A tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly.

What Types of Credits Are There?

Tax credits can be divided into two types: refundable and nonrefundable. A refundable tax credit allows a taxpayer to receive a refund if the credit they are owed is greater than their tax liability. A nonrefundable credit allows a taxpayer to receive a reduction in their tax liability only until it reaches zero.

How Do Tax Credits Work in Practice?

Suppose a taxpayer, Chris, who has one dependent, has a tax liability of $1,300 prior to credits. A tax credit would reduce the amount owed dollar-for-dollar, unlike a deduction, which reduces taxable income. In this case, Chris may be able to claim the Child Tax Credit, which is valued at a maximum of $2,000 per child, ($1,700 of which is refundable for tax year 2025. If he took no other credits and met the income thresholds, Chris would receive a $400 refund (see example A).

Suppose also that Amy is a taxpayer who cares for her mother, who has a disability, in her home and claims her as a dependent. While Amy is at work, she hires a paid caretaker to assist her mother (see example B). Under current law, Amy may qualify for the Child and Dependent Care Tax Credit (CDCTC). The credit amount varies based on each taxpayer’s income, amount of qualifying expenses, and number of dependents. Under current law (as of 2025), $1,050 is the maximum credit that can be claimed by a taxpayer with one dependent who has $3,000 in qualifying expenses. If Amy has $1,000 in tax liability, is eligible for the maximum credit amount, and takes no other credits, she will not owe any federal income taxes, but she will also not receive a refund. Because the CDCTC is nonrefundable, even though her credit is greater than her total tax liability, the credit can only reduce her liability until it reaches zero.

| Refundable Tax Credit (Example A) | Nonrefundable Tax Credit (Example B) |

|---|---|

| Chris’ Tax Liability = $1,300 | Amy’s Tax Liability = $1,000 |

| Apply the Child Tax Credit ($2,000 total; $1,700 refundable) | Apply the Child and Dependent Tax Credit (CDCTC): $1,050 total |

| $1,300 – $1,700 = -$400 | $1,000 – $1,050 = -$50 |

| Chris’ Liability: $0 | Amy’s Liability: $0 |

| Chris’ Refund = $100 | (Amy has no refund because the credit is nonrefundable) |

Because refundable credits often result in refunds, they tend to be more expensive than nonrefundable credits in terms of lost revenue.

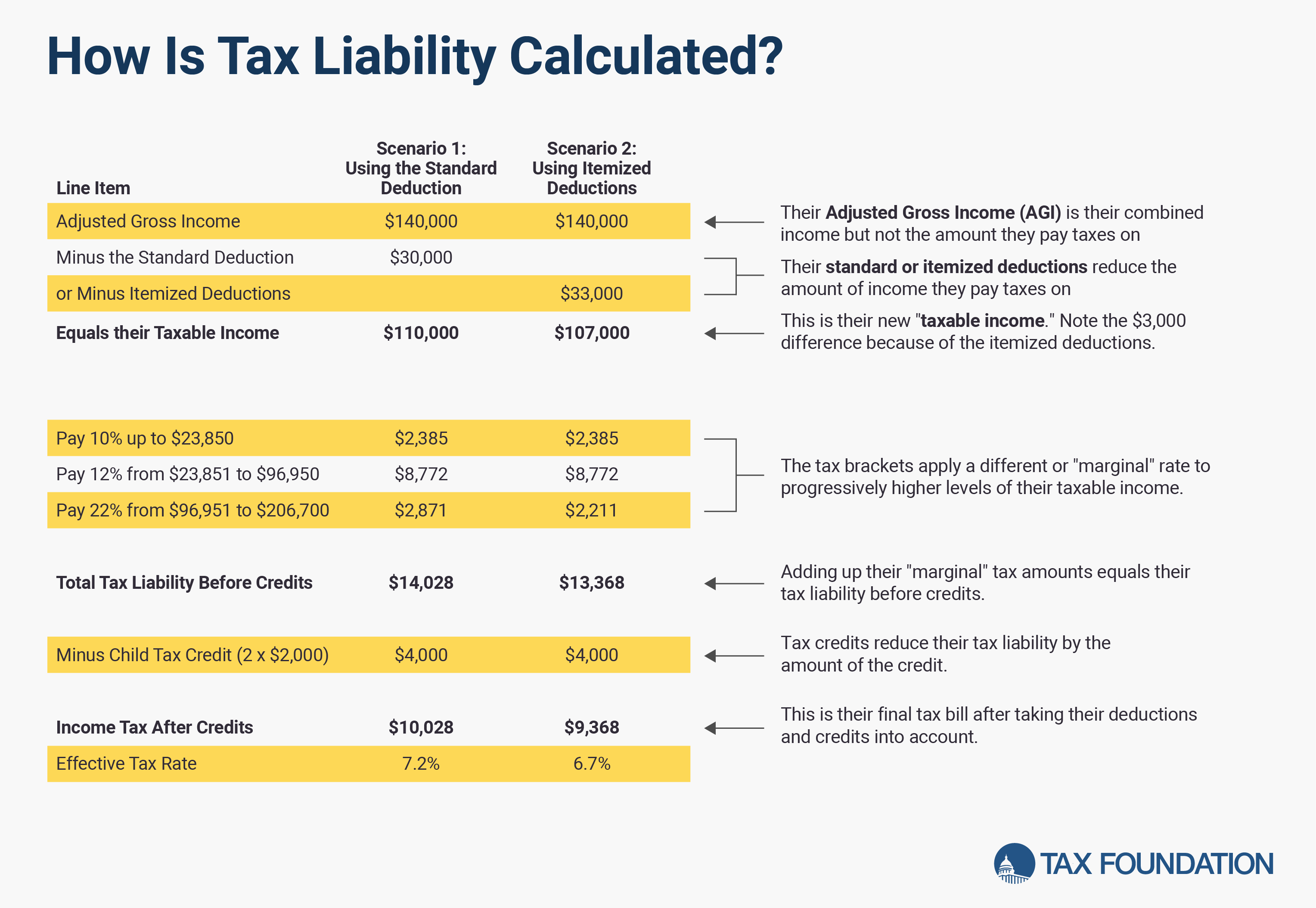

Tax Credits vs. Tax Deductions

Tax credits directly reduce tax liability dollar-for-dollar, while tax deductions reduce tax liability by the amount deducted multiplied by the taxpayer’s marginal tax rate. Consequently, a tax credit of a particular amount is always more valuable than a deduction in the same amount. Tax credits also tend to favor lower-income filers when compared with deductions, not only because they may be refundable, but also because lower-income filers face lower marginal rates, limiting the value of a deduction. Imagine, for instance, two filers, one with taxable income of $30,000 and another with taxable income of $300,000. A $1,000 deduction will reduce both filers’ taxable income by the same amount, but because that income is subject to a 12 percent marginal rate for the lower-income filer and a 35 percent marginal rate for the higher income filer, the reduction in tax liability would be $120 for the lower-income filer and $350 for the higher-income filer. By contrast, a $350 credit would reduce tax liability by $350 for both filers.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe