FDA Menthol Ban Would Boost Smuggling, Reduce Revenues, with Few Health Benefits

Learn more about the FDA’s proposal to ban the sale of menthol cigarettes and flavored cigars. Including its effect on revenue & public health measures.

4 min read

Learn more about the FDA’s proposal to ban the sale of menthol cigarettes and flavored cigars. Including its effect on revenue & public health measures.

4 min read

Total tax collections are currently running 25 percent higher than last year, and if that pattern holds, total federal tax collections will reach over $5 trillion in FY 2022—a new all-time high.

3 min read

Compared to other industrialized countries, the United States relies more on individual income taxes and property taxes and less on consumption taxes.

4 min readDesigning tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

Not only is the tax inequitable and inefficient, it also could be what drives businesses and remote workers into another state.

7 min read

Temporary tax relief measures, like refund checks or gas tax holidays, are not necessarily bad, and can be justified as ways to return excess revenues to taxpayers, but they often miss an opportunity to do better by taxpayers in the long run.

7 min read

Coming out of the pandemic, the state of Ohio is estimating significant tax revenue growth, and some lawmakers are looking to take advantage and repeal the Commercial Activity Tax (CAT), one of only a few gross receipts taxes still levied in the country.

7 min read

Mississippi lawmakers should deliver tax relief in 2022, but they need not take an all-or-nothing approach. There are many ways to improve the state’s tax code, even if full income tax repeal doesn’t remain on the table.

6 min read

Due to the House Build Back Better tax plan’s economically costly and inefficient tax increases, our analysis finds that long-run GDP would drop by a little over $1 for every $1 in new tax revenue.

6 min read

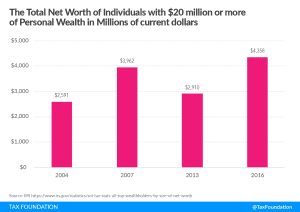

Congressional Democrats are reported to be weighing a special tax on the assets of billionaires to raise revenues to pay for their Build Back Better spending plan. There are two fundamental challenges to such a plan.

8 min read

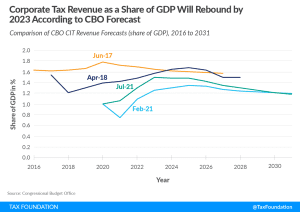

This year’s robust corporate tax collections calls into question efforts by the administration and congressional Democrats to increase the corporate tax rate and raise other corporate taxes based on claims of relatively low tax collections following the Tax Cuts and Jobs Act (TCJA) in 2017.

2 min read

If the spending in the $3.5 trillion budget resolution were financed entirely from tax increases, it would rival as a share of GDP the tax increases used to finance World War II and the Korean War.

3 min read

One of the Senate’s proposals to pay for the Build Back Better Act is a federal excise tax on virgin plastics, which are plastics that are not reprocessed or recovered.

4 min read

A carbon tax would be a less economically harmful pay-for than either personal or corporate income tax hikes and a more efficient way to reduce carbon emissions than green energy tax credits, but would come with other trade-offs.

4 min read

Kentucky and Tennessee won an important legal victory Friday when a federal court ruled that the American Rescue Plan Act (ARPA)’s restrictions on state fiscal autonomy were unconstitutional and enjoined (blocked) the enforcement of those provisions against both states.

7 min read

Reviewing the sources of personal income shows that the personal income tax is largely a tax on labor, primarily because our personal income is mostly derived from labor. However, varied sources of capital income also play a role in American incomes. While capital income sources are small compared to labor income, they are still significant and need to be accounted for, both by policymakers trying to collect revenue efficiently and by those attempting to understand the distribution of personal income.

10 min read

In light of these forecasts, which could be revised upwards further given the pace of growth in the economy and corporate profits, it seems clear that the 2017 tax reform did not substantially reduce the revenue potential of the corporate tax.

3 min read

As states close their books for fiscal year 2021, many have much more revenue on hand than they anticipated last year. Eleven states have responded by reducing income tax rates and making related structural reforms as they strive to solidify a competitive advantage in an increasingly competitive national landscape.

29 min read

The United Nations (UN) recently released its annual “World Investment Report,” which shows the dramatic fall in global foreign direct investment (FDI) caused by the COVID-19 crisis.

3 min read