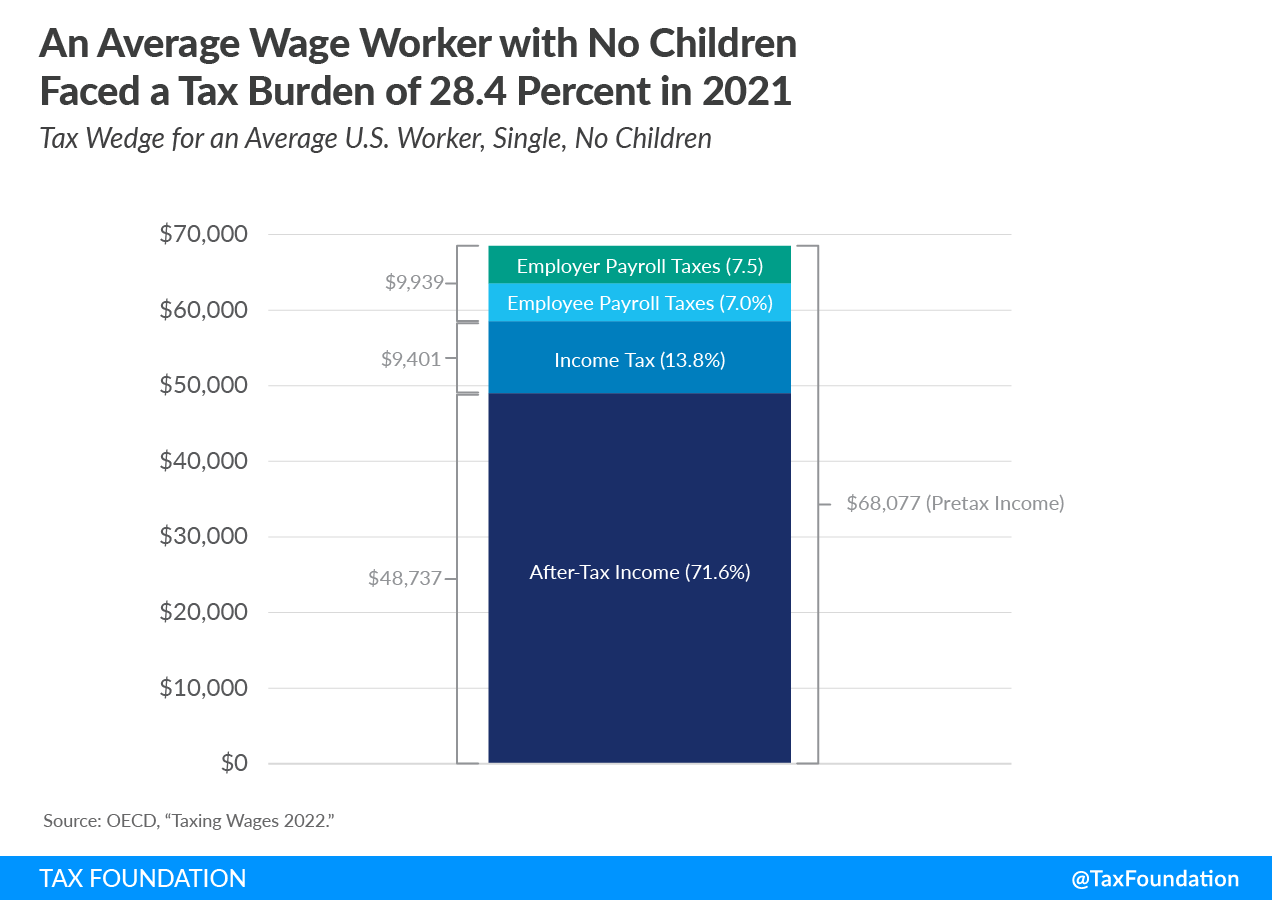

Broadly speaking, a tax wedge is the difference between the pre-tax price or return and after-tax price or return. For labor income, it is the difference between the total labor costs to the employer and the corresponding net take-home pay of the employee.

How Is a Tax Wedge Calculated and What Does It Mean?

The Organisation for Economic Co-operation and Development (OECD) calculates it by taking “the sum of personal income tax, employee and employer social security contributions plus any payroll taxes, minus any benefits received by the employee, as a percentage” of labor costs. In other words, the average tax wedge measures what part of labor costs are taxes and social security contributions.

The tax wedge shrinks as taxes decline and net take-home pay increases, and grows when taxes on the employer increase.

To make the taxation of labor more efficient, policymakers in the US and abroad should understand how the tax wedge is generated, and taxpayers should understand how their tax burden funds government services. Understanding it is a good start to measuring the tax burden on labor and employment.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe