Capital stock taxes are imposed on a business’s net worth (or accumulated wealth). Unlike corporate income taxes, which are levied on a business’s net income (or profit), capital stock taxes are assessed regardless of profitability, and because they are based on net worth, including all business assets, they penalize business investment.

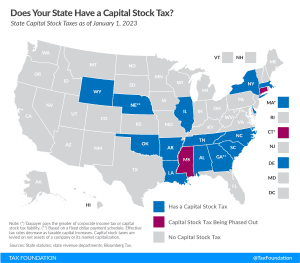

Capital stock taxes are often called franchise taxes, though some states use that term in reference to business license taxes, and Texas uses it for a gross receipts tax. Only 14 states still levy a capital stock tax, with several states eliminating the tax in recent years.

Who Is Subject to These Taxes?

The range of businesses subject to capital stock taxes varies from state to state. In some states, they are only imposed on C corporations, sometimes as a component of—or a minimum tax within—the corporate income tax. In other states, they apply to pass-through businesses as well.

While exact formulas and methodologies vary from state to state, capital stock taxes are usually levied on a firm’s net assets, with rates ranging from a low of 0.02 percent in Wyoming to a high of 0.3 percent in Arkansas. Among the states that levy a capital stock tax, six place a cap on the maximum liability a business may be required to pay, while the remaining eight do not.

Regardless of which entities are subject to capital stock taxes, or the formulas used to levy them, the effect is the same: they disincentivize capital accumulation.

The Impact of Capital Stock Taxes

As a form of business wealth taxation, capital stock taxes bear many of the inefficient hallmarks of an individual wealth tax, but with additional implications for the economy.

“Capital stock,” which this tax targets, includes the value of all the physical components a firm uses to generate its goods or services, minus the firm’s debt. As capital stock taxes are levied regardless of whether a business makes a profit, they are especially onerous to new businesses that have yet to turn a profit, industries with low profit margins, and to all businesses during times of economic downturn.

Taxing a company based on its net worth penalizes the firm for making additional capital investments. This disincentive results in firms that underproduce and operate below their full potential. Purchasing additional equipment, or replacing old equipment, becomes more costly—both in terms of tax liability and tax compliance costs. Without additional capital investment, fewer workers are hired, and those that are employed are less productive. Since productivity directly influences wages, underproducing workers are also unable to realize their full earning potential. In short, the unintended consequences of capital stock taxation can have a limiting effect on the state’s economy.

Lawmakers have grown to realize the problems with capital stock taxes. As a result, some states have reduced them or repealed them altogether. Kansas phased out the tax prior to tax year 2011, followed by West Virginia and Rhode Island in 2015, Pennsylvania in 2016, and Connecticut and Oklahoma in 2024. Mississippi is in the process of phasing out its capital stock tax by 2028.

New York had phased the tax out in 2021 but decided to temporarily reinstate it due to coronavirus-related budget concerns. Similarly, Illinois planned to exempt all capital stock from taxation but later reversed course.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe