options for budgetary offsets, they should prioritize competitiveness and economic growth, as a heavier corporate tax burden will undermine the core purpose and achievement of the TCJA.

24 min read

On average, businesses in the OECD are liable for collecting, paying, and remitting more than 85 percent of the total tax collection.

15 min read

The empirical evidence thus far on sugar-sweetened beverage taxes fails to support claims that these taxes will create substantial health benefits. At the same time, their structural limitations make them ill-suited for generating stable, equitable revenue.

54 min read

With such an important change to Iowa’s property tax system, it’s important that lawmakers get the details right.

33 min read

An update to the EU’s Excise Tax Directive that embraces harm reduction principles would save lives and provide a steady stream of revenue to support public health expenditures.

22 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

While LIFO is rarely the main focus of the overall tax policy debate, it is a sound structural piece of the tax code. LIFO comes close to matching the economic ideal while still remaining true to the accounting principle.

15 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

55 min read

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

Nebraska has an opportunity to revise the property tax package enacted in 2024 to ensure that Nebraskans enjoy meaningful property tax relief.

32 min read

Given the poor state of the budget process and worsening debt trajectory, lawmakers should move boldly and quickly to address the issue, including via a fiscal commission process. Issues to consider should include reforms to both spending and taxes.

42 min read

According to a new poll from the Tax Foundation and Public Policy Polling, more than half of taxpayers lack basic tax literacy, regardless of educational attainment, income level, or political affiliation.

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

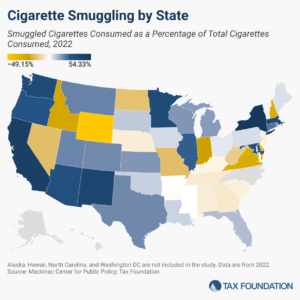

Growing cigarette tax levels and differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

16 min read

Policymakers can and should address taxpayers’ legitimate grievances about out-of-control property tax bills, but they should do so without upending a system of taxation that is more efficient, fair, and pro-growth, and better suited to municipal finance, than any of the alternatives.

39 min read