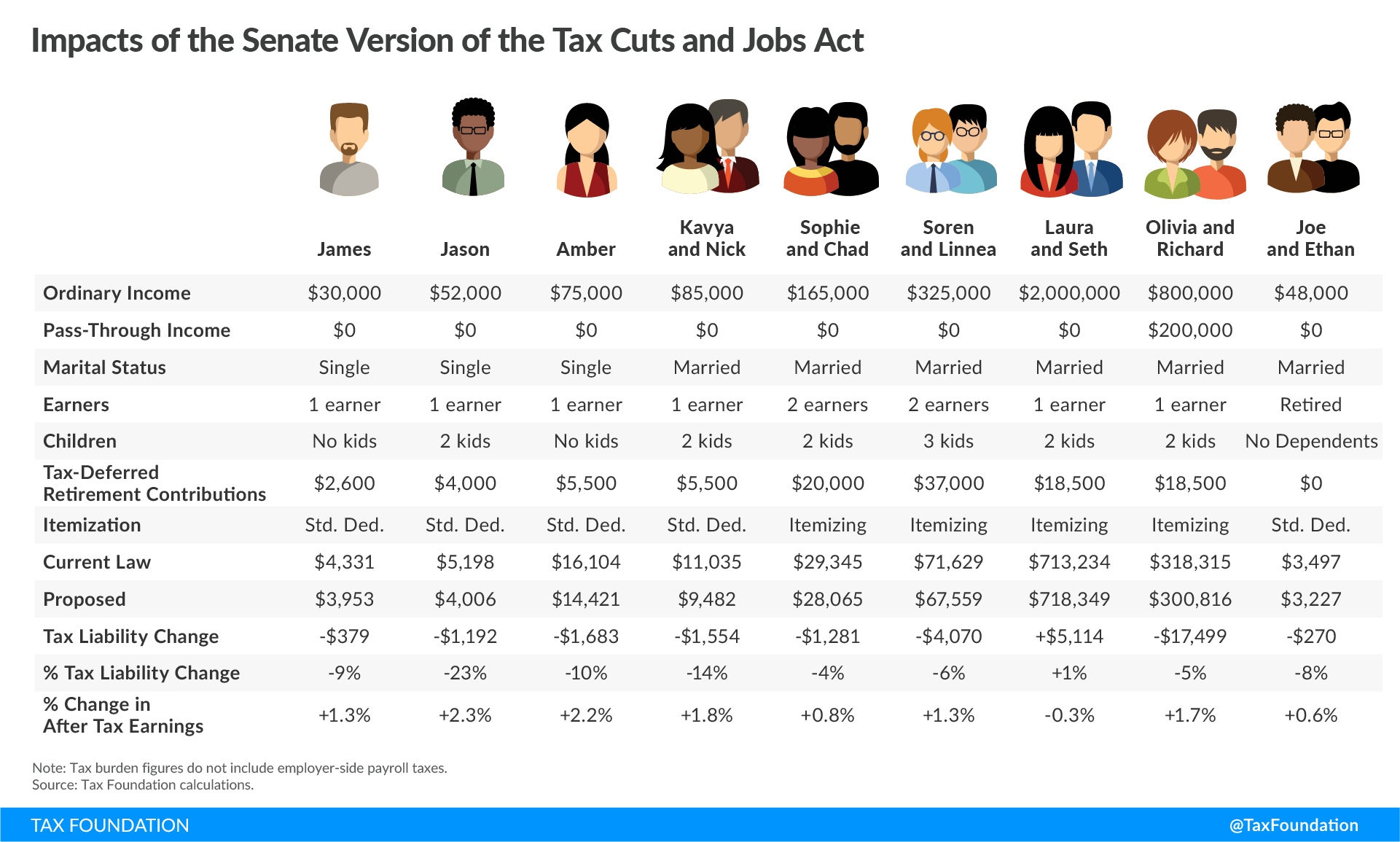

To help provide a sense of how the Senate’s version of the Tax Cuts and Jobs Act would impact real taxpayers, we’ve run the taxes of nine example households, each with realistic characteristics, to show how the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. provisions of the bill would impact individuals and families across the income spectrum.

Our results indicate a reduction in tax liability for every scenario we modeled save one, with some of the largest cuts accruing to moderate-income families with children. Individuals with pass-through income also benefit from a deduction worth 17.4 percent of pass-through income (click the image below for a larger version).

Our first household (James) is a single individual earning $30,000 with no dependents. We assume that this filer takes the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. and has tax-deferred retirement contributions of $2,600 (5 percent of income). Under current law, this taxpayer faces overall tax liability (including employee-side payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. es) of $4,331, and would see a tax cut of 9 percent, to $3,953. This household’s after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. would increase by 1.3 percent.

Our second household (Jason) is a single parent with two children, earning $52,000. This filer contributes $4,000 to tax-deferred retirement accounts. The taxpayer takes the standard deduction, and is eligible for child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. s. This taxpayer sees a 23 percent reduction in tax liability, increasing after-tax income by 2.3 percent, chiefly due to the plan’s expanded child tax credit. This filer’s liability goes from $5,198 under current law to $4,006 under the proposed tax bill.

Our third household (Amber) is a single individual earning $75,000 with no dependents. We assume this filer takes the standard deduction and has tax-deferred retirement contributions of $5,500. This taxpayer’s liability is reduced by 10 percent, with after-tax income increasing by 2.2 percent. Taxes owed go from $16,104 under current law to $14,421 under the Senate proposal.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeOur fourth household (Kavya and Nick) is a single-earner married couple with two kids, earning $85,000. We assume tax-deferred retirement savings of $5,500, and that the couple takes the standard deduction. They also benefit from the expanded child tax credits, and see an overall tax savings of 10 percent, from $11,035 to $9,482. This family’s after-tax income increases by 1.8 percent.

Our fifth household (Sophie and Chad) is the first to take itemized deductionItemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers. s, which requires additional assumptions. We modeled a dual-income family with incomes of $95,000 and $70,000 respectively (for a total of $165,000), with two children. To derive the amount of deductible home mortgage interest, we assume a $340,000 home financed with a 30-year mortgage with 3.5 percent interest and 20 percent down. (In all cases, we assume that mortgage debt meets the definition of acquisition debt, and is not equity debt.) For deductible property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. , we assume an effective property tax rate of 1 percent. We also assume charitable contributions comprise 2.5 percent of income, and an effective state and local income tax rate of 5 percent. This couple has $20,000 in tax-deferred retirement contributions, and loses most of the value of the child tax credit under current law, but could claim it in full under the Senate bill. These taxpayers see a 4 percent reduction in tax liability, from $29,345 to $28,065. Their after-tax income increases by 0.8 percent.

Our sixth household (Soren and Linnea) also itemizes. A dual-income household with three children, this household sees incomes of $250,000 and $75,000 respectively, with an $800,000 home (same assumptions as above), charitable contributions of 2.5 percent of income, an effective state and local income tax rate of 5 percent, and a slightly higher effective property tax rate of 1.25 percent. The couple has $37,000 in retirement contributions (maxing out 401(k)s under current law in 2018), and is ineligible for child tax credits under current law, but eligible under the Senate proposal. Their tax liability would decrease by 6 percent under the plan, from $71,629 to $67,559. Their after-tax income increases by 1.3 percent.

Our seventh household (Laura and Seth) is a married, single-earner, two-child household with $2 million in income, a $2.5 million home, a maxed-out 401(k), and other assumptions identical to the previous household. In this case, tax liability actually increases by 1 percent, from $713,234 to $718,349, due to the loss of certain itemized deductions not fully offset by rate reductions. Their after-tax income declines by 0.3 percent.

Our eighth household (Olivia and Richard) is a married, single-earner, two-child household with $1 million in income, $200,000 of which is derived from a passive stake in a qualifying pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. and subject to the pass-through deduction. We assume a $1.5 million home, with other assumptions identical to the above households. In this case, tax liability declines 5 percent, from $318,315 to $300,816, with the benefit of the partial deduction for pass-through income more than offsetting the loss of certain itemized deductions. Their after-tax income increases by 1.7 percent.

Finally, our ninth household (Joe and Ethan) consists of married retirees with $48,000 in retirement income. We assume that they take the standard deduction, which is increased for filers over 65. They also fall within an income range that allows 15 percent of their Social Security income (which we set at $16,800) to be exempt from taxation. Under the plan, their after-tax income increases by 0.6 percent, with tax liability falling from $3,497 to $3,227, an 8 percent reduction in tax liability.

All but one of our sample filers receive a tax cut, but the size of that reduction varies. The significantly higher standard deduction, combined with lower marginal rates and a more generous (and more broadly available) child tax credit, drives the reductions in tax liability for low- and middle-income filers. A reduction in itemized deductions limits reductions in tax liability for upper-income earners, though these filers benefit from the repeal of the alternative minimum tax. A deduction worth 17.4 percent of pass-through income provides a benefit for some filers.

Individual income taxes are only one component of the proposed Tax Cuts and Jobs Act, and changes to business taxation could have a significant impact on wages and economic growth. Still, sometimes it’s helpful to drill down on one component of reform, and, as these sample taxpayers demonstrate, most taxpayers across the spectrum experience lower tax bills under the Senate proposal.

Share