An estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs.

History of the Estate Tax

The United States government temporarily levied various estate and inheritance taxes through the nineteenth century during periods of war. The modern federal tax was enacted in 1916 and has remained law since. In 1926, the federal government began offering a generous federal credit for state estate taxes. This credit incentivized all states to impose an estate “pick up tax” because an estate’s total liability was the same whether or not a state imposed its own estate tax. This made estate and inheritance taxes an attractive revenue option for states. After the federal government fully phased out its state estate tax credit, many states stopped imposing them. Some states tied their estate tax to the federal estate tax credit. These estate taxes were thus phased out by default, while other states responded by proactively repealing their estate taxes.

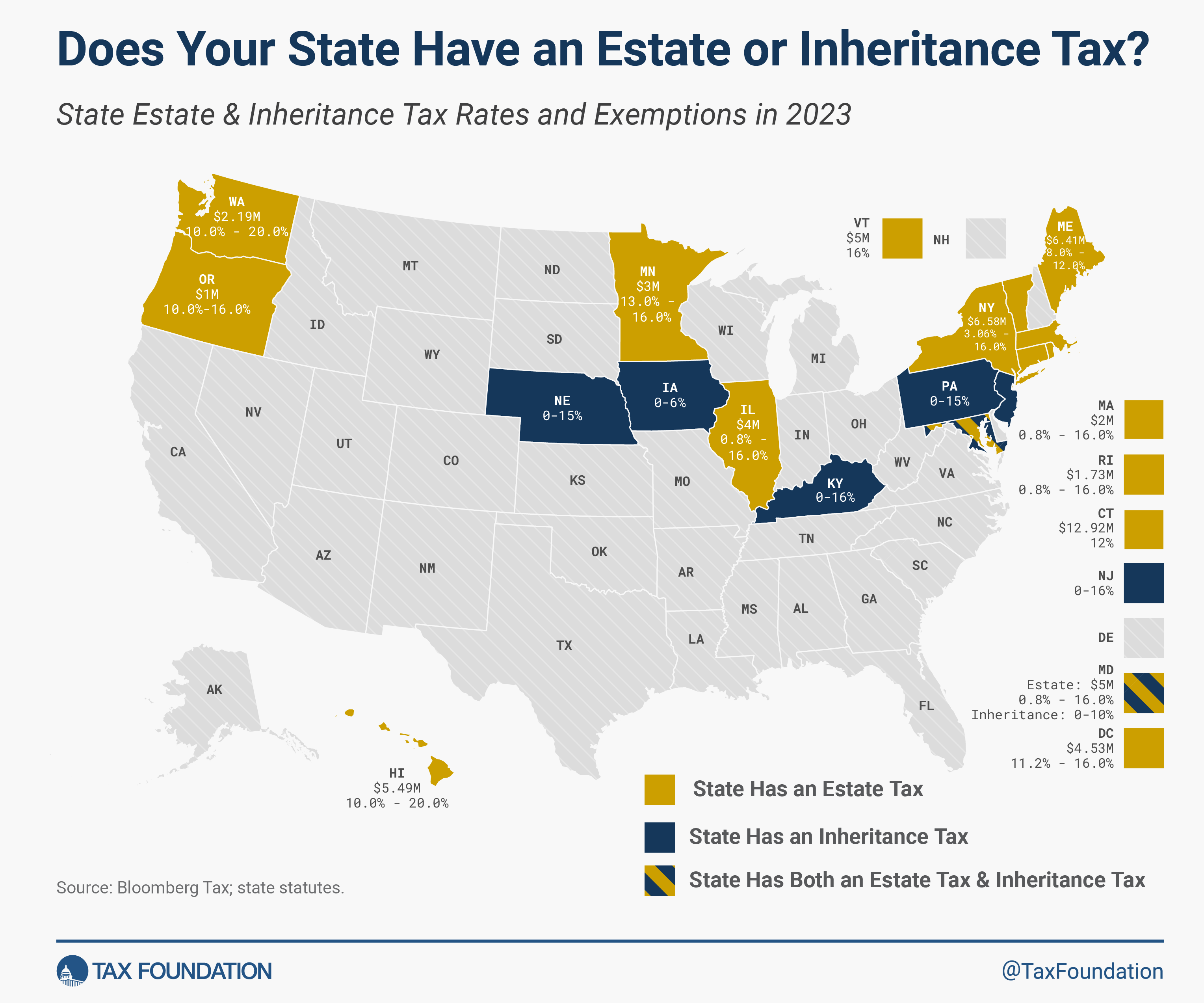

Most states have been moving away from estate and inheritance taxes. Many states that retain these taxes have raised their exemption levels, as imposing such a tax without matching the federal exemption could further hurt a state’s competitiveness.

What Is the Impact of Estate Taxes?

Estate and inheritance taxes are administratively burdensome. Furthermore, these taxes disincentivize business investment and can drive high-net-worth individuals out-of-state. When high-net-worth individuals leave a state to avoid its inheritance or estate tax, the individual’s state of origin loses not only the prospective estate or inheritance tax revenue but also the economic activity and revenue from other taxes that might have been collected during the individual’s lifetime.

Studies show that economic decision-making is, in fact, affected by estate tax regimes.

These tax regimes can yield estate planning and tax avoidance strategies that are economically inefficient, not only for affected taxpayers, but for the economy at large. Many tax avoidance activities are occasioned by the federal estate tax and would exist even absent state inheritance and estate taxes, though state levies may affect which planning techniques are most economically viable. Some avoidance strategies, however, are driven largely or exclusively by state inheritance and estate taxes, such as migration to states which forgo such taxes.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe