A consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or income taxes where all savings are tax-deductible.

A Tax on Spending

While sales taxes can be regressive when poorly designed, consumption taxes, as a whole, do not need to be. Consumption taxes, in theory, would encourage saving and investment, whereas income taxation discourages this behavior because it taxes both consumption and savings.

A consumption tax system would shift the time of collection from when money is earned to when money is spent. To minimize economic distortions, there is ideally only one standard rate that is levied on all final consumption, with as few exemptions as possible.

Generally, consumption taxes are an economically efficient way of raising tax revenue. Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

Despite this, the downside of these taxes is that they are regressive because lower-income earners and households tend to spend more of their income than they save.

Consumption vs. Income Tax Systems

Currently, the US taxes individuals and businesses with income taxes, such as the individual income tax and corporate income tax. While the US does levy consumption taxes in the form of sales taxes and excise taxes, it does not have a national consumption tax.

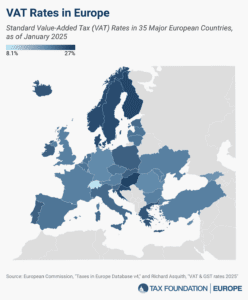

In Europe, consumption taxes are levied as excise taxes and VATs. Every European country and more than 170 countries worldwide levy a VAT on purchases for consumption.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe