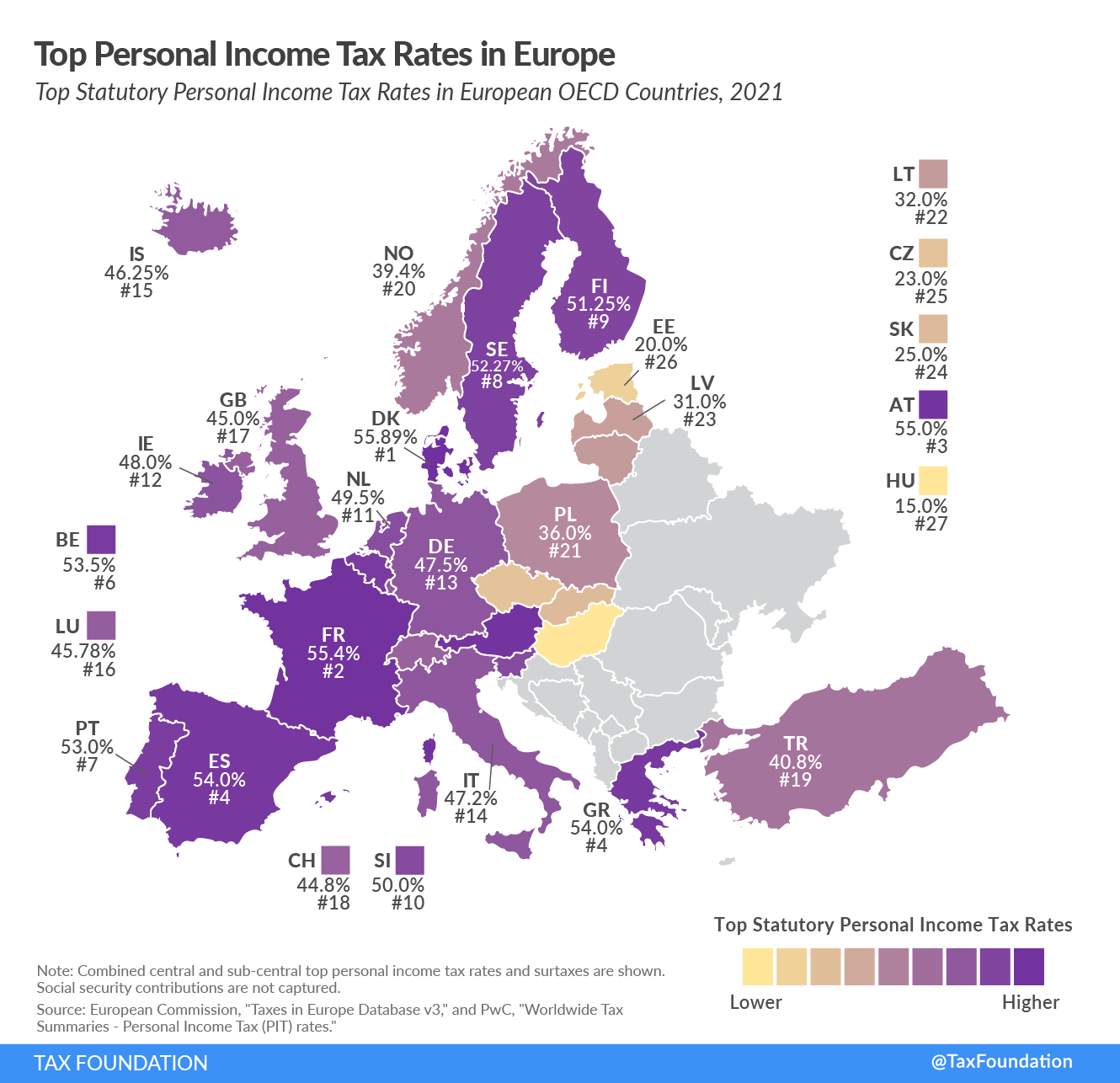

Top Personal Income Tax Rates in Europe, 2022

2 min readBy:Most countries’ personal income taxes have a progressive structure, meaning that the tax rate paid by individuals increases as they earn higher wages. The highest income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate individuals pay differs significantly across European OECD countries—as shown in today’s map.

The top statutory personal income tax rate applies to the share of income that falls into the highest tax bracket. For instance, if a country has five tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. , and the top income tax rate of 50 percent has a threshold of €1 million, each additional euro of income over €1 million would be taxed at 50 percent.

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) had the highest top statutory personal income tax rates among European OECD countries in 2021. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) had the lowest personal income top rates.

| European OECD Country | Top Statutory Personal Income Tax Rate |

|---|---|

| Austria (AT) | 55.0% |

| Belgium (BE) | 53.5% |

| Czech Republic (CZ) | 23.0% |

| Denmark (DK) | 55.9% |

| Estonia (EE) | 20.0% |

| Finland (FI) | 51.2% |

| France (FR) | 55.4% |

| Germany (DE) | 47.5% |

| Greece (GR) | 54.0% |

| Hungary (HU) | 15.0% |

| Iceland (IS) | 46.2% |

| Ireland (IE) | 48.0% |

| Italy (IT) | 47.2% |

| Latvia (LV) | 31.0% |

| Lithuania (LT) | 32.0% |

| Luxembourg (LU) | 45.8% |

| Netherlands (NL) | 49.5% |

| Norway (NO) | 39.4% |

| Poland (PL) | 36.0% |

| Portugal (PT) | 53.0% |

| Slovakia (SK) | 25.0% |

| Slovenia (SI) | 50.0% |

| Spain (ES), Valencia | 54.0% |

| Sweden (SE) | 52.3% |

| Switzerland (CH) | 44.8% |

| Turkey (TR) | 40.8% |

| United Kingdom (GB) | 45.0% |

| Source: PwC, “Worldwide Tax Summaries,” accessed Feb. 1, 2022, taxsummaries.pwc.com. | |