Join Us for a Free “State Tax Policy Boot Camp”

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

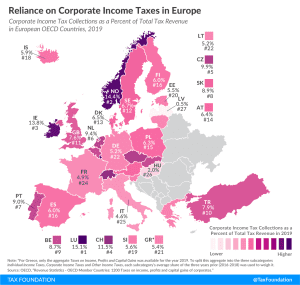

Despite declining corporate income tax rates over the last 30 years in Europe (and other parts of the world), average revenue from corporate income taxes as a share of total tax revenue has not changed significantly compared to 1990.

1 min read

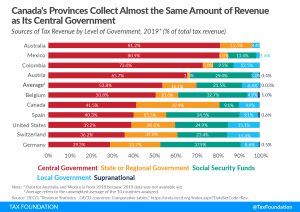

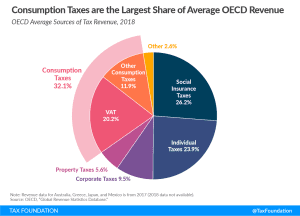

Developed countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less distortionary effects than taxes on income.

16 min read

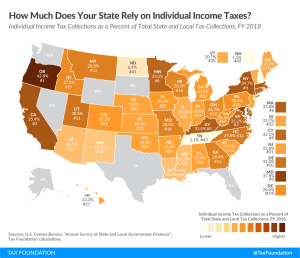

Sources of state revenue have come under closer scrutiny in light of the impact of the coronavirus pandemic, as different tax types have differing volatility and economic impact—although even beyond these unique circumstances, it is important for policymakers to understand the trade-offs associated with different sources of tax revenue.

4 min read

The potential override of Gov. Larry Hogan’s (R) veto of a digital advertising tax (HB732) looms large over the current legislative session in Maryland, though it is only one of many tax proposals under consideration in the state.

7 min read

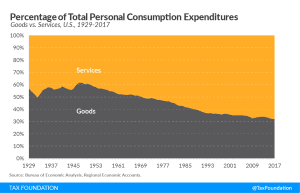

By failing to keep pace with modern consumption patterns, sales taxes have become less neutral, less equitable, and less economically efficient over time.

16 min read

Improving trust fund solvency and staving off costly business tax increases is a win-win proposition for federal and state governments alike.

4 min read

Although this week’s Super Bowl festivities may be muted, states with legalized sports betting may have something to cheer: a tax revenue bump thanks to the accompanying excise taxes.

3 min read

Combined state and local tax collections were down only $7.6 billion across the period, representing a total state and local tax revenue decline of 0.7 percent compared to the first nine months of 2019.

6 min read

Our new study provides a 360-degree assessment of New York’s budget crisis, analyzes proposed revenue options, and offers solutions to raise revenue without driving more taxpayers out of the state or undoing recent positive reforms

106 min read

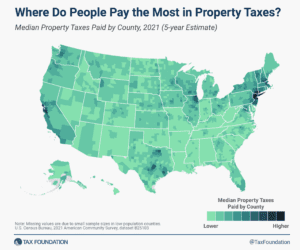

Today marked the release of second-quarter GDP data and provides a new glimpse into early changes in state and local revenues and spending. All told, second-quarter state and local tax receipts came in about 3.8 percent lower than they did in the same quarter a year ago. Income and sales taxes fell considerably while property and excise tax collections remained stable.

3 min read

Reviewing the sources of personal income shows that the personal income tax is largely a tax on labor, primarily because our personal income is mostly derived from labor. However, varied sources of capital income also play a role in American incomes.

9 min read

Revised state revenue forecasts show a significant decline in projected revenues for both the recently concluded FY 2020 and current FY 2021, though the picture they paint is considerably less dire than many feared a few months ago.

13 min read

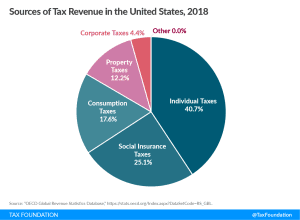

Have you ever wondered where the money comes from to build roads, maintain a national defense, or pay for programs like Social Security? Taxes.

We examine whether excise taxes are a solution to budget deficits, and while the short answer to that question is no, there are of course nuances. Excise taxes can play a role in state revenues even as policymakers appreciate that excise taxes are not viable long-term revenue tools for general spending priorities.

21 min read

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

2 min read