Itemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers.

How Do Itemized Deductions Work?

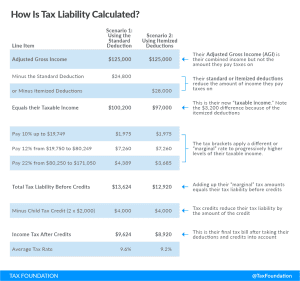

The process of taking itemized deductions, often called “itemizing,” allows taxpayers to deduct certain expenses from their taxable income, often up to a certain limit.

In lieu of itemizing, taxpayers can reduce their taxable income by a flat amount via the standard deduction. If a taxpayer’s itemized deductions are more than the standard deduction, they are best off itemizing. Otherwise, the standard deduction provides a larger reduction in taxable income. The Tax Cuts and Jobs Act of 2017 (TCJA) doubled the value of the standard deduction, making the more complex process of itemization a less attractive option for millions of households. The Joint Committee on Taxation (JCT) estimated that this change caused the number of filers who itemize to drop by 61 percent.

Of those itemizing, the three most-claimed deductions are for mortgage interest, state and local taxes, and charitable donations. In 2022, the JCT estimated that taxpayers deducted a combined $27.4 billion for mortgage interest expenses, $22.5 billion for state and local taxes paid, and $49.7 billion for charitable contributions made.

Who Benefits from Itemized Deductions?

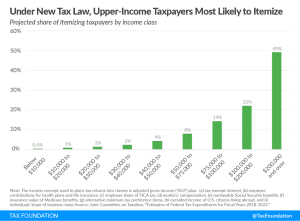

Itemized deductions primarily benefit higher-income households. JCT projections for 2022 show that just 14 percent of filers making between $50,000 and $80,000 itemized, compared to nearly 40 percent of taxpayers making $200,000 and over.

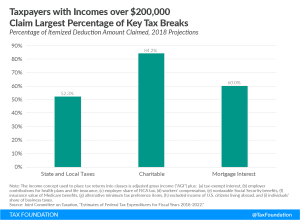

According to the JCT, high-income taxpayers will claim 60 percent of the state and local tax deduction, 88 percent of the charitable donation deduction, and 67 percent of the mortgage interest deduction.

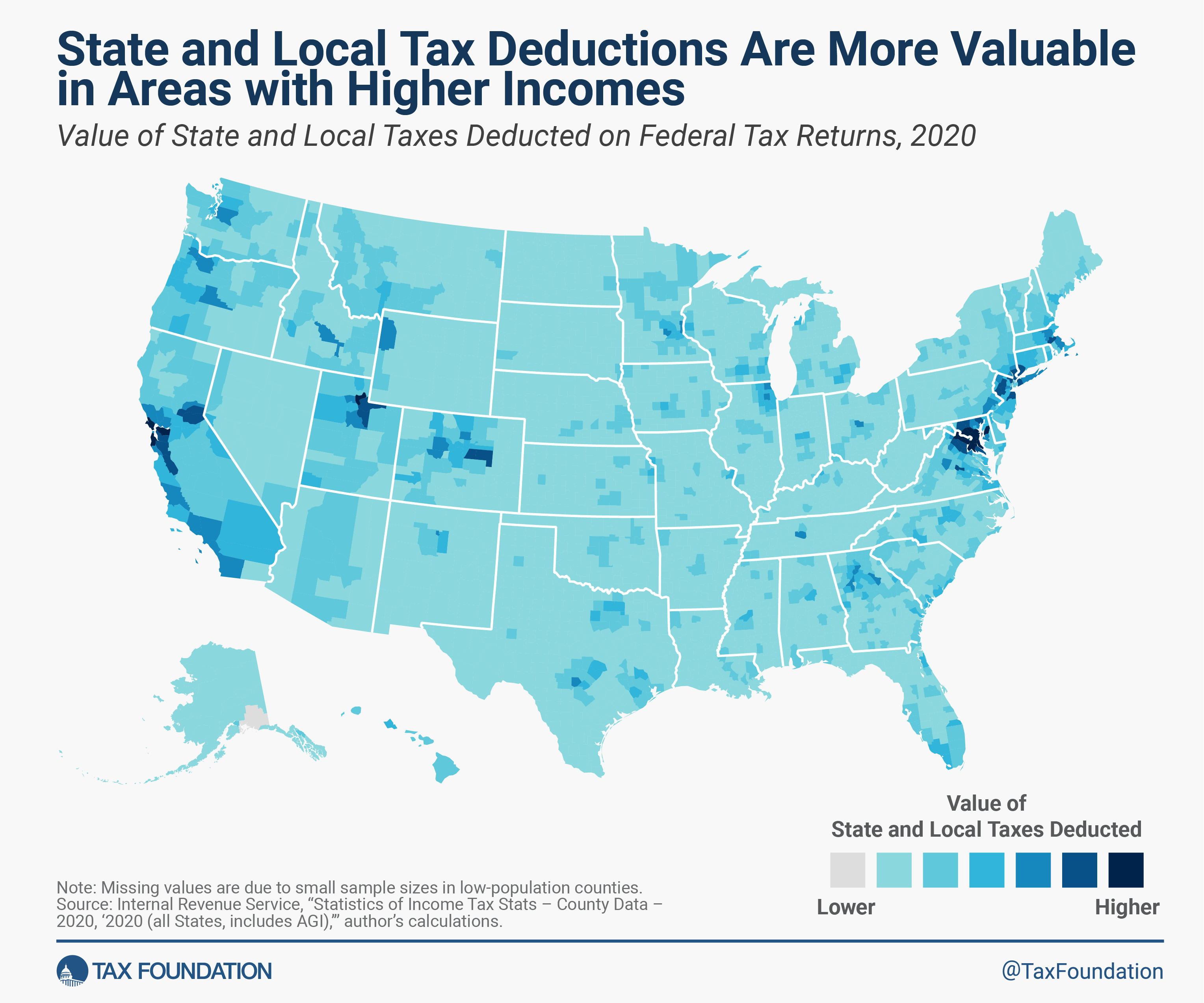

The benefit of itemized deductions varies significantly by region as well as income. For example, more taxpayers claim the state and local tax (SALT) deduction in high-tax states like New York, New Jersey, and Connecticut. This variation is due to two main factors:

- Taxpayer income: High-income taxpayers are more likely to itemize, because they likely have more qualified deductions to take than low-income taxpayers, who are more likely to take the standard deduction.

- State and local tax burdens: The greatest beneficiaries of the SALT deduction generally have high state and local taxes.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe