Alabama’s 2025 Legislative Session Advances Pro-Growth Tax Reforms

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

4 min read

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

4 min read

The Institute for Policy Studies (IPS) only succeeds in demonstrating that America has more millionaires than it used to, not that high-tax states are doing well in attracting or retaining them.

7 min read

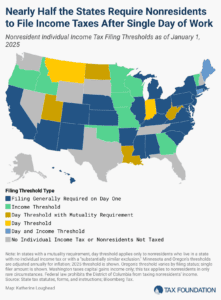

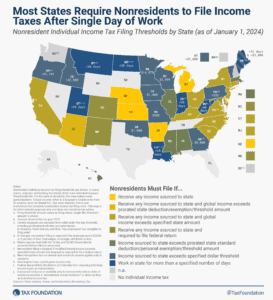

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read

A recent proposal in Minnesota exempting certain nonresident workers from having to file and pay income taxes would reduce compliance costs for business travelers and their employers at limited cost to the state.

4 min read

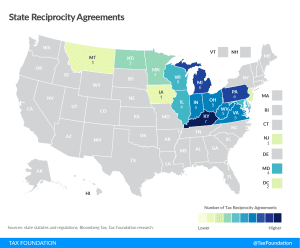

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

By streamlining, simplifying, and reducing tax burdens for remote and nonresident workers, a newly proposed bill could make Arkansas a more attractive state for both employees and employers.

4 min read

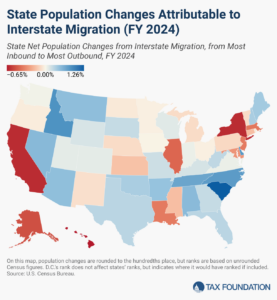

Americans were on the move in 2024, and many chose low-tax states over high-tax ones.

6 min read

Here’s how much NFL players can expect to pay in state and local income taxes—to all relevant states—at multiple salary levels, by team.

7 min read

One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

Working from home is great. The tax complications? Not so much.

4 min read

If Alabama continues on its current path, its treatment of remote workers would be even more aggressive than that of New York—a shaky legal foundation.

6 min read

Remote and flexible work opportunities are here to stay, whether states like it or not. With enhanced opportunities to take their job with them wherever they please, more workers can factor tax burdens into their decision of where to live.

15 min read

Spain should follow the example of Madrid, the country’s most competitive region. A more efficient income tax system is a better objective than just focusing on incentives for foreigners to change their tax residence.

5 min read

In most states, you don’t have to visit for long before you start accruing tax liability.

5 min read

A question for policymakers to consider is how this new era of worker mobility will impact the fiscal landscape, and what changes must be made to address resulting revenue and compliance concerns.

6 min read

A rosy revenue outlook has allowed Ohio to join eight other states in providing tax relief this legislative session. The Ohio legislature agreed on a two-year budget, which includes individual income tax cuts.

4 min read

Ohio is one of a growing number of states which experienced revenue increases despite the economic slowdown from the coronavirus pandemic and is now looking to return some of that through tax relief.

5 min read

Montana adopted structural reforms to both individual and corporate income taxes during the recently adjourned legislative session, enacting three bills reducing individual tax rates, simplifying the state’s individual tax system, repealing 16 tax credits, and changing the apportionment factor for corporate income tax.

5 min read