Shaky Economic and Fiscal Outlook Requires Stable and Pro-Growth Tax Extenders Policy

Policymakers face a difficult balancing act this year in what is likely to be an unusual tax extenders season.

6 min read

Policymakers face a difficult balancing act this year in what is likely to be an unusual tax extenders season.

6 min read

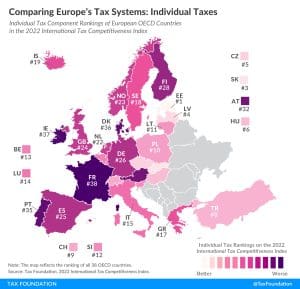

France’s individual income tax system is the least competitive among OECD countries. France’s top marginal tax rate of 45.9 percent is applied at 14.7 times the average national income. Additionally, a 9.7 surtax is applied to those at the upper end of the income distribution. Capital gains and dividends are both taxed at comparably high top rates of 34 percent.

2 min read

While supporters of the federal estate tax may be correct that only a fraction of estate tax returns eventually pays the estate tax, IRS data shows that it disproportionately impacts estates tied to successful privately owned businesses. Thus, it acts as a second or third layer of federal tax on these successful businesses over the owners’ lifetime.

9 min read

Since 2020, Spain has dropped from 26th to 34th on the International Tax Competitiveness due to multiple tax hikes, new taxes, and weak performances in all five index components.

7 min read

With increases to the standard deduction, a flat tax could provide a net tax cut to taxpayers of all income levels, providing both short-term and long-term relief to taxpayers across the income spectrum. It would also simplify the tax code in ways that encourage greater investment and economic growth, particularly by ensuring that the marginal rate on small business investment is competitive with peer states.

4 min read

Colombia should consider shifting its planned tax reforms from harmful corporate and individual taxes to less harmful consumption taxes.

5 min read

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

4 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

The Social Security Administration (SSA) announced the cost-of-living adjustment for Social Security payments based on inflation over the previous year. This has brought renewed attention to how the tax code treats Social Security benefits, which can be a confusing subject for taxpayers.

4 min read

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read

In the EU, Italy plays an important role in economic policy. If the EU wants to further develop own resources, it will need the backing of the Italian government—which seems unlikely at the moment.

4 min read

Some tax ballot initiatives will be straightforward, some will be complex, and—let’s be honest—some will be a drafting nightmare.

5 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

Will states consider student loan forgiveness a taxable event? In some states, the answer could be yes.

5 min read

As Idaho attempts to further solidify its position as a growth-oriented, taxpayer-friendly state this special session, other states should look to its example and pursue similar reforms.

6 min read

As Missouri legislators head into a special session, they should consider making a pro-growth change that the state is already so close to achieving: creating a flat income tax.

4 min read