Testimony to the Ohio House Committee on Ways & Means

Chairman Schaffer, Vice Chairman Scherer, Ranking Member Rogers, Members of the Committee:

Thank you for the opportunity to speak with you today. My name is Scott Drenkard, and I’m an economist and the director of state projects at the Tax Foundation. For those unfamiliar with the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation, we are a nonpartisan, nonprofit organization that has monitored fiscal policy at all levels of government since 1937. We have produced the Facts & Figures handbook since 1941, we calculate Tax Freedom Day each year, and have a wealth of data, rankings, and other information at our website, www.TaxFoundation.org.

I’m pleased to have the opportunity to speak with you today with regard to House Bill 49, particularly elements of the budget bill related to simplifying the process of collection of Ohio’s municipal net profits taxes. While we take no position on legislation, we hope to offer our insights and provide a national perspective on tax issues.

Ohio’s municipal income tax system is the most poorly structured local income tax in the United States

Municipal income taxes are not necessarily unique to Ohio; however, the collection of local income taxes in Ohio is a serious headache compared to what is done in other states, particularly for businesses.

In 2011, we wrote a paper on city- and county-level income taxes, and found that of the 17 states that rely on local income taxes, Ohio has among the highest rates. In 2010, local income tax collections as a percentage of state personal income were 1.06 percent. The only state with higher effective rates is Maryland.

One feature of Ohio’s local income tax system that differs from almost everywhere else is that businesses in this state must withhold income taxes in every jurisdiction that an employee works in. More than 600 cities and villages tax a business’s net profits in the state as well.

In some cases, the cost of compliance of these two taxes is significantly larger than the actual tax burden for employers.

This complexity is an unnecessary compliance burden, as employers, especially contractors of varying stripes, must track their employees’ location by hour, by jurisdiction, to properly comply with the differing tax codes of all the localities in which they conduct business. In a 2013 piece in Forbes I noted a story of a northeast Ohio electrical contractor who once filed 221 W-2s for 19 employees, along with 39 business returns, most having a tax due of $5 or less.

Governor Kasich (R) has proposed one statewide, unified filing system for all businesses to file their net profits tax returns. The net profits system would build on the state’s current Ohio Business Gateway and allow businesses to complete only one return under one set of rules. Municipalities would still set tax rates and reciprocal credits.

Localities would still be in charge of collecting municipal income taxes on wages. The Ohio Department of Taxation would keep a reasonable 1 percent of the collections to support administration and distribute the rest back to localities. By comparison, some cities already use third-party administrators that retain 2.5-3 percent of the collections.

Unifying the net profits tax is a meaningful reform of Ohio’s flawed system

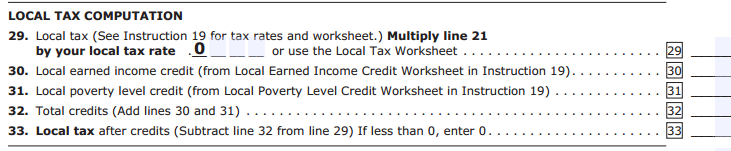

There are many ways for municipal tax systems to function more smoothly than Ohio’s currently does. In 2013, when this committee was considering H.B. 5, I noted in testimony that Maryland is similar to Ohio in that the state leans heavily on local income taxes to fund government, but it does so in a way that generally minimizes taxpayer headache. If you look at their state income tax form, the entirety of the compliance with the local income tax is handled on just a few lines of the form.

Figure 1: Maryland Local Income Taxes on the State Form

In Pennsylvania, localities simply tax nonresidents based on their primary place of employment, and this cuts down on a tremendous amount of additional paperwork. I think that is a viable model for states that have local income taxes, and an ideal toward which Ohio should strive.

Unifying the collection and administration of the net profits tax is a common sense first step toward a simpler municipal income tax system more in line with the rest of the country. It would promote a system where Ohio businesses aren’t put at a competitive disadvantage and can focus on creating value as opposed to complying with tax laws.

Conclusion

Occasionally in the tax policy debate, tax administration gets forgotten; however, administrative and compliance costs are important facets of the conversation. It’s in everyone’s best interest to reduce the compliance burden associated with Ohio’s municipal income tax system, and Governor Kasich’s proposal for unified collection of the net profits tax is a big step in the right direction.